CF Acquisition Corp VI Stock News and Forecast: CFVI stock pops on Joe Rogan deal hopes

- CF Acquisition Corp VI

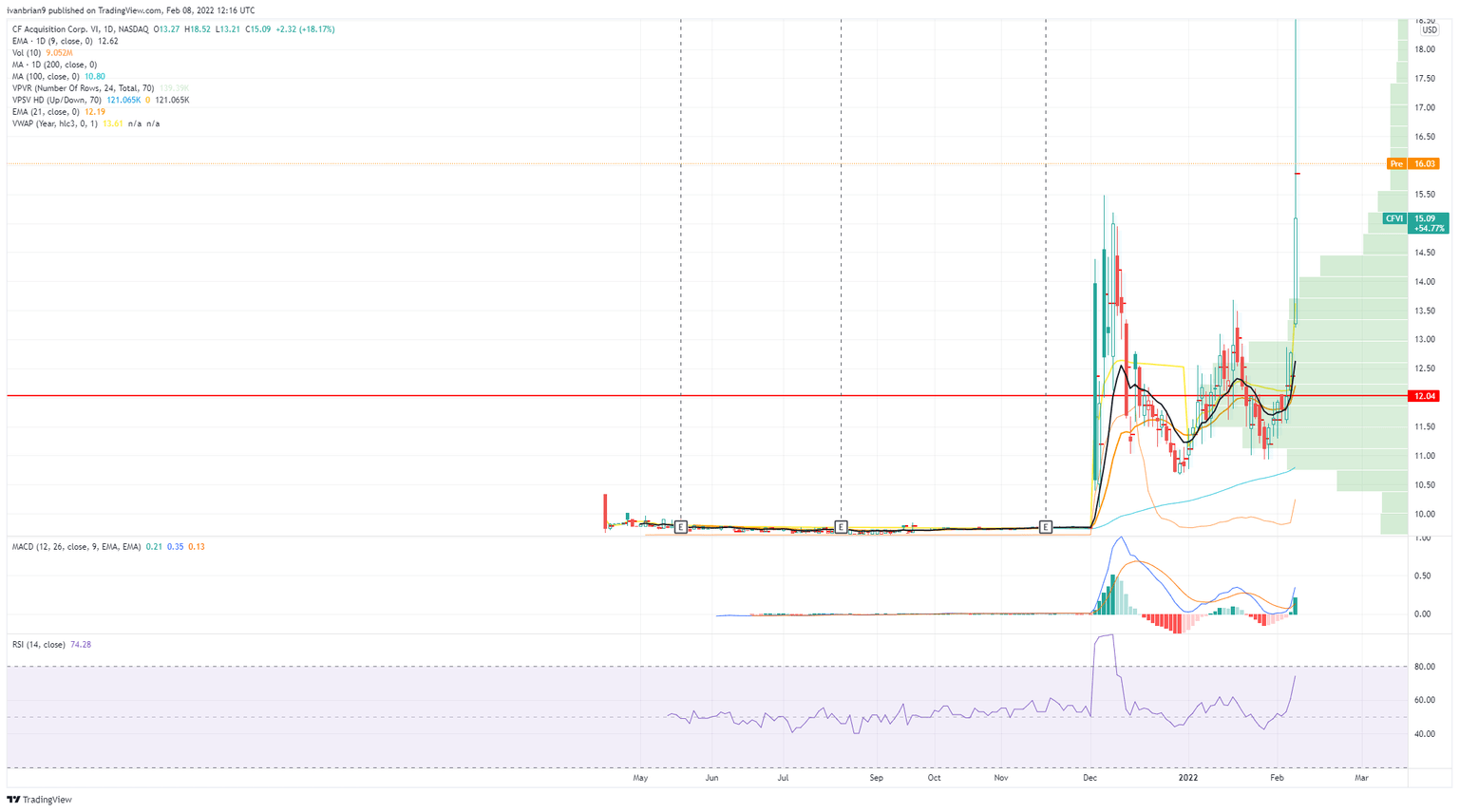

- CFVI stock closes at $15.09 for an 18% gain.

- CFVI shares had traded above $18 at one stage on Monday.

CF Acquisition Corp VI (CFVI) is a blank check company that is due to merge and take Rumble public. Rumble is a Canadian online video-sharing platform. It was founded in 2013, but its growth has really only taken off since the first lockdown in early 2020. From just over 1 million users at the start of the first lockdown, it had over 30 million by mid-2021. Rumble is known as a conservative social media site, and it has partnered to stream content from Truth Social, the new Donald Trump social media venture.

CF Acquisition Corp VI Stock News

The news of Spotify's (SPOT) issues with Joe Rogan's podcast took a back seat to the wild swings in Meta Platforms (FB) and Amazon (AMZN). It nonetheless attracted much interest. Neil Young pulled his music from Spotify in protest at the Joe Rogan Experience, and the rumble (pun intended) has kept on metastasizing. Spotify initially tried to dampen the furor with new rules. In the new Spotify Platform Rules, Spotify bars its contributors from “content that promotes dangerous false or dangerous deceptive medical information that may cause offline harm or poses a direct threat to public health.”

Spotify CEO Daniel Ek had apologised to staff but said censorship was not the answer and the company planned to keep the Joe Rogan podcast.

Now it has emerged that Spotify faces competition in the form of Rumble. The company is a video sharing platform and is aiming to be a white knight in the Spotify/Joe Rogan debate. Rumble CEO Chris Pavlovski made an enticing and highly lucrative offer. The publicity certainly has helped CFVI stock to surge higher.

We are not sure of the logic of pushing shares of CFVI nearly 20% higher on this news. It is certainly attention-grabbing, but a shareholder should always be cognizant of the bottom line when investing or trading. Is this deal workable? Can Rumble get it through? What will it deliver in terms of the bottom line?

We doubt Spotify is going to give up one of its prized assets that easily. The Wall Street Journal appeared to break the news of the deal between Joe Rogan and Spotify back in May 2020, and the deal is a multi-year, exclusive licensing agreement as far as we are aware. That would mean Spotify has exclusivity, and Rumble has a limited chance of success unless Spotify terminates the agreement. Spotify's CEO has already said that is not in the cards: “And I want to make one point very clear – I do not believe that silencing Joe is the answer.”

CF Acquisition Corp VI Stock Forecast

This is highly speculative. Momentum is the main driver here rather than fundamental or technical factors, so make sure you get out when momentum changes. The likelihood of the deal going through is small. Does that mean CFVI shares will fall back to $12? That depends on momentum. Rumble has generated a huge amount of publicity from this. That could see user numbers jump more. It could also see traders anticipate this and keep the price elevated. From a purely technical perspective, $12 is the volume-based point of control. There is little resistance up here. We stress this is momentum trading: when momentum stalls, so too will the share price. Control your risk accordingly.

CFVI chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.