Dow Jones Industrial Average climbs further on tepid Thursday

- The Dow Jones rose on Thursday, buoyed by a general improvement in equities.

- Investors shrugged off a downside GDP print, focusing on medium-term factors looming ahead.

- US PCE inflation figures due on Friday will be the last data hurdle this week.

The Dow Jones Industrial Average (DJIA) rose to its highest figure in 16 weeks on Thursday, testing above 43,300 for the first time since late February. A general improvement in equity market tides lifted all boats, and investors are keeping an eye on key factors looming over markets in the medium term.

The Trump administration is struggling to muscle its “Big, Beautiful Budget Bill” through the US government. Several hitches and snags have cropped up along the way at both the congressional and Senate levels, and the Trump team is running out of time to get the deficit-swelling budget passed before the July 4 Independence Day holiday.

Budgets, tariffs, inflation

President Trump’s temporary suspension of “reciprocal tariffs” announced in April is set to end on July 9, and the arbitrary deadline is looming ahead with very little clear progress on any major trade deals. Donald Trump’s whipsaw approach to announcing and then canceling or delaying tariffs has sparked a challenging stance in markets, with investors broadly banking on each new iteration of tariff threats from the White House to result in the Trump administration finding a reason to cancel or delay once again. However, the approaching reciprocal tariff deadline could see some market tensions rise as investors brace for the Trump team’s next moves.

White House Press Secretary Karoline Leavitt floated the idea of Trump delaying his reciprocal tariffs again in the run-up to the July 9 deadline. However, further delay discussions without hard action could still see markets grow anxious as the US economy continues to grapple with an uncertain trade policy future.

Inflation metrics will take on an increasingly significant role in the weeks and months ahead as policymakers and market participants alike look for signs of inflationary pressure from President Trump’s tariff policies. US Personal Consumption Expenditure Price Index (PCE) inflation for the month of May will print on Friday. Core annualized PCE inflation is expected to rise to 2.6% YoY, with monthly figures expected to hold steady at 0.1% MoM.

Dow Jones price forecast

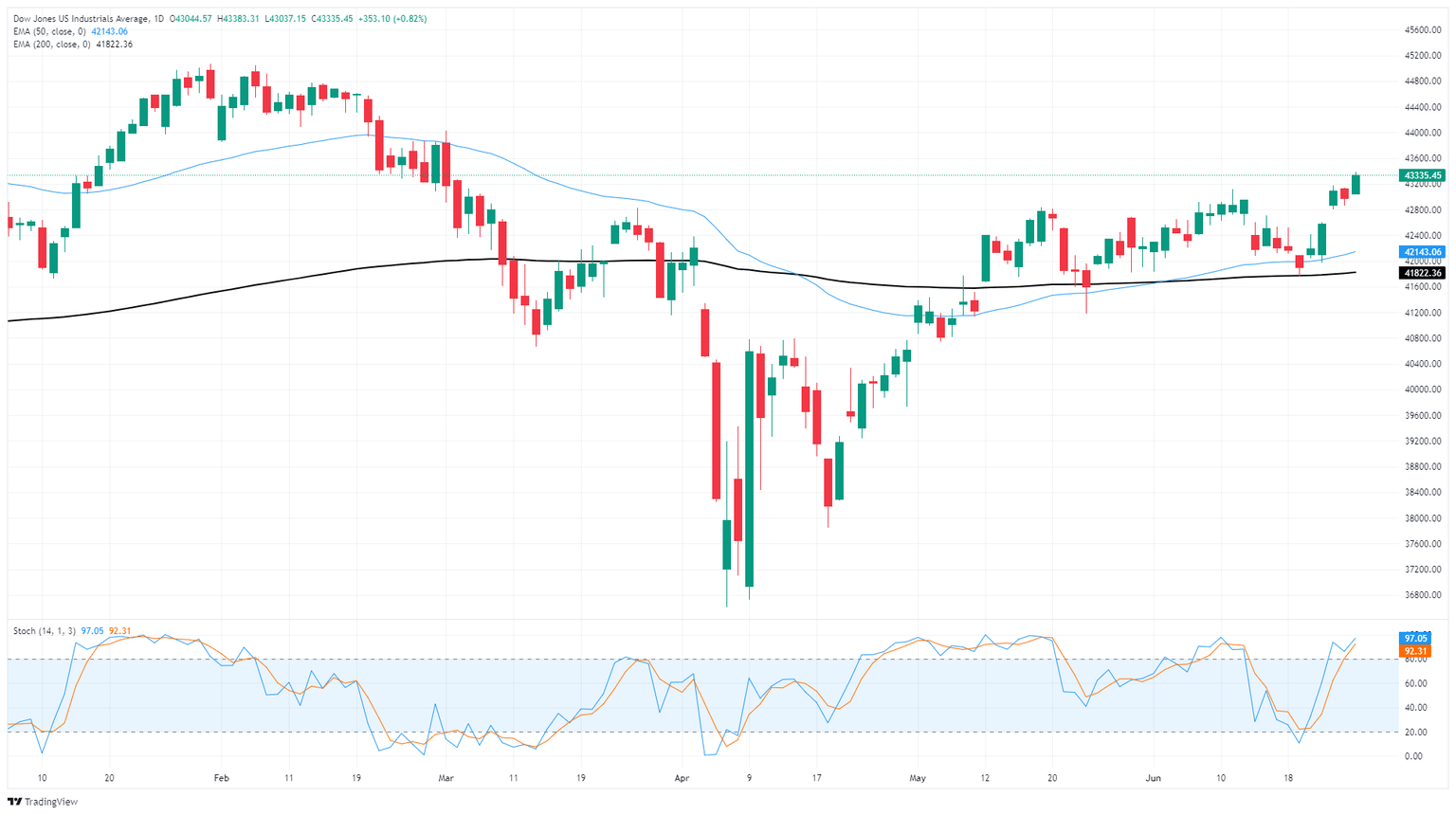

The Dow Jones Industrial Average continues its steady climb after catching a technical bounce from the 200-day Exponential Moving Average (EMA) last week, rising nearly 4% from the 41,860 region. The Dow Jones has successfully recovered all of its losses suffered following reciprocal tariff announcements in April, but it is still on the low side of record highs posted above the 45,000 handle.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.