China releases bill for Hong Kong National Security, risk takes a fresh hit

According to a draft of the legislation seen by Reuters, China’s National People’s Congress (NPC) “proposed new legislation for Hong Kong requires the territory to quickly finish enacting national security regulations under its mini-constitution.”

However, no further details are provided on the new proposal, as all eyes remain on China’s parliamentary Vice Chairman Wang Chen, who is scheduled to give a speech explaining the new law later on Friday.

The new legislation cites that China’s parliament has powers to set up the legal framework and implementation mechanism to prevent and punish subversion, terrorism, separatism and foreign interference, “or any acts that severely endanger national security.”

Taiwan has already expressed concerns over China’s new firmer policy on Hong Kong while the same is unlikely to go down well with the US. The US has until the end of this month to decide whether to certify Hong Kong’s autonomy under the Human Rights and Democracy Act of 2019.

Meanwhile, China’s state news agency, Xinhua reported earlier today that China would review the draft national security law for Hong Kong due to “activities that have seriously challenged the bottom line” of system allowing city to govern its own affairs after handover from UK.”

“Law-based and forceful measures must be taken to prevent, stop and punish such activities,” Xinhua reported, citing the document.

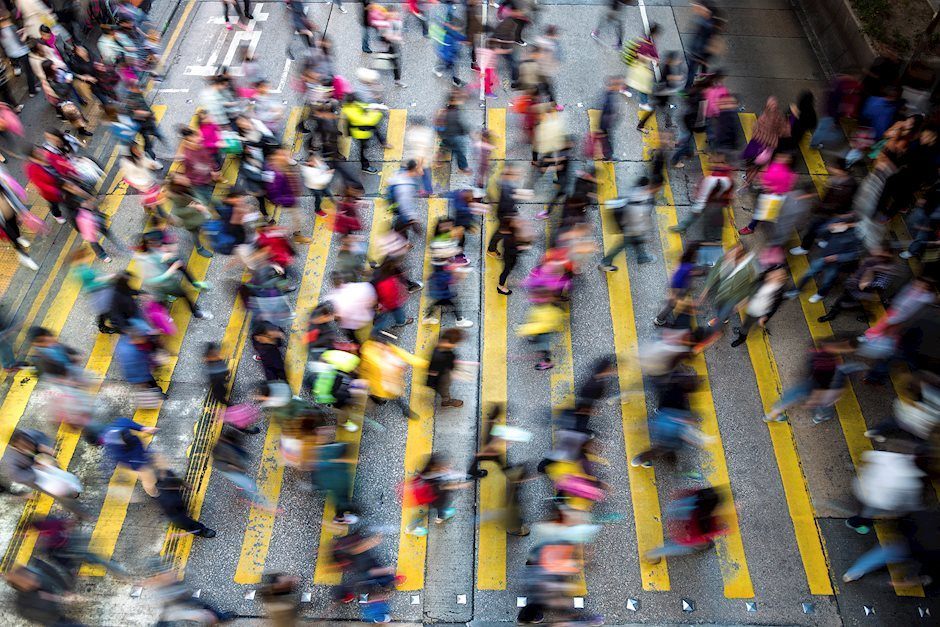

Reuters is now reporting that Hong Kong activists have called for a protest march this Friday against Beijing’s plans to impose National Security legislation.

Market reaction

The market sentiment has soured further as China taking “forceful measures’ on Hong Kong under the National Security laws are likely to deepen the ongoing US-China tensions.

The Asian stocks are flashing red, led by the 5% drop in Hong Kong’s benchmark index, the Hang Seng. The US stock futures are down nearly 0.70% while the US 10-year Treasury yields sink 4.50%.

Meanwhile, the US dollar index holds gains just above 99.50 amid increased flight to safety. Gold prices are trading flat below 1730 levels.

On the fx front, USD/JPY is testing the 107.50 support amid risk-aversion and BOJ’s additional support measures. AUD/USD is downed 0.40% to 0.6530, the weakest so far.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.