Canadian Dollar snaps three-day win streak as BoC rate call looms

- The Canadian Dollar appears to have finally run out of steam.

- Key Canadian CPI inflation figures will print this week, slated for Tuesday.

- Another BoC rate call also looms over Loonie markets, due on Wednesday.

The Canadian Dollar (CAD) appears to have run out of steam, snapping a three-day win streak and paring some of its newfound gains against the US Dollar (USD). Most of the Loonie’s near-term gains against the Greenback have come at the hands of a broad-market weakening in USD flows, rather than any particular strength to be found in the CAD itself.

The Bank of Canada (BoC) is poised to deliver another rate call this week, and markets are pondering whether the BoC will try to squeeze one more rate cut into the chute before tariffs begin to take bites out of the economy. Key Canadian Consumer Price Index (CPI) inflation, also due this week, will serve as a handy canary in the coalmine for what kind of moves on interest rates the BