Dow Jones Industrial Average struggles after PCE inflation accelerates again

- The Dow Jones explored the bearish side on Thursday, testing below 44,500.

- The Dow is missing out on another bullish push in large tech stocks.

- US PCE inflation and consumer income data ticked higher in June.

The Dow Jones Industrial Average (DJIA) tested the low end on Thursday, chalking in a fourth straight bearish session as equities grapple with a stubborn Federal Reserve (Fed), which is increasingly unlikely to deliver rate cuts in the third, or any quarter, if the US doesn’t get a firmer handle on inflationary pressure that continues to throw up caution flags.

United States (US) economic data remains far more robust than many market watchers and policymakers had feared when the Trump administration kicked off a never-ending cycle of tariff threats and subsequent walk backs. Global reciprocal tariffs have routinely been announced, delayed, and re-announced, but key double-digit tariffs on core industries like steel and aluminum imports, as well as foreign cars, are already beginning to bite around the edges of key inflation metrics.

Inflation ticks higher following Fed rate hold on inflation concerns

Core US Personal Consumption Expenditure Price Index (PCE) inflation ticked higher in June, rising 0.3% MoM as many market participants had expected. On an annualized basis, PCE inflation accelerated to 2.6% YoY, outrunning the expected hold at 2.5%. US Consumer Income also rebounded 0.3% in June, and rising wage pressures will add further inflationary forces further down the line.

US Nonfarm Payrolls (NFP) remain on the data docket for this Friday, promising to close out the trading week with a tense release. US jobs and inflation data have taken on additional importance for the Fed following this week’s decision to hold interest rates steady for another meeting period. Annualized headline PCE inflation, a key inflation metric for the Fed’s rate-setting policymakers, has remained above the Fed’s 2% target band for almost four and a half years.

US President Donald Trump announced yet another delay in widespread tariffs, this time for only one country: Mexico. Trump declared early Thursday that Mexico has agreed to drop its “non-tariff barriers” that have prevented US companies from accessing Mexican consumer markets. However, there may be another miscommunication issue plaguing the Trump team’s efforts to secure trade deals: According to a statement from Mexico’s President Claudia Sheinbaum, the current between-tariffs deal does not imply further action on Mexico’s part.

Trump team reiterates well-known statements

According to White House Press Secretary Karoline Leavitt, the looming deadline for countries to deliver desirable trade deals to the Trump team’s desk or face stiff “reciprocal” tariffs remains Friday, August 1. To date, this is the fourth time Press Secretary Leavitt has announced that reciprocal-plus tariffs will for sure be going into effect on a particular date since Donald Trump took office in January, frequently just hours before President Trump himself announces a delay, or temporary suspension, or impending trade deal that has yet to be finalized.

US Treasury Secretary Scott Bessent reiterated on Thursday that the US and China have “the makings of a deal” to avert stiff import tariffs in both directions, which are set to automatically kick in if the two sides don’t reach a meaningful agreement by August 12. Bessent provided no details and has been teasing a potential final breakthrough in US-China trade talks for months.

