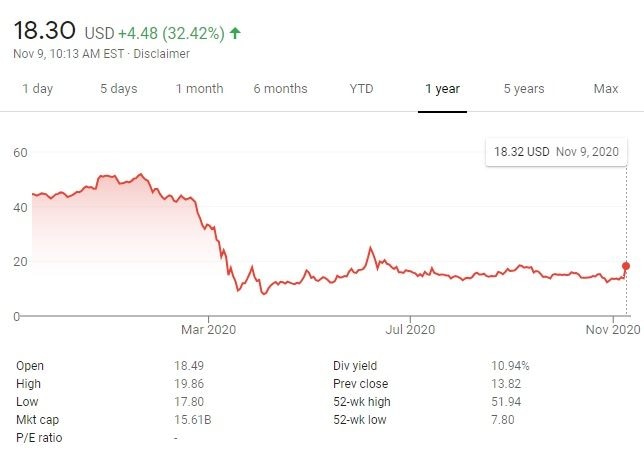

CCL Stock Price: Carnival Corp shares soar more than 30% on vaccine optimism

- Carnival Corp stocks are up more than 30% on Monday.

- CCL touched its highest level since early June near $20.

- Pfizer says its coronavirus vaccine is more than 90% effective.

Major equity indexes in the US jumped to fresh all-time highs after the opening bell on Monday as Pfizer's latest report on its experimental coronavirus vaccine revived optimism for an effective treatment.

Pfizer announced on Monday that the vaccine they have been developing with BioNTech was "more than 90%" effective in phase three clinical study, citing results from an external and independent Data Monitoring Committee.

NYSE: CCL

Major cruise liner shares, which suffered heavy losses during the first months of the coronavirus crisis, are posting impressive gains at the start of the week. Carnival Corp (CCL: NYSE) shares are leading the rally, gaining 32.4% on a daily basis at $18.30. Earlier in the session, CCL touched its highest level since early June at $19.86.

Reflecting the impressive performance of the cruise industry, Royal Caribbean Cruises Ltd and Norwegian Cruise Line Holdings Ltd shares are up 30% and 25%, respectively.

In late March, Carnival Corp announced that it has decided to suspend CCL stock dividend and repurchase with an aim to improve liquidity while having its operations halted due to the outbreak. The company also noted that it expects to register a net loss in the fiscal year ending November 30th.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.