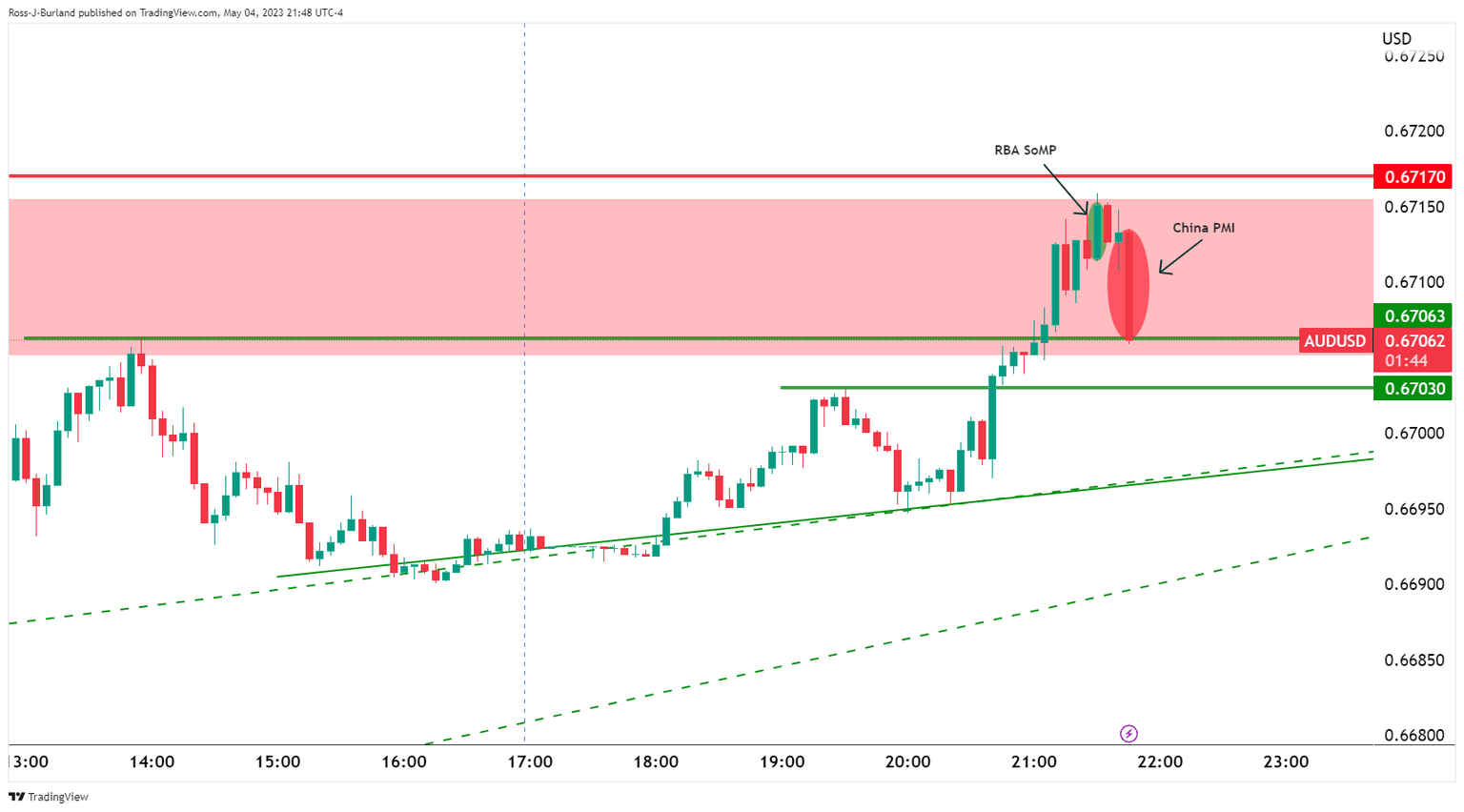

China Caixin Services PMI: 56.4 (forecast 57, previous 57.8), AUD sliding

The China Caixin Services PMI, released by Markit Economics, has hit the market as follows:

- Actual 56.4 (forecast 57, previous 57.8).

´´China's service activity grew for a fourth straight month in April, a private-sector survey showed on Friday, as businesses continued to benefit from a return toward pre-pandemic levels of demand and output, although expansion slowed slightly,´´ Reuters has reported.

´´The figure echoed the official PMI released on Sunday, which showed a slightly slower pace of growth.´´

´´The world's second-biggest economy is facing an uneven recovery and some persistent headwinds, with strong activity in services and a contraction in manufacturing.

China's tourism rebounded to pre-COVID levels in the five-day May Day holidays as domestic travel rose by more than two-thirds from a year earlier, government data showed.

´It remains to be seen if the economic rebound is sustainable after a short-term release of pent-up demand, with a number of indicators flagging that the recovery has yet to find a stable footing,´said Wang Zhe, senior economist at Caixin Insight Group.´´

"In the future, relevant policies should focus on expanding domestic demand, stabilising employment and improving expectations, as well as improving the monetary transmission mechanism and creating a virtuous circle of economic development," said Wang.

AUD/USD update

The price is two-way around the Reserve Bank of Australia's statement of Monetary Policy that came out just ahead of the Chinese data.

About the Caixin Services PMI

The Caixin Services PMI™, released by Markit Economics, is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 private service sector companies. The panel has been carefully selected to accurately replicate the true structure of the services economy.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.