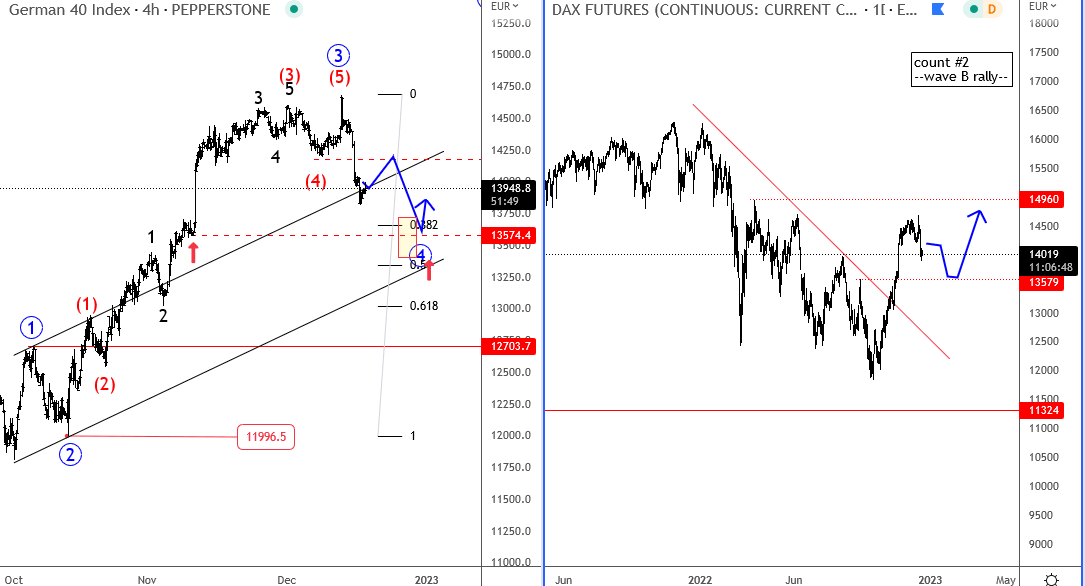

DAX now in a corrective price action – Support at 13500-13600

DAX turned agresively higher a few months back, broke an important trendline on a daily chart, which more and more looks like an impulse in the 4-hour chart, so we are tracking a five-wave recovery that can send the price higher after wave four pullback which seems to be in play now. Notice that the price broke 14200 support so this can still be the only first leg of a higher degree wave 4 that can be headed to 13570, ideal support.

BLACK FRIDAY Monthly 50% Off Lifetime Crypto, FX and major Global Markets. Apply here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.