Crude Oil extends rally, WTI crosses above $82.00

- Crude Oil prices are continuing a bull run on Monday.

- WTI is breaking out on the bull side as supply constraint concerns weigh.

- US Crude Oil bids into its highest prices since November.

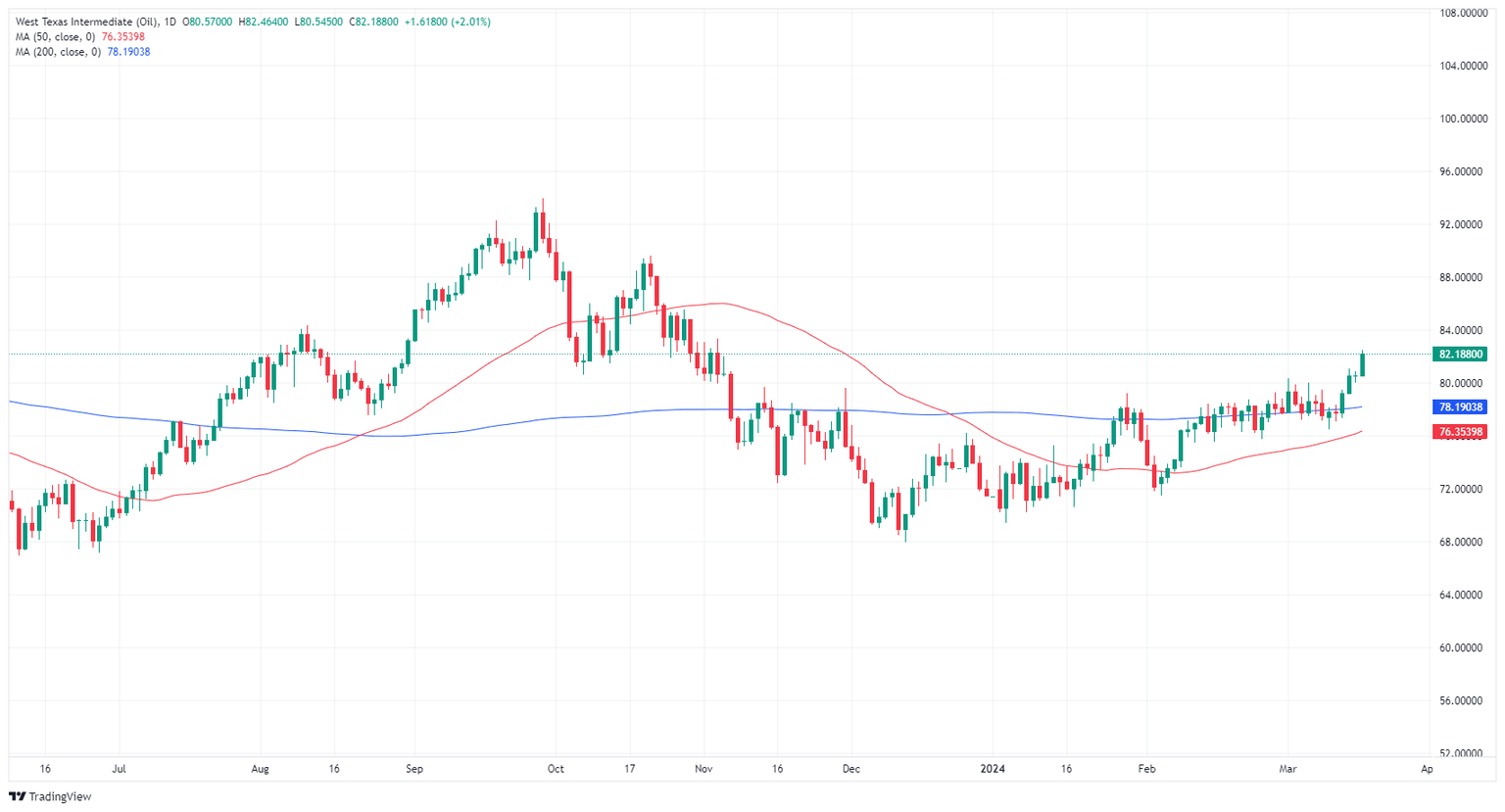

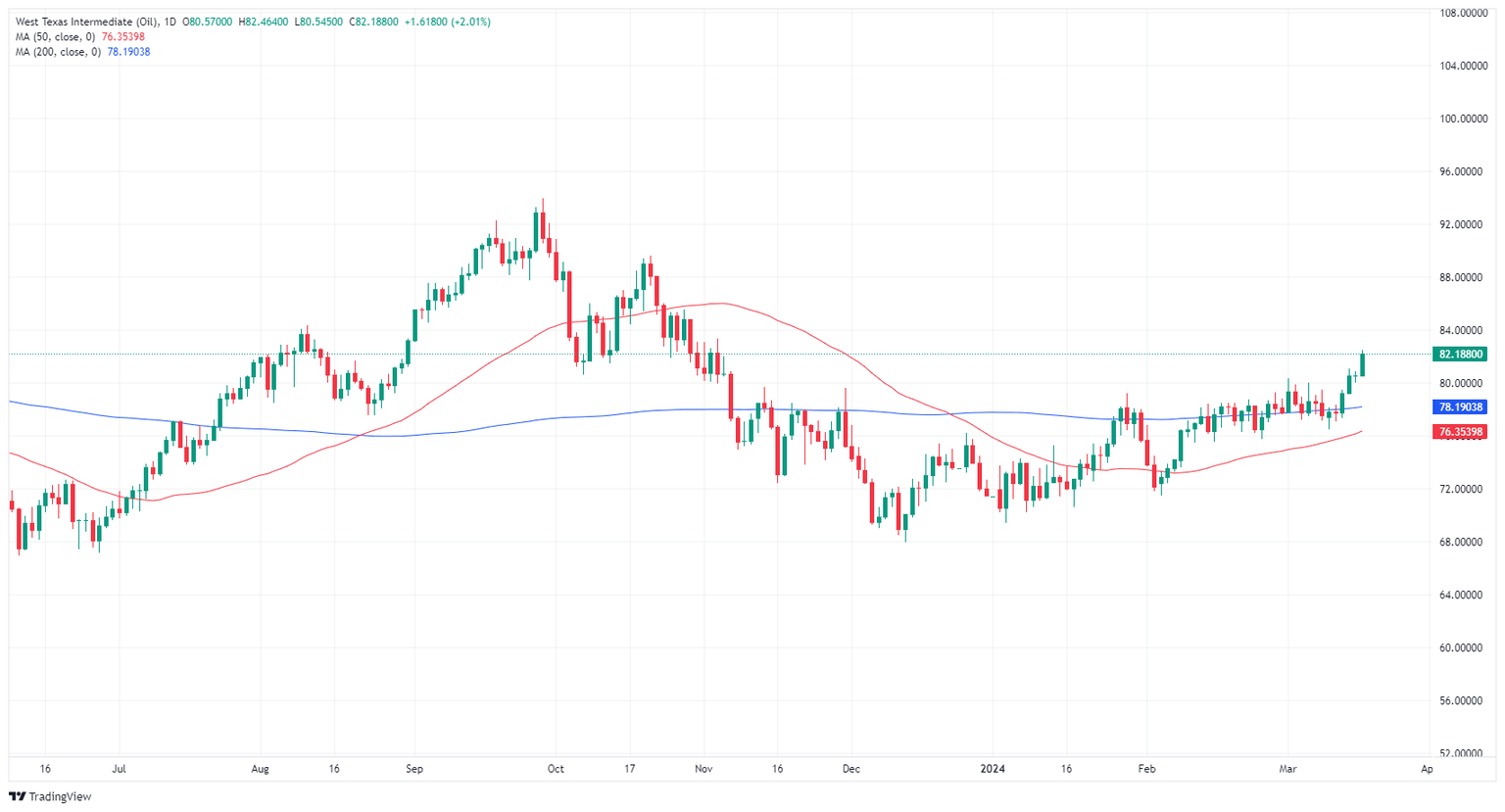

West Texas Intermediate (WTI) US Crude Oil climbed over $82.00 per barrel on Monday, extending a near-term bull. US Crude Oil tested its highest barrel prices since November, hitting a 16-week high of $82.46 to kick off the new trading week.

Energy markets are increasingly concerned that declining Crude Oil supplies will continue into the immediate future. Despite record oil pumping amounts from countries outside of the Organization of the Petroleum Exporting Countries (OPEC), specifically the US, Crude Oil markets are broadly expected to see a medium-term to long-term supply constraint, bumping barrel costs higher.

