Canadian Dollar whipsaws on tariff talk and CPI prints

- The Canadian Dollar roiled on Tuesday, hitting multi-year lows before recovering.

- The Bank of Canada is expected to continue trimming interest rates this month.

- Canadian CPI inflation figures ticked down, but core measures accelerated.

The Canadian Dollar (CAD) went end-over-end on Tuesday, whipsawing as Loonie traders grapple with a mixed bag of political headlines and inflation data that strongly implies more rate cuts are on the table. Tariff talk is slowly absorbing most of the market’s available attention span, but a still-widening rate differential poses significant risks for the CAD.

US President Donald Trump held off on deploying his long-threatened package of day one tariffs on nearly all of the US’ largest trading partners, including Canada. Most market participants assumed (apparently rightly) that the talk of immediate tariffs via executive order were largely bluster for the campaign trail, but Donald Trump is still chasing the high of threatening global nations with self-imposed import taxes that would derail the financial well-being of his own citizens.

Daily digest market movers: Canadian Dollar goes parabolic on tariff Tuesday

- Canadian Consumer Price Index (CPI) inflation ticked down in December, falling to 1.8% YoY versus the expected hold at 1.9%. On a monthly basis, Canadian headline CPI contracted -0.4% MoM, in-line with expectations.

- Cooling headline inflation figures will be more than enough to push the Bank of Canada (BoC) into a fresh batch of rate cuts; interest rate futures traders are now pricing in 83% odds of a 25 bps rate trim from the BoC next week, up slightly from the previous 78%.

- Core inflation metrics, the BoC’s own CPI core measure, accelerated to 1.8% YoY versus the last print of 1.6%, but again the monthly figure contracted by -0.3% MoM.

- Donald Trump made a point of leaving the door open to a sweeping 25% tariff on all Canadian exports to the US, possibly in February.

- Mid-tier Canadian Retail Sales figures are due on Thursday, but no drastic swings or changes are expected on that front.

