Crude Oil Price News and Forecast: WTI reverses lower faster than you can blink

Four factors moving oil prices

Oil was on the front foot at the start of the New Year buoyed by the prospect of a signed US – China trade deal and rising tensions in the middle east, in addition to shrinking stockpiles and the start of deeper OPEC plus production cuts. However, the push higher has been short lived.

1. Middle Eastern tensions. An Iran back Iraqi militia withdrew from the US embassy in Baghdad after storming it in protest over airstrikes. Elevated tensions involving Iranian backed forces has increased geopolitical risk in the region. However, there is no immediate threat to Iraq’s oil supply so the move higher could be short lived.

2. Trade deal. The US – China trade deal is expected to be signed on 15th January. Strong indications that the first phase trade deal will be signed and formally entered into within the coming weeks is boosting sentiment towards the global economic outlook and to a degree lifting expectations for future oil demand. Read more...

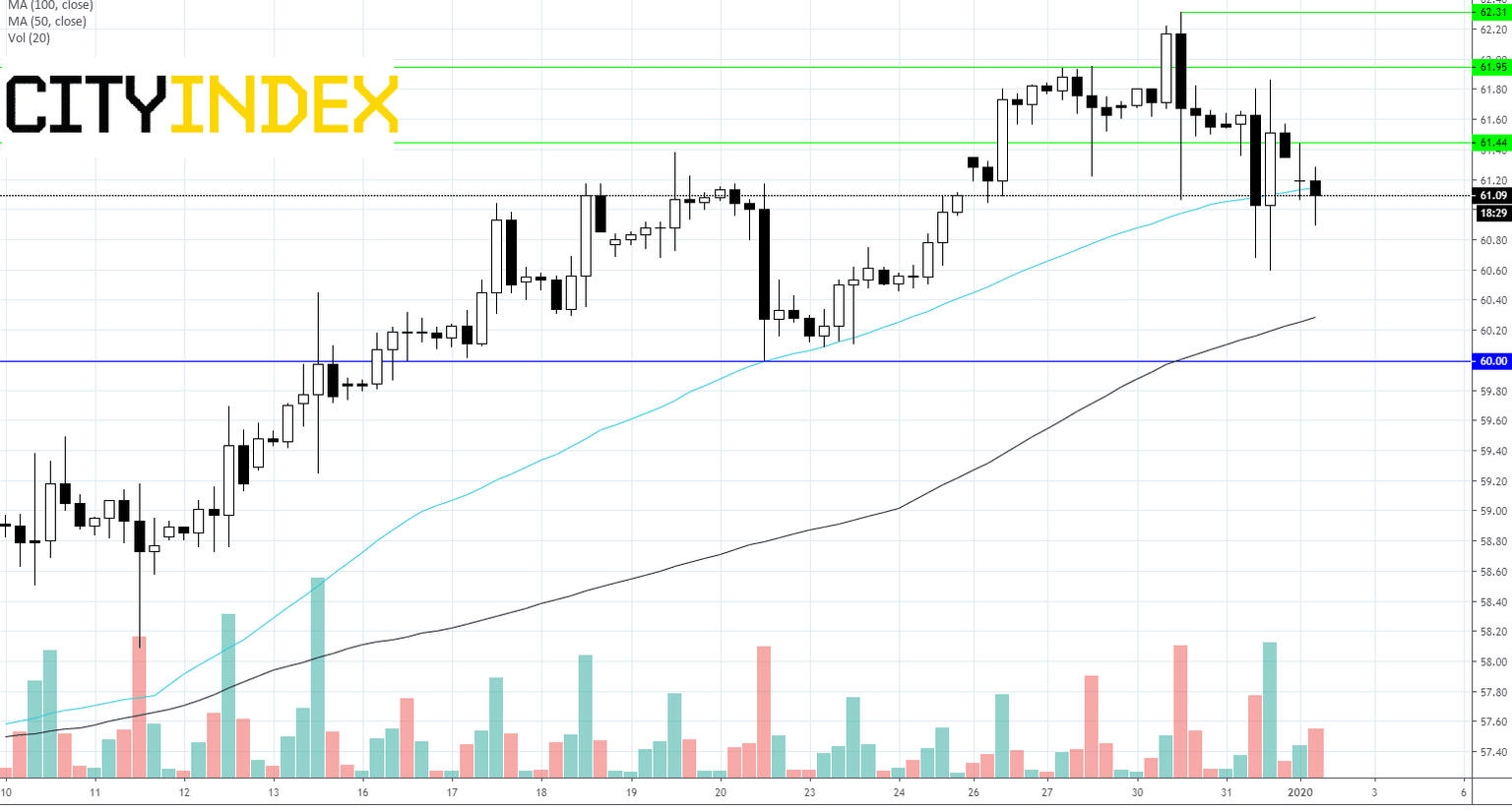

Oil Reverses Lower Faster Than You Can Blink

Although oil bulls managed to push the futures higher and broke above the upper border of the rising green trend channel during yesterday’s session, Monday’s upswing turned out only temporary.

