Crude Oil Futures: Extra losses appear unlikely

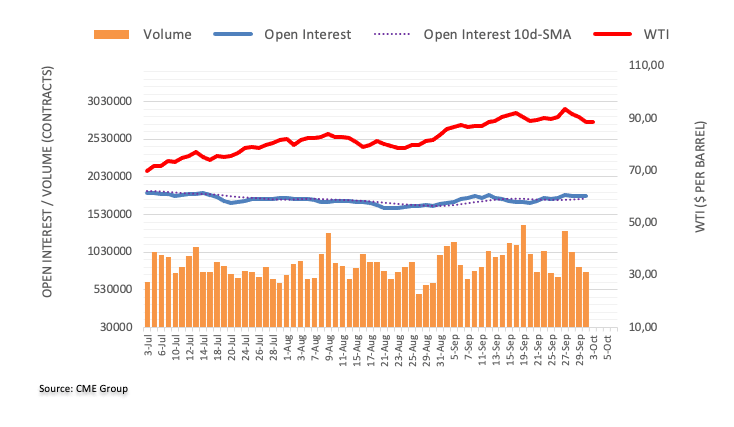

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions for the third consecutive session on Monday, this time by around 1.3K contracts. Volume followed suit and shrank for the third straight session, now by around 55.8K contracts.

WTI meets initial support near $88.00

WTI prices extended the corrective decline on Monday, closing below the key $90.00 mark per barrel. The daily downtick, however, was on the back of declining open interest and volume and suggests that further retracements seem not favoured in the very near term. In the meantime, the $88.00 region per barrel emerges as quite a decent support for the time being.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.