Four factors moving oil prices

Oil was on the front foot at the start of the New Year buoyed by the prospect of a signed US – China trade deal and rising tensions in the middle east, in addition to shrinking stockpiles and the start of deeper OPEC plus production cuts. However, the push higher has been short lived.

1. Middle Eastern tensions. An Iran back Iraqi militia withdrew from the US embassy in Baghdad after storming it in protest over airstrikes. Elevated tensions involving Iranian backed forces has increased geopolitical risk in the region. However, there is no immediate threat to Iraq’s oil supply so the move higher could be short lived.

2. Trade deal. The US – China trade deal is expected to be signed on 15th January. Strong indications that the first phase trade deal will be signed and formally entered into within the coming weeks is boosting sentiment towards the global economic outlook and to a degree lifting expectations for future oil demand.

Realistically though, traders will want to see this optimism reflected in stronger data before we see a meaningful advance in oil prices.

3. Production cuts. This month also sees the start of deeper production cuts agreed by the OPEC plus group at the end of last year. This move has already been priced in. Of more concern was data showing that Russian output reached a post-Soviet high last year. Despite curbing production under the OPEC plus agreement and being one of the architects, Russia has a poor record of fulfilling its pledge.

4. Fall US Inventories. A decline in US inventories last week lifted the price of oil. API report showed that US crude stocks fells 7.8 million barrels week ending 27 December, significantly greater than the 3.2 million forecast. Investors are now awaiting Friday’s EIA crude stock data for fresh direction

Levels to watch:

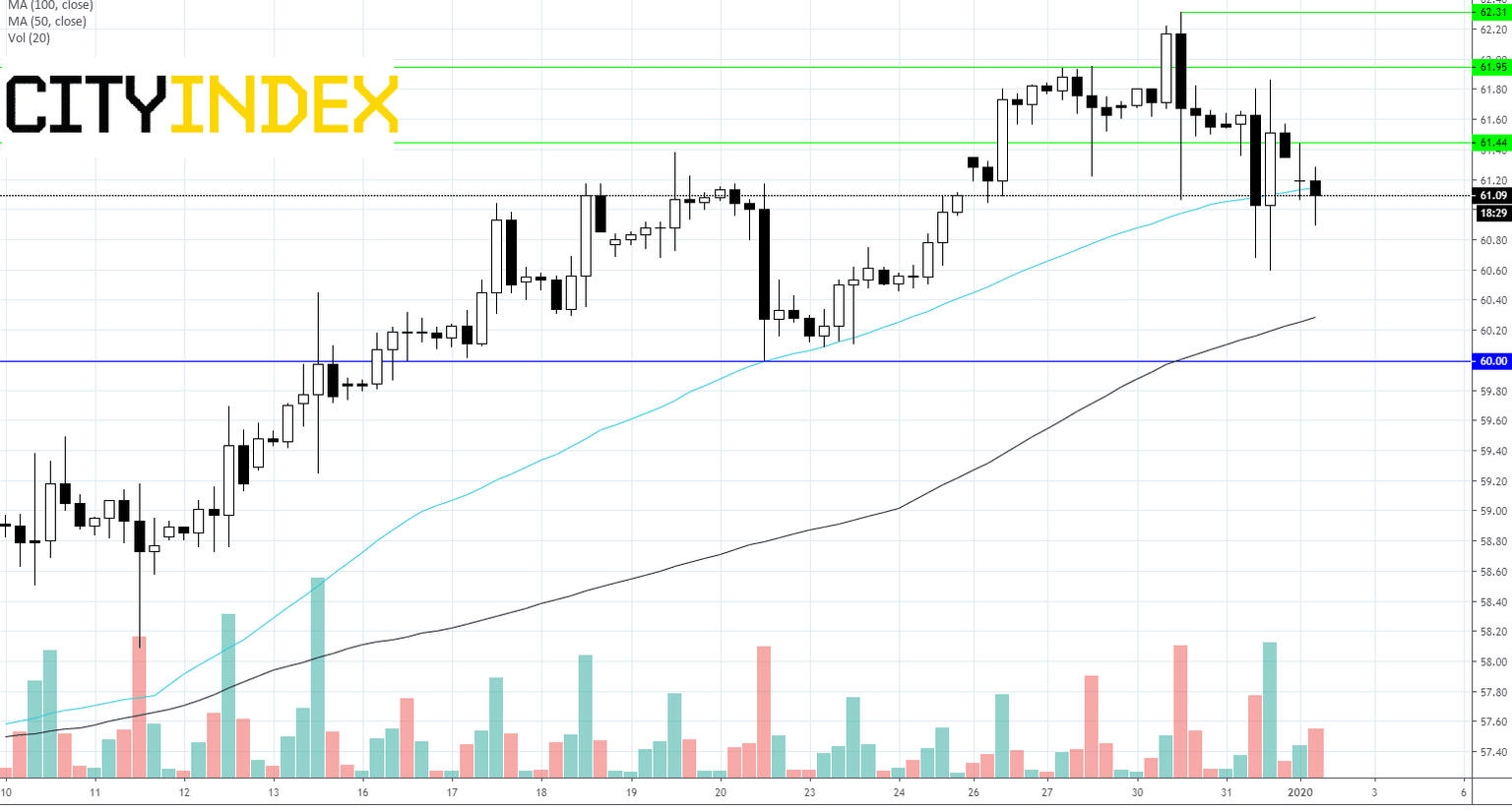

After starting 2020 on the front foot WTI is showing evidence of weakness. Falling volumes raise doubts over bull’s strength going forwards. After failing to break through resistance close to $61.50, the bulls have lost momentum and WTI has seen heavy selling over the past hour. WTI has fallen below 50 SMA although remains firmly above 100 SMA and 200 SMA. Oil bulls need to push through $61.50 to open the door to $61.95 and $62.31. A breakthrough support at $60 could negate the uptrend.

Author

Fiona Cincotta

CityIndex