Earlier today, crude oil futures opened the day with the bearish pink gap, invalidating yesterday’s breakout above the channel. This bearish development triggered further deterioration in the following hours, which means that our yesterday’s analysis is up-to-date also today:

(…) the sizable red gap remain in play. It keeps supporting the bears and lower values of the futures in the coming week(s).

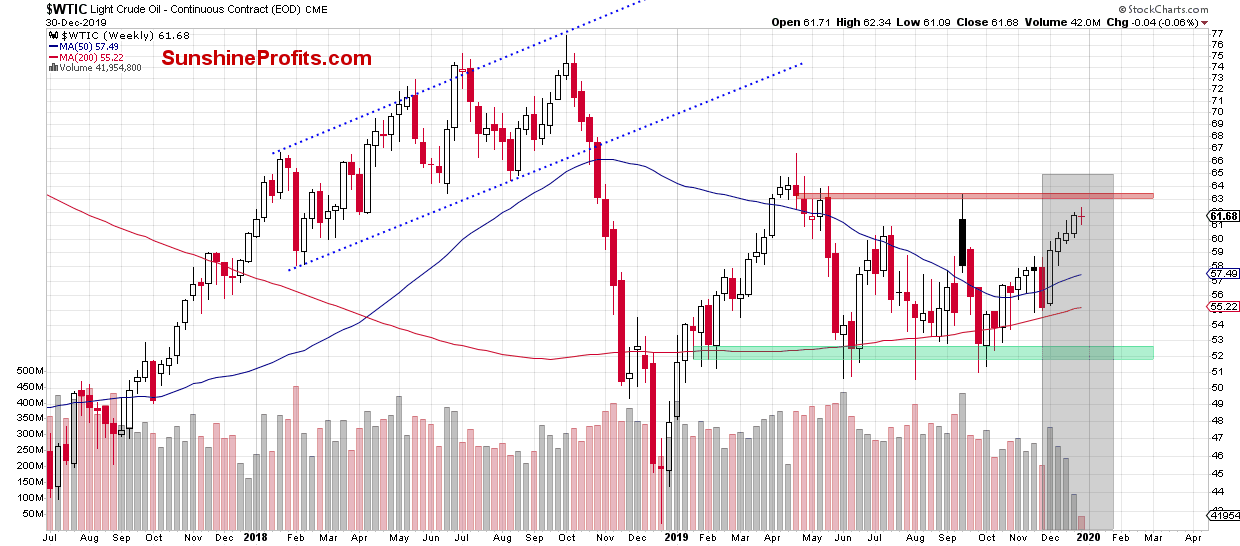

Let’s take a look at the weekly crude oil chart. The volume is progressively declining, raising doubts about the bulls’ strength going forward. Read more...

WTI registers small daily losses, continues to trade above $61

Crude oil prices continued to push higher toward the end of the year and the barrel of West Texas Intermediate reached its highest level in more than three months at $62.31 on December 30th. Although profit-taking weighed on the WTI and caused it to post small daily losses on December 31st, it still closed the month 11.1% higher.

Steady start to 2020

At the start of the new year, the WTI edged lower but was able to limit its losses supported by the heightened hopes of global economic recovery gathering momentum and the weekly report published by the American Petroleum Institue, which showed late Tuesday that crude oil stockpiles in the US fell by 7.8 million barrels in the week ended December 27th. As of writing, the WTI was down 0.4% on a daily basis at $61.28. Read more...

Author

FXStreet Team

FXStreet