Did last week’s decline threaten the path to 7120 for the SP500? Here’s what the Elliott Wave shows

We have been anticipating and tracking the SP500 (SPX) to reach 7120 for some time, and last week’s decline appeared to throw a wrench in that wheel. However, as the stock market, or any financial market for that matter, approaches the end of its final 4th and 5th waves, the question almost always arises: Will there be one more rally or not? The challenge from an EW perspective is: “Did we count the waves, especially the initial part of the rally, correctly?” Namely, if one misinterprets the first sets of 1st and 2nd waves at the start of the rally, one will likely misinterpret the final sets of 4th and 5th waves as well.

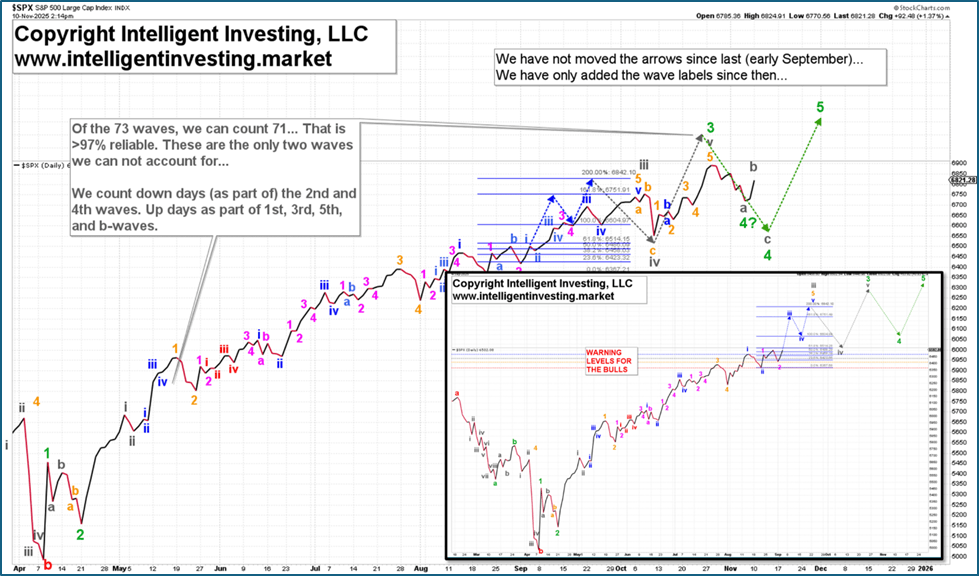

So, we returned to our most trusted daily line chart, which displays only closing prices, minimizing noise — i.e., “less is more.” Additionally, the closing price is the most significant price of the day and carries the most weight. See Figure 1 below.

Figure 1. Our short-term Elliott Wave count, with the projected path from early September inserted

Considering that 73 waves have been identified so far since the April 7 low (!), it’s clear that even with a 98% accuracy and reliability rate, about 2 waves could still be miscounted. Therefore, we must constantly re-evaluate our analyses; nothing is fixed. To do that, we follow the scientific method*. We find it remains very possible to see a final W-5 toward that 7120-7125 target.

Namely, we last updated this daily line chart on September 4th; see insert. So, it was overdue. We found that this chart projected the completion of a gray Wave-iii around 6840, a gray Wave-iv near 6515, followed by a gray Wave-v, ideally at approximately 7020. Then, a final (green) 4th- and 5th-wave estimate at about 6575 and roughly 7120, respectively. Fast forward: the index topped out at 6753 for W-iii, bottomed at 6552 for W-iv, and peaked at 6890 for W-3. All targets were within +/-2% of the actual prices and demonstrated the reliable accuracy our premium newsletter subscribers have come to expect from our work.

Furthermore, last week’s closing low at 6720 also aligns well with the projected green W-4 low from over two months earlier. Therefore, our overall Elliott Wave path since early September continues to track the market. Additionally, the index only reached 6920 instead of 7120, which is a 200-point (2.8%) miss, and somewhat significant, as stock markets tend to be more accurate than that. However, since 4th waves often form complex patterns, meaning they can develop into an extended (gray) W-a, -b, and -c, we cannot be certain it has finished yet. As a result, last Friday’s low could have been W-a of W-4.

Thus, if the SPX stays above 6631 (last Friday’s actual low), we can expect the W-5 to reach approximately 7120. However, a daily close below 6720 would be a serious warning for the Bulls that the current rally from Friday’s low is only Wave b of Wave 4, and another move lower (gray W-c) to around 6575 is likely. Either way, the green W-5 is most likely going to happen.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.