Weekly Crude Oil Stocks for the week ended March 15 from the American Petroleum Institute (API) are due Tuesday, and last showed a -5.5 million barrel drawdown. The Energy Information Administration’s (EIA) own Crude Oil Stocks Change is due Wednesday. The EIA’s barrel counts are expected to be further drawn down by a scant 25K barrels after the previous week’s decline of -1.5 million.

WTI technical outlook

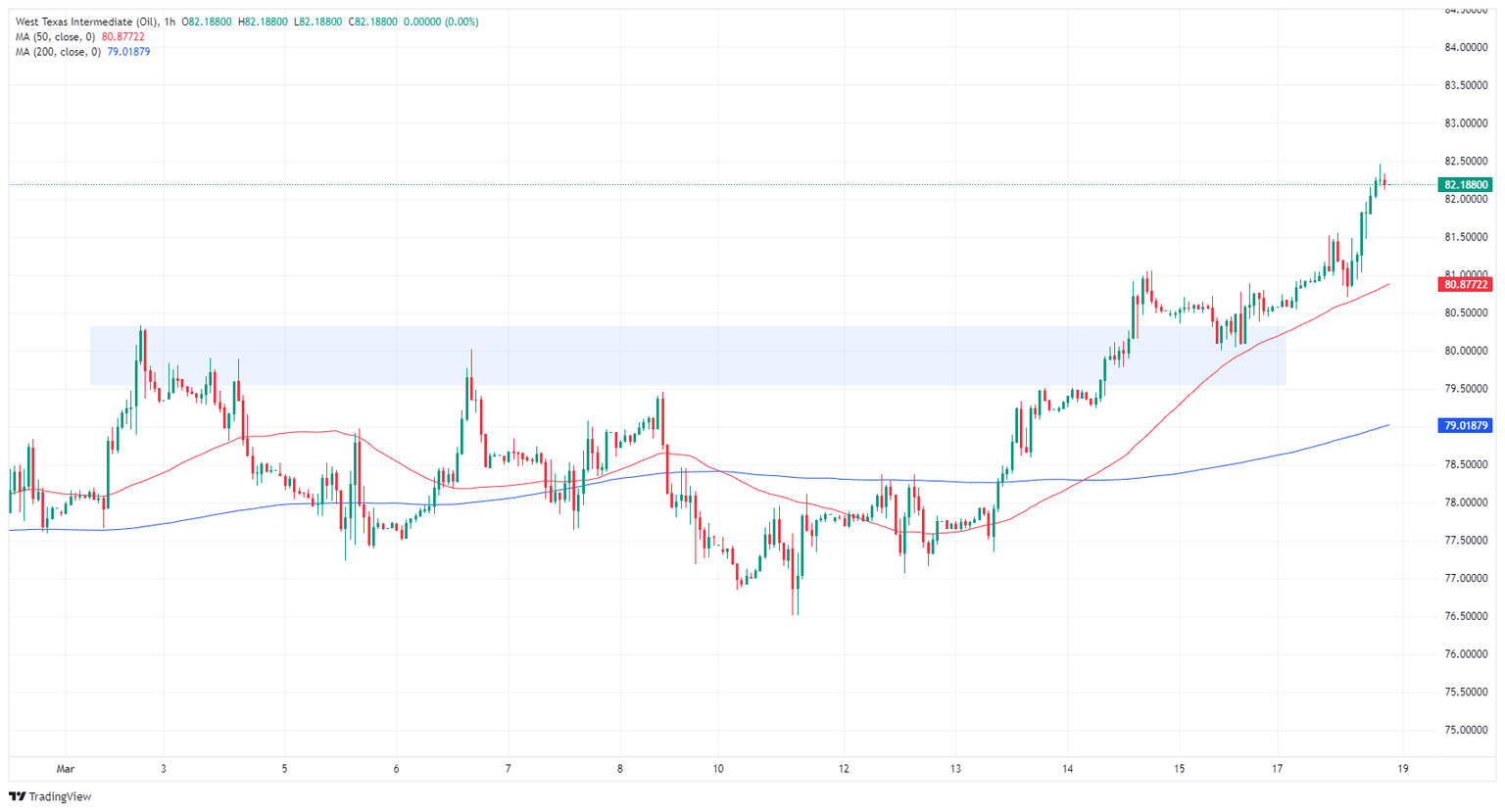

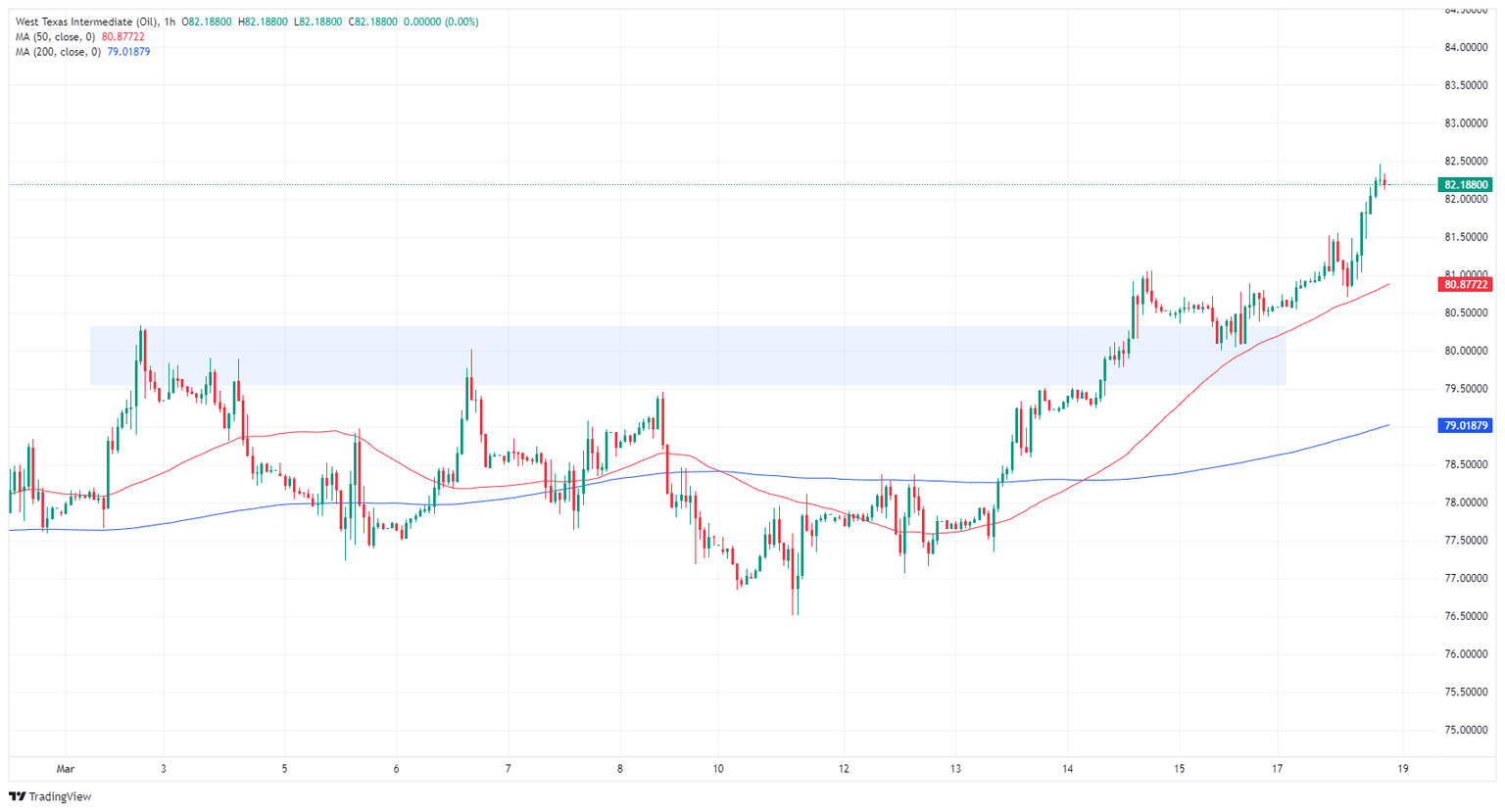

Monday’s bullish bounce sees WTI trading above the $82.00 handle after catching a rebound from a previous supply zone near $80.00 per barrel. Crude Oil has gained nearly 7.5% from the last swing low below $77.00.

Monday’s bullish extension adds further topside momentum to a technical recovery on daily candlesticks after WTI US Crude Oil bottomed out near $67.85.

WTI hourly chart

WTI daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.