CCL Stock Price: Carnival Corp has three reasons to continue cruising into the abyss

- Coronavirus cases are rising in Europe and the US.

- A probable Biden victory is unlikely to prioritize the cruise industry.

- The "herd immunity" theory has been shattered by a new study.

Cruising to nowhere – that seems to be the grim reality for Carnival Corp and also its peers. While the Miami-based firm may have an advantage over its peers, the whole sector is suffering from three adverse development that may cause NYSE: CCL to sink.

1) Covid concerns: Recent statistics from Europe and the US paint a grim picture. The seven-day rolling average of American infections has hit a new record near 70,000. Hospitalizations, cases, and also mortalities are on the rise in the old continent, with governments imposing new restrictions. While no authority has slapped a full lockdown, long nighttime curfews will probably are already in place in France. At the time of writing, the disease and restrictions are both trending higher.

2) No herd immunity: A new study by Imperial College London screened 365,000 people over three rounds of testing between June and September and it has shown that the level of antibodies in recovered COVID-19 patients fades within months. Supporters of allowing the disease to spread – many of them in US – may be disappointed.

For Carnival's audience, made mostly of elderly and more vulnerable clients, that is worrying. Many would-be customers would likely shy away from booking a cruise – even if a vaccination comes out.

3) Unfavorable elections: Congress is now adjourned until after the elections and has failed to pass a stimulus bill. President Donald Trump mentioned the cruise industry as a potential recipient of federal funds – but he may be on his way out. Opinion polls show a steady lead for former Vice-President Joe Biden.

The presidential debates have not moved the needle, and in the meantime, around 64 million Americans have already cast their ballots, narrowing the chances for the incumbent. The challenger is likely to pass a multi-trillion deal but may prioritize green causes over cruises.

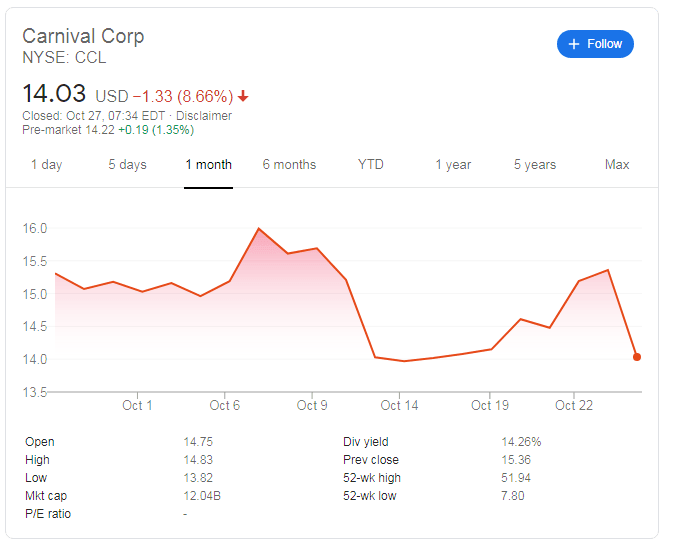

NYSE: CCL

Carnival Corp (NYSE: CCL) fell by 8.66% on Monday, more than the broader stock market. It is now near the October lows. Further down, the round $10 level is eyed. Resistance is at $15.25, a recent high, followed by $16.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.