Chevron (CVX) double correction possible while trend remains bullish

Chevron Corporation is a global energy company that specializes in oil and gas. It’s headquartered in San Ramon, California, and operates in more than 180 countries. Below we update the long term Elliott Wave outlook of the company.

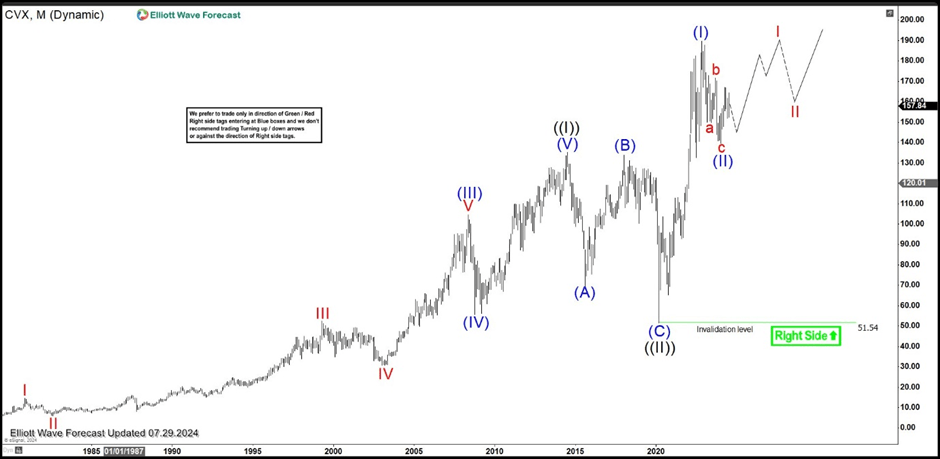

Chevron monthly Elliott Wave chart

Monthly Elliott Wave Chart of Chevron (CVX) above shows wave ((I)) Grand Super Cycle ended at 135.1. Pullback in wave ((II)) unfolded as a zigzag Elliott Wave structure. Down from wave ((I)), wave (A) ended at 69.58. Wave (B) corrective bounce ended at 133.88. Stock then resumed lower in wave (C) towards 51.54. This completed wave ((II)) in higher degree. The stock has turned higher in wave ((III)) which subdivides into impulsive structure. Up from wave ((II)), wave (I) ended at 189.68. Wave (II) pullback is proposed complete at 139.62 but the stock still needs to break above wave (I) at 189.68 to rule out a double correction. While above 51.54, expect pullback to find support in 3, 7, or 11 swing for further upside.

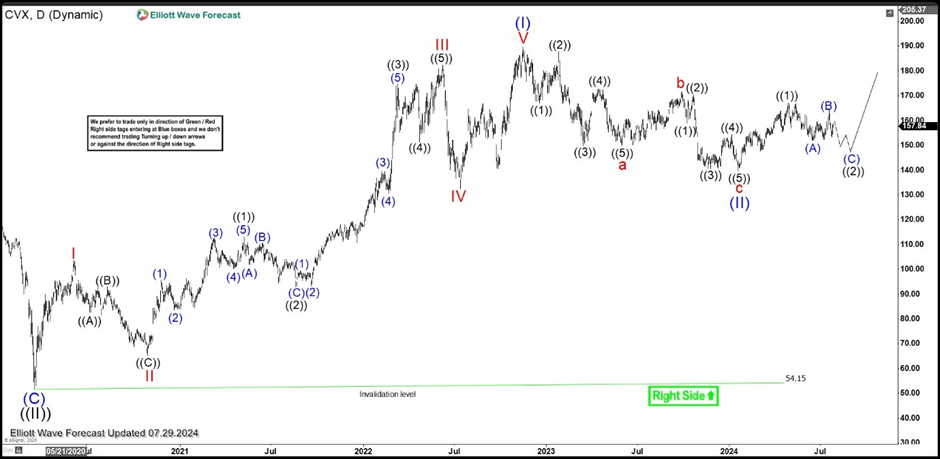

Chevron daily Elliott Wave chart

Daily Elliott Wave Chart for Chevron above shows that rally in wave (I) ended at 189.68. Wave (II) is proposed complete at 139.62 with internal subdivision as a zigzag. The stock has turned higher in wave (III) as a 5 waves impulse, although it still needs to break above wave ((1)) at 167.11 to rule out a double correction. Up from wave (II), wave ((1)) ended at 167.11. There’s scope for the stock to do another leg lower before ending wave ((2)). As far as it stays above 54.15, expect dips to find support in 3, 7, or 11 swing for further upside.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com