China’s another property group calls of bond trading, Evergrande’s foreign repayments loom

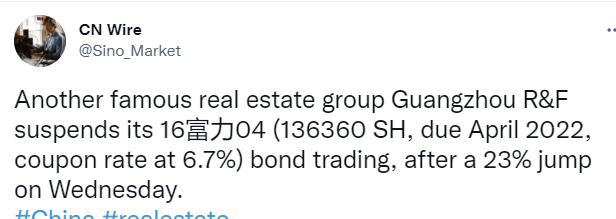

The latest headlines are crossing the wires, via CN Wire, citing the suspension of bond trading of yet another Chinese property group.

The above tweet is only going to intensify the concerns over a contagion, fuelled by the country’s troubled Evergrande property development giant.

The risk sentiment got a bit of a boost, earlier on, after Evergrande announced that the main unit Hengda Real Estate group will make a coupon payment for onshore bonds due September 23.

However, the risk-on flows quickly ebbed after investors reassessed the risks, considering that China Evergrande’s repayment to its foreign bondholders still looms on Thursday and that nothing is announced for the same.

Market implications

The S&P 500 futures, the risk gauge, pares back gains to now trade flat at 4,356 while AUD/USD eases 20-pips to near 0.7250.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.