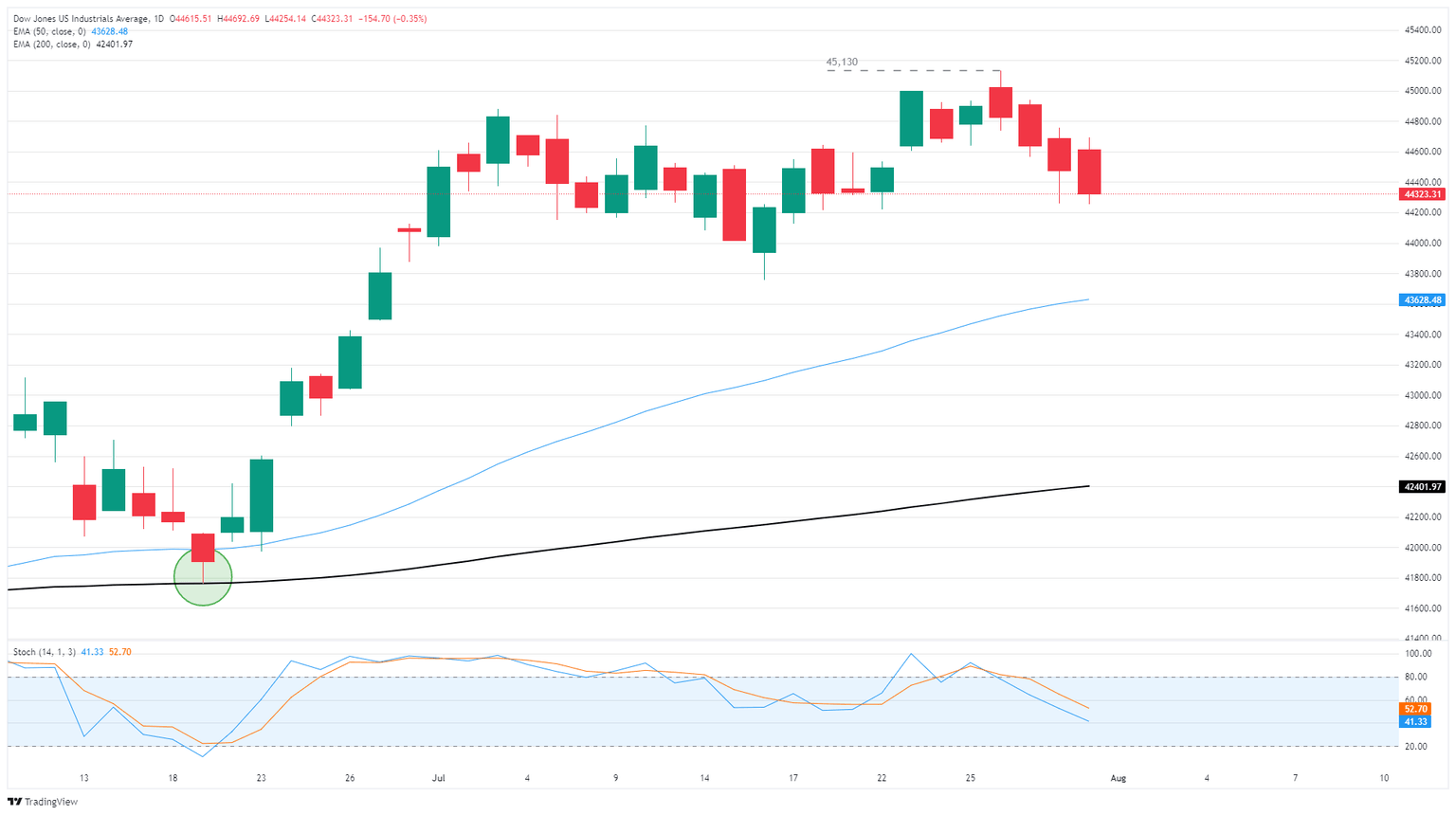

Dow Jones price forecast

The Dow Jones is testing back below the 44,400 level for the second time this week, slumping into a fourth straight bearish session as equities run out of bullish momentum. The Dow briefly ticked into a new all-time high at the intraday level earlier this week, but the major equity index is now down almost 2% from Monday’s record high bid of 45,130.

The Dow Jones is still planted firmly in bullish territory, with firm technical support priced in at the 44,000 handle. Price action could fall another 1.4% and still be trading on the north side of the 50-day Exponential Moving Average (EMA) near 43,625.

Dow Jones daily chart

Economic Indicator

Personal Consumption Expenditures - Price Index (YoY)

The Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The YoY reading compares prices in the reference month to a year earlier. Price changes may cause consumers to switch from buying one good to another and the PCE Deflator can account for such substitutions. This makes it the preferred measure of inflation for the Federal Reserve. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Thu Jul 31, 2025 12:30

Frequency: Monthly

Actual: 2.6%

Consensus: 2.5%

Previous: 2.3%

Source: US Bureau of Economic Analysis

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.