CCIV Stock Price: Lucid Motors – Churchill Capital IV closes lower as merger vote is adjourned

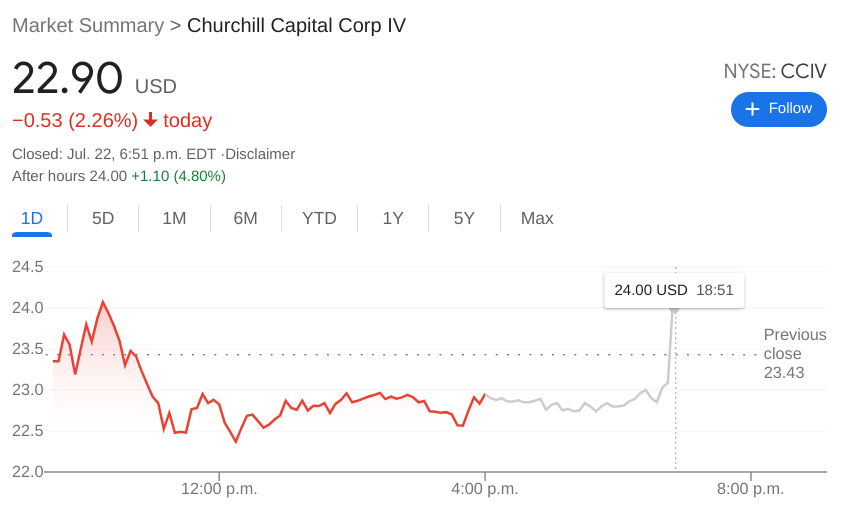

- NYSE:CCIV fell by 2.26% as the broader markets traded mostly flat on Thursday.

- The CCIV-Lucid Motors merger vote was adjourned until Friday.

- Tesla is set to report its earnings call and options traders are betting on a price drop.

NYSE:CCIV held its long awaited shareholder vote on Thursday, and the results were less than encouraging for investors. Shares of CCIV fell by 2.26% to close the trading day at $22.90. CCIV has had a volatile week ahead of its merger with Lucid Motors, as investors seem to be apprehensive now that the date has finally arrived. The stock is still trading well above its $15.00 PIPE value, so there is a bit of a built in cushion, but needless to say Lucid is not off to the best start on the public markets.

Stay up to speed with hot stocks' news!

The shareholder vote was held up by Proposition 2, which was the same Proposition that retail investors misinterpreted a few weeks ago. The wording states that shareholders need to vote on increasing the number of shares from 501 million to 15 billion. This is what retail investors interpreted as share dilution, although this is not the case. Lucid Motors also reported that many of the voting instructions were heading to the shareholder's spam folder in their email, so the vote has been adjourned until Friday, which was the day that Lucid was supposed to begin trading under LCID.

CCIV stock news

Tesla (NASDAQ:TSLA) is reporting its earnings on Monday, and options traders are already hammering put orders on the stock. It is anticipated that Tesla will beat on earnings per share and revenues, but the $640-strike puts are getting the most volume ahead of the call. Shares of Tesla dipped during the past week after CEO Elon Musk revealed that Tesla still holds Bitcoin and may accept it once again as a payment. The bearish sentiment of investors most likely had to do with the recent correction that Bitcoin has been mired in.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet