Dow Jones Industrial Average rebounds on hopeful Monday

- The Dow Jones rebounded back above 44,000 on Monday amid a bullish recovery.

- Equities are shrugging off last week’s sharp losses sparked by downside revisions in NFP data.

- Softening labor data has increased hopes for a Fed rate cut, offsetting downturn declines.

The Dow Jones Industrial Average (DJIA) bounced back on Monday, clawing back over 500 points and scrambling back over the 44,000 major handle as equity markets recovered their footing following last week’s late rout fueled by worse-than-expected hiring figures from the latest Nonfarm Payrolls (NFP) report. Net job gains came in well below expectations in July, and the previous two months saw sharp downside revisions that wiped out most of the previously reported gains in net employment.

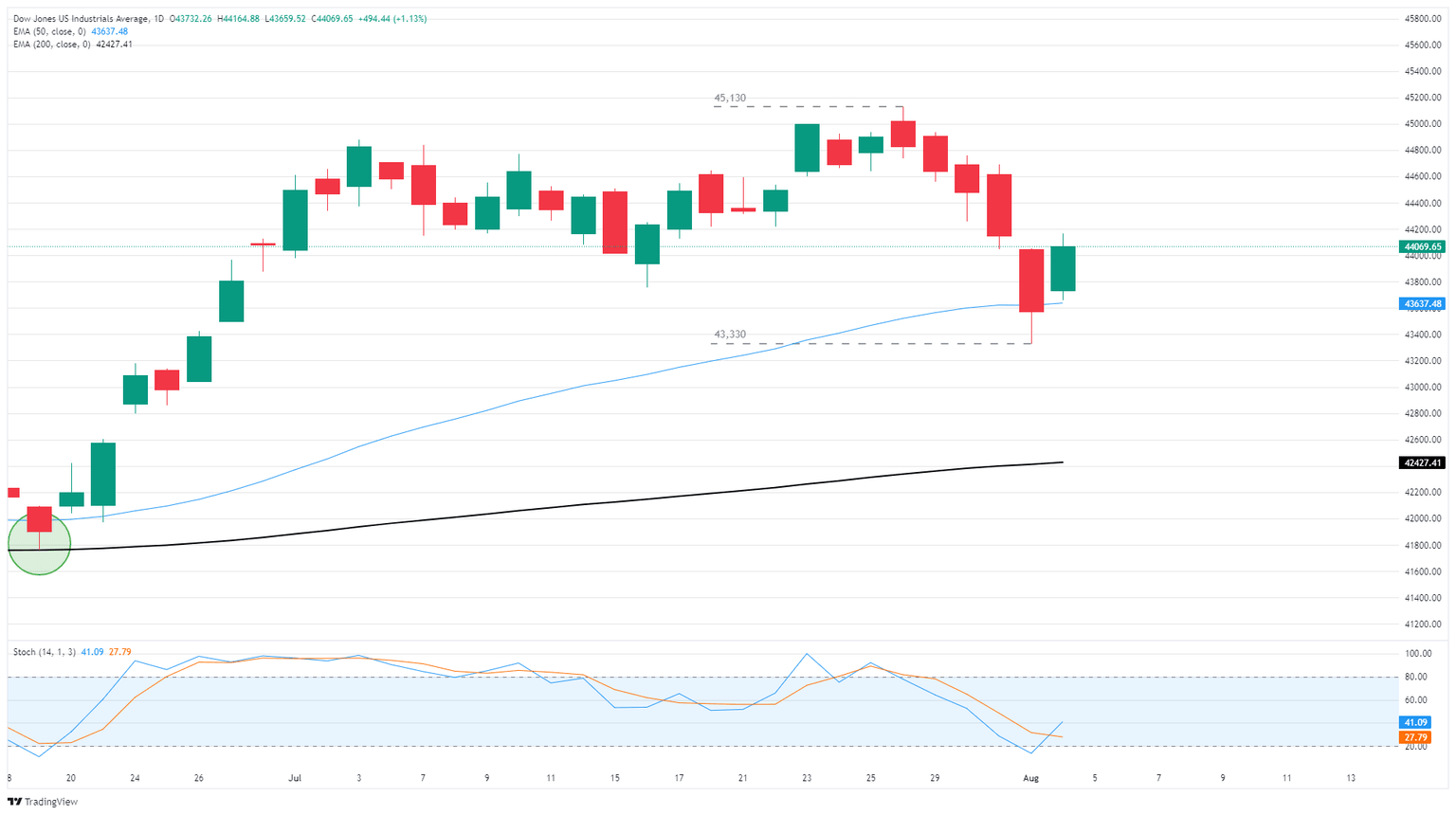

Following five straight days of declines that saw the Dow Jones tumbled nearly 4% top-to-bottom, Monday’s bullish rebound is a welcome turnaround for index traders. The Dow has bounced over 1.8% from last Friday’s lows near 43,330, reclaiming the 44,000 key level and walking back nearly half of last week’s tip-to-tail declines. The Dow is still on the low side of recent highs near 45,130, but it is in the process of posting a bullish technical bounce from the 50-day Exponential Moving Average (EMA) near 43,640.

Soft jobs lead to Fed rate cuts, bolstering stocks

Despite an overall uptick in investor sentiment, markets still remain broadly jittery in the face of impending tariff deadlines. President Donald Trump’s “firm” August 1 deadline on sweeping reciprocal tariffs has now become an equally firm August 8 deadline, and investors and firms alike are beginning to buckle under the weight of global tariffs that continue to exist in a quantum state, phasing in and out of existence on a moment’s notice.

Friday’s downside NFP print, plus negative revisions, has ramped up expectations of an interest rate cut from the Federal Reserve (Fed) in September. According to the CME’s FedWatch Tool, rate markets are pricing in nearly 90% odds of at least a quarter-point rate trim at the Federal Open Market Committee’s (FOMC) next rate decision on September 17.

Despite increased odds of a rate cut, Trump wants better jobs reports

Souring jobs data sparked an irate Donald Trump to immediately fire the head of statistics for the Bureau of Labor Statistics (BLS), claiming that the head of statistics was planted by former President Joe Biden and had intentionally manipulated employment data to make current President Donald Trump “look bad”. Following the resignation of Fed Board of Governors member Adriana Kugler last Friday, Donald Trump is now poised to select a new head of the BLS and a new member of the Fed Board of Governors.

Not one to sit idle and focus on one issue for too long, Donald Trump has also pivoted back into renewed tariff threats. Trump is now threatening to impose stiff additional tariffs on India, who the Trump administration claims has been both buying and selling Russian Crude Oil products, disregarding a combination of existing sanctions and Trump's desire for additional sanctions against Russia. Trump has threatened to use steep tariff penalties on any country that trades in Russian Oil products in an effort to strongarm an immediate ceasefire agreement between Russian President Vladimir Putin and Ukraine.

Read more stock news: Palantir rallies in anticipation of blowout Q2 earnings

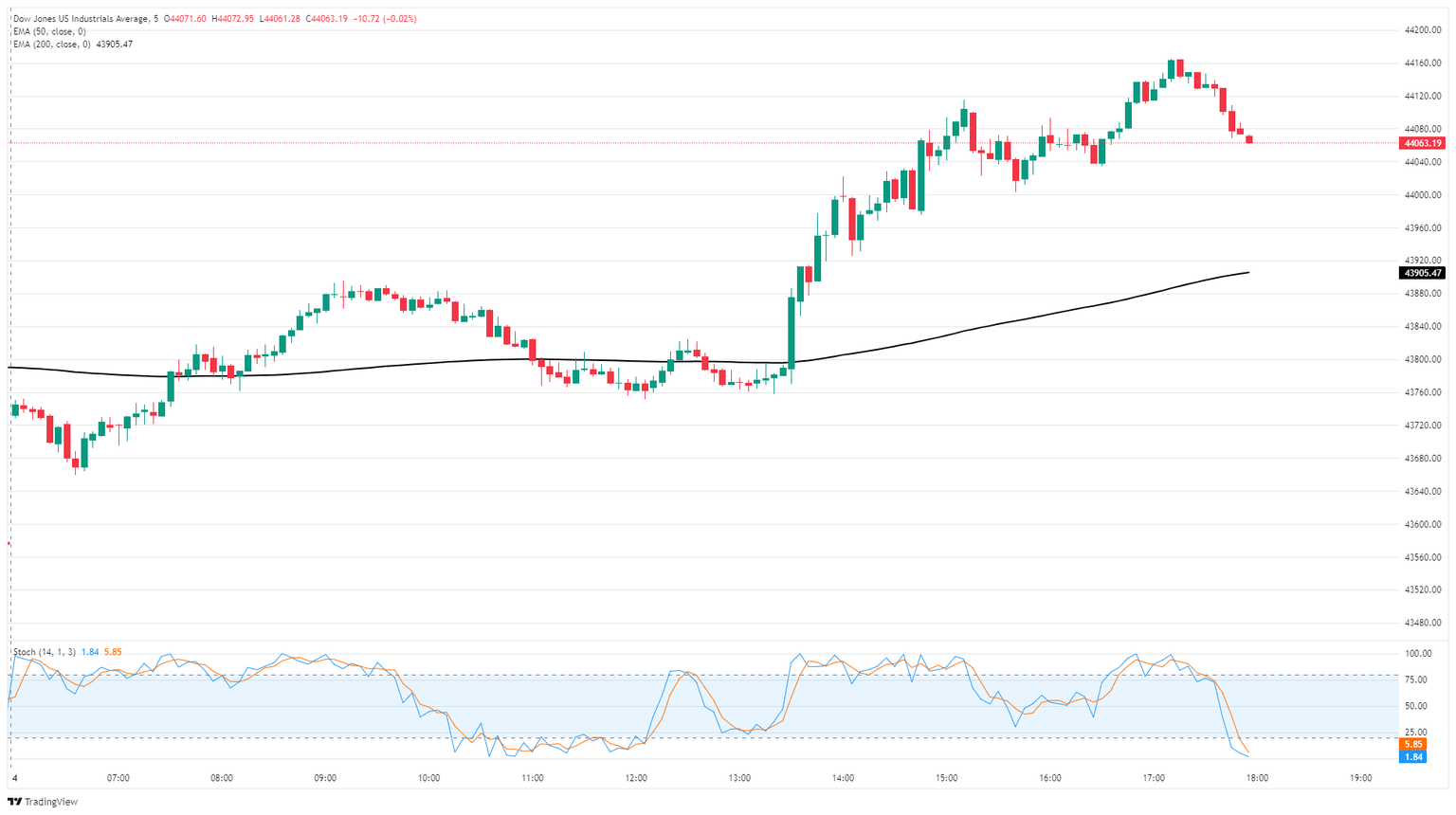

Dow Jones 5-minute chart

Dow Jones daily chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.