Canadian Dollar tumbles after fresh Greenback strength

- The Canadian Dollar took a tumble on Monday as markets bid up the US Dollar again.

- A fresh push into the safe haven Greenback on trade fears has pulled the rug from beneath the Loonie.

- Despite a fresh delay to widespread tariffs, Trump has threatened even more trade duties.

The Canadian Dollar (CAD) fell back on Monday, catching a fresh bout of risk aversion as investors stepped back into the safe haven US Dollar (USD). The Trump administration is poised to stiffen import fees imposed on key US trading allies, even as yet another self-imposed deadline on already-threatened tariffs comes and goes.

July 9 was supposed to mark the return of President Donald Trump’s wide-ranging reciprocal tariffs threatened in early April. The scattershot tariff package that imposed tariffs on all imports into the US was mostly delayed until July 9. Now the Trump administration is giving countries another month to deliver better trade deal offers to the Trump team, and additional tariff threats have been added to the pile.

Daily digest market movers: Canadian Dollar takes a hit after fresh risk-off flows bolster the Greenback

- The Canadian Dollar fell back over one-half of one percent against the rebounding US Dollar on Monday, bolstering the USD/CAD pair back above 1.3650.

- Loonie losses are set to continue piling up: the Greenback is poised to continue climbing as tariff threats weigh on investor sentiment, and key Canadian employment data due later this week is expected to show a faltering Canadian economy.

- The Trump administration sent demand letters to countries including South Korea and Japan early this week, announcing an additional 25% tariff on top of currently-suspended reciprocal tariffs.

- Trump staffers also kicked the tariff deadline down the road this week, pushing the July 9 reciprocal tariff deadline further back to the beginning to August.

- According to White House Press Secretary Karoline Leavitt, more trade demand letters will be sent out to 12 countries on Monday, with additional letters set to come later.

Canadian Dollar price forecast

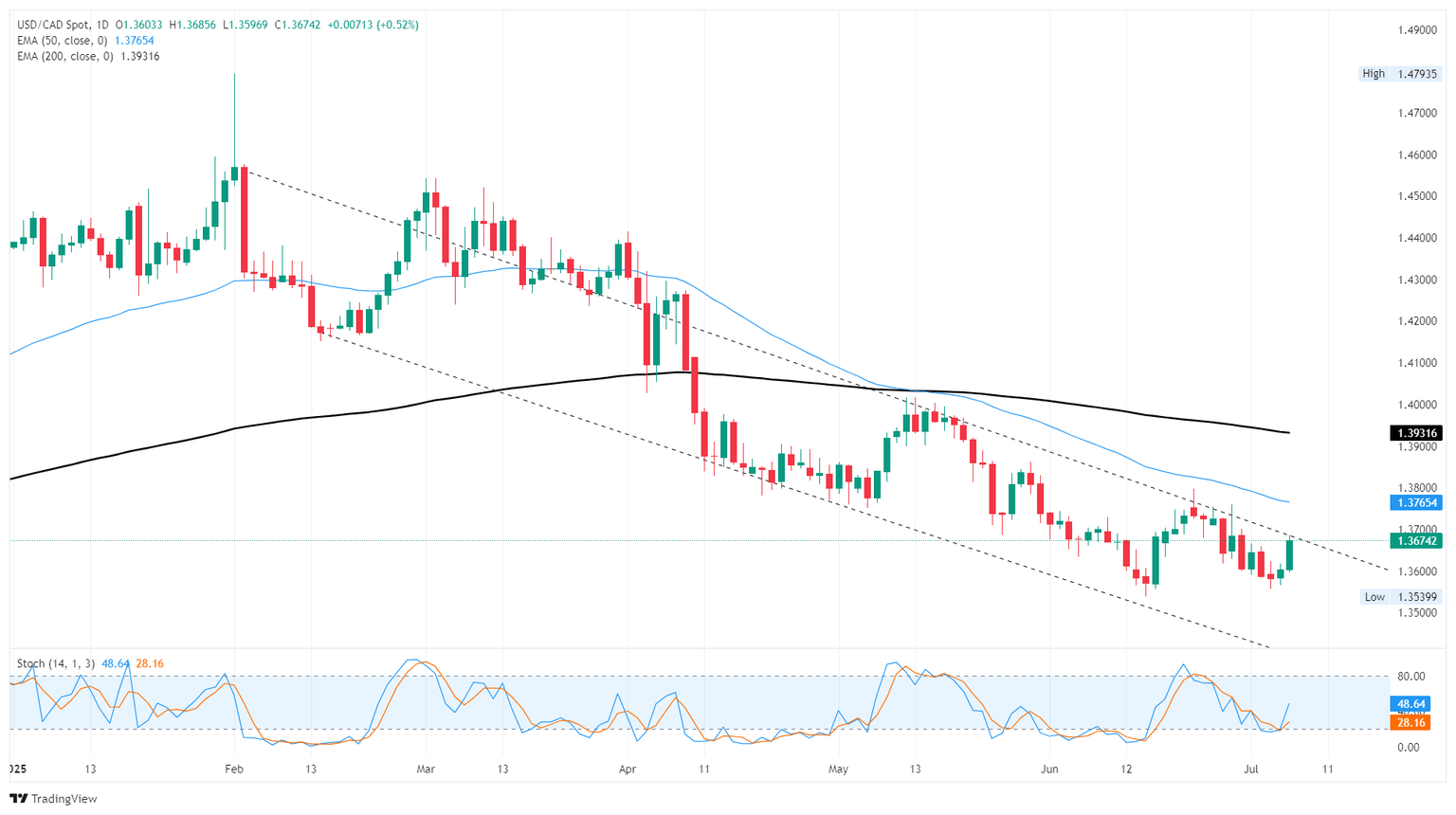

The Canadian Dollar’s latest bout of bearish pressure has pushed the USD/CAD pair back into a descending trendline just below 1.3700. Daily candlesticks are poised to mark in a double bottom chart pattern, signaling that a long-term turnaround in ongoing Greenback weakness could be coming to a close moving forward.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.