Canadian Dollar price forecast

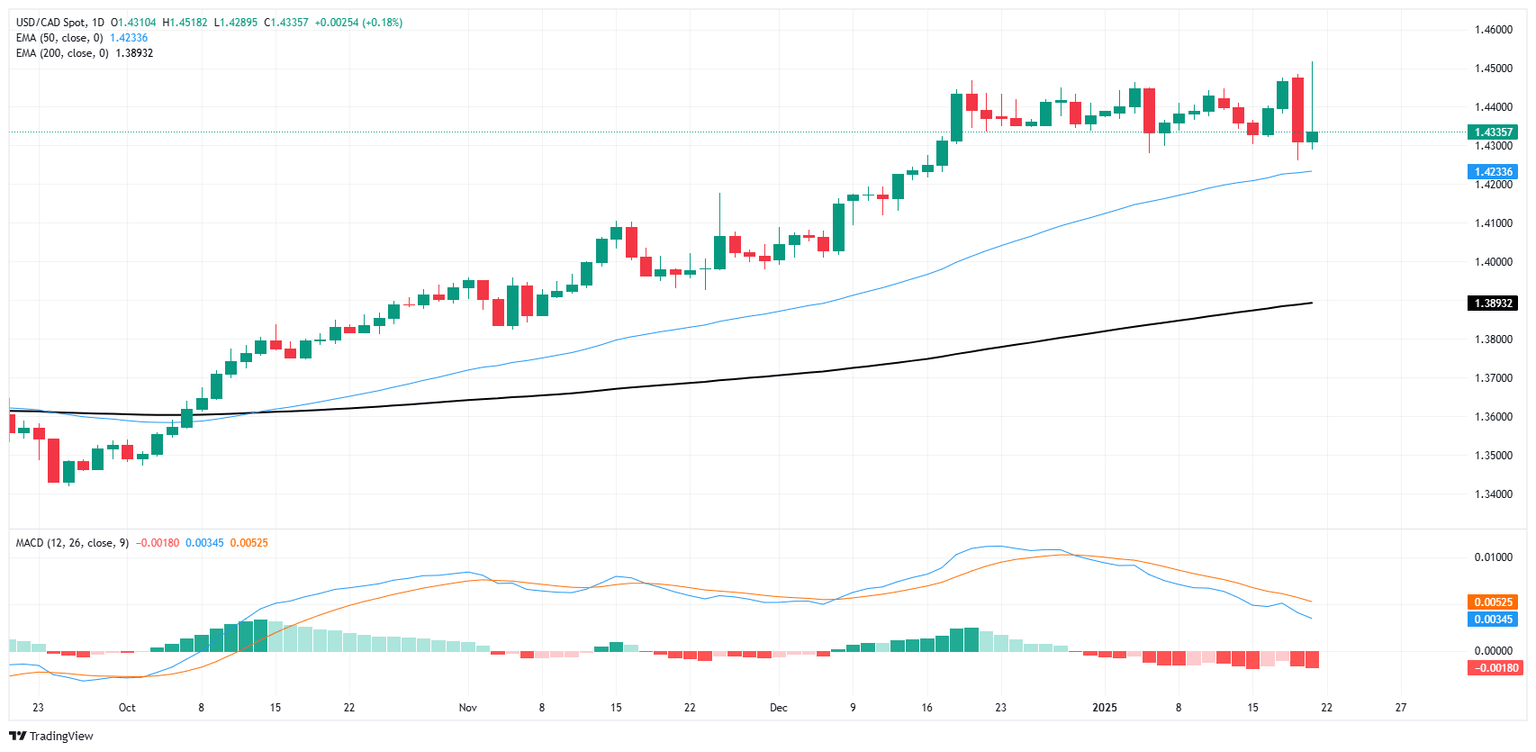

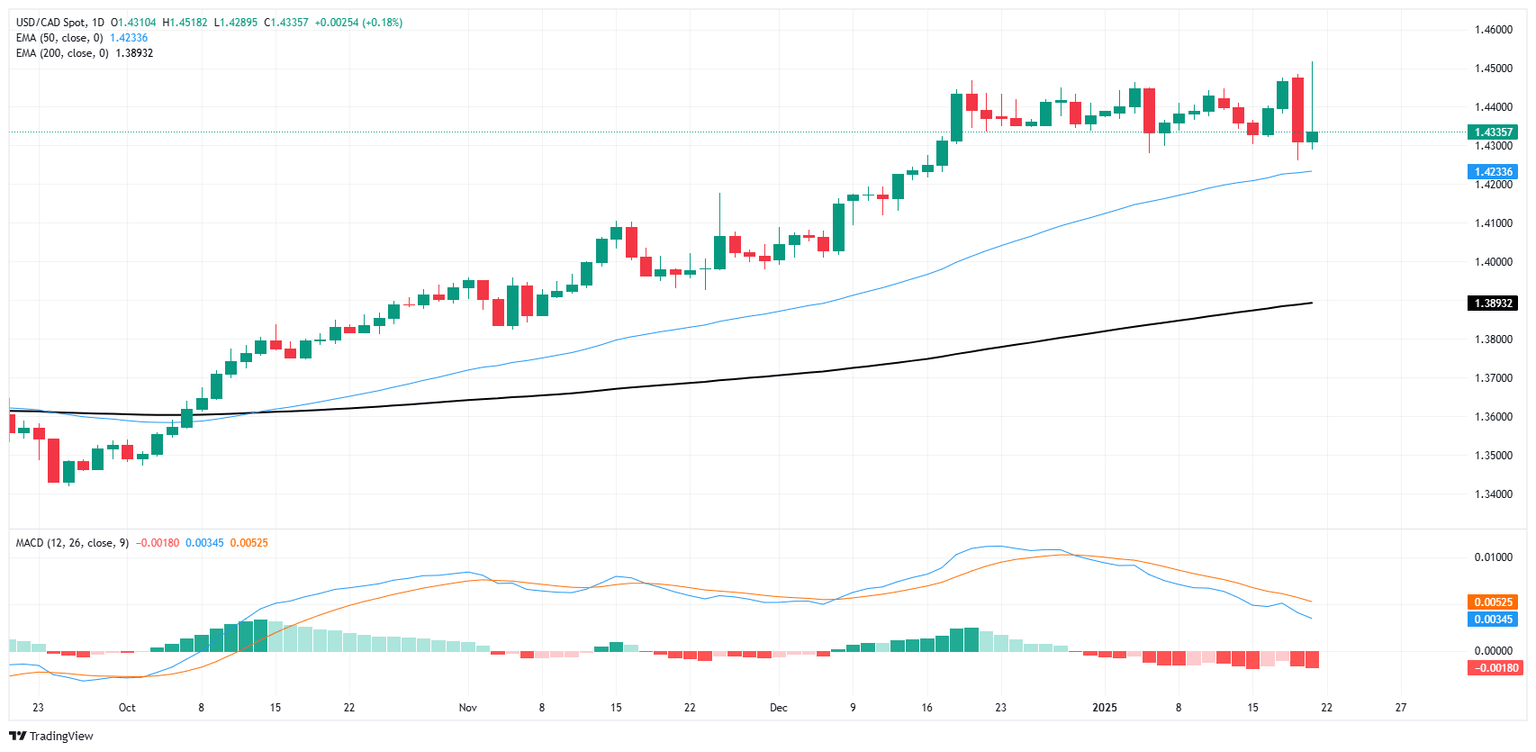

Tuesday’s wide swing sent the Canadian Dollar spiralling into a fresh five-year low, pushing USD/CAD into the 1.4500 handle for the first time since March of 2020. Markets quickly recovered their footing to keep the pair under pressure and staring at a technical floor near 1.4300, but the damage was done and the Loonie is set to continue fighting a losing battle.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.