Dow Jones climbs on upbeat consumer mood, shrugs off weak earnings

- The Dow Jones is struggling to stay in the green as it wraps up a wobbly trading week.

- UoM Consumer Sentiment Index figures showed US consumers are recovering from April’s tariff tilt.

- Key earnings misses on Friday are dragging the major equity index down for the day.

The Dow Jones Industrial Average (DJIA) wobbled on Friday, testing fresh weekly highs on consumer sentiment and inflation expectations data. However, the Dow backslid after earnings misses in key overweight companies dragged the index sharply lower to round out the trading week.

The University of Michigan’s (UoM) July Consumer Sentiment Index showed another recovery in aggregated survey responses, with the index climbing to 61.8 from 60.7. 1- and 5-year Consumer Inflation Expectations also eased on Friday, with the one-year lookahead slipping to 4.4% from 5% and the 5-year inflation outlook falling to 3.6% from 4%.

Key earnings beat the street, but shares still fall

Q2 earnings week wrapped up on Friday, with downside in key heavyweight companies dragging the Dow lower. Both 3M (MMM) and American Express (AXP) fell by more than 3% post-earnings despite beating headline forecasts. 3M cleared earnings and revenue expectations, but a 2.2B quarterly expenditure on legal fees, and investors are concerned that more court costs could be on the horizon.

American Express also beat headline growth and profit expectations, but investor concerns are growing that the credit company will face firm headwinds moving forward. FX market volatility and exchange rates, rapidly evolving digital payment alternatives, and trade frictions from tariffs all threaten American Express’s bottom line.

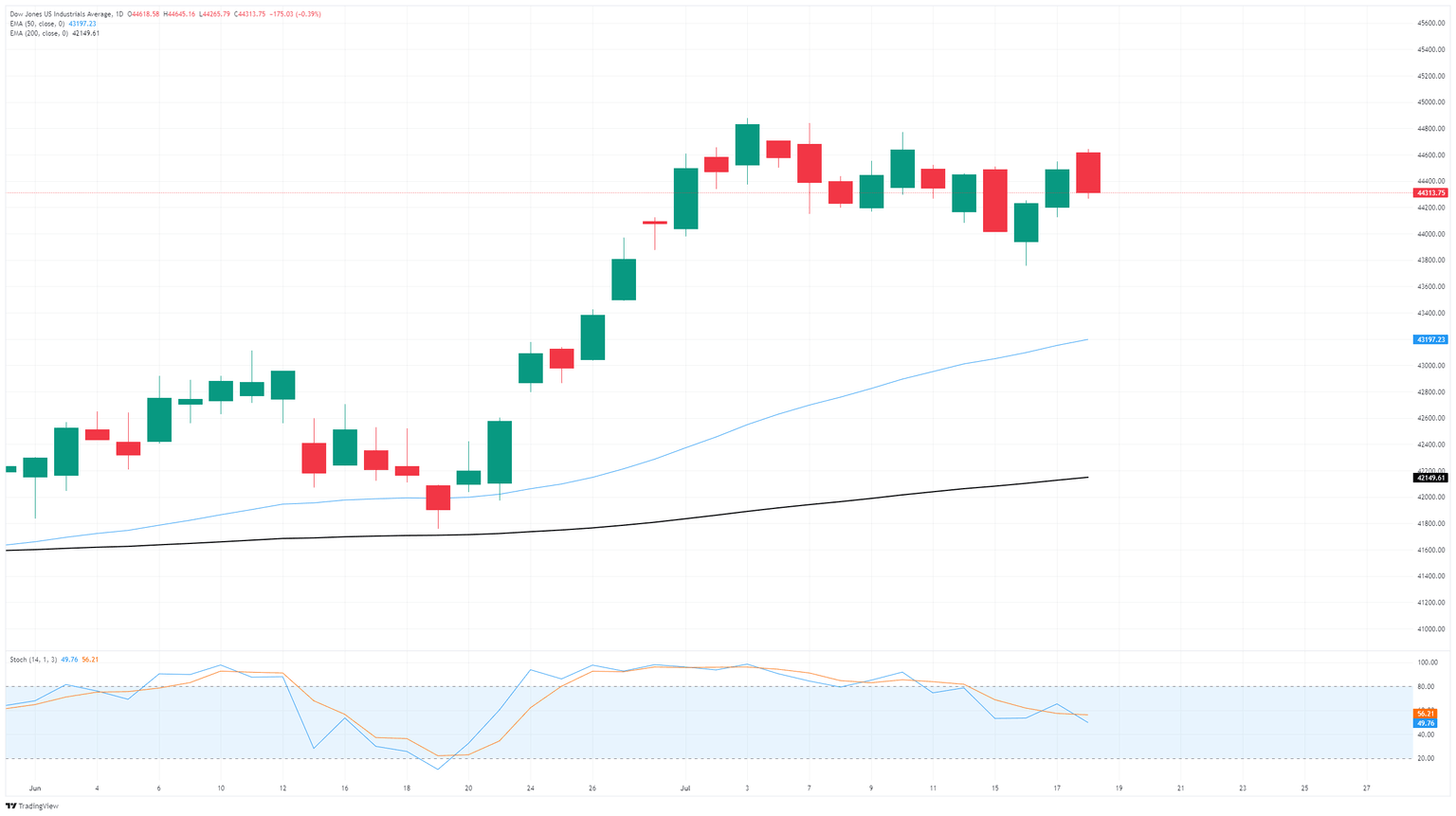

Dow Jones price forecast

Friday’s downside momentum has put the Dow Jones within touch range of the trading week’s opening bids, with the major equity index trading within 0.1% of Monday’s initial prices. The Dow is struggling maintain a foothold at the 44,500 region, and lack of sustained bullish momentum could see the DJIA extend into the bearish side as technical oscillators continue to ease back into the midrange.

Dow Jones daily chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.