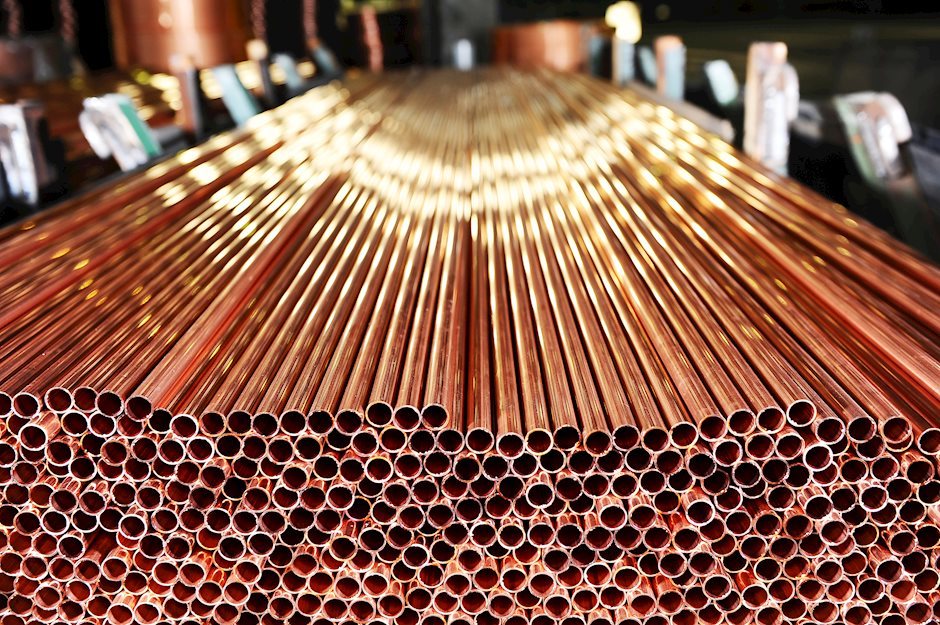

Copper: Demand concerns outweigh disappointing production and potential shortfalls – Commerzbank

At the end of last week, the world's largest Copper mine producer based in Chile reported an 8.4% year-on-year decline in Copper output for the first half of the year, Commerzbank’s commodity analyst Barbara Lambrecht notes.

Demand concerns weigh on Copper despite low production

“Although the company was optimistic that production would recover in the second half of the year, the group is danger of missing the slight increase in production forecast for the year as a whole. According to Bloomberg Intelligence, it could thus lose its first place to the second-largest producer to date.”

“But new production losses are also looming here: The union has called on workers at the world's largest Copper mine, Escondida, that has a capacity of 1.35 million tons of Copper ore, to reject the employers' offer and go on strike. If the workers do reject the offer, there does not necessarily have to be an immediate strike, as both parties have the right to ask the government for mediation.”

“The fact that the Copper price came under renewed pressure despite disappointing production reports and the threat of production losses is likely due to ongoing demand concerns. The sentiment indicators from China's manufacturing sector due in the middle of the week are also unlikely to provide a tailwind.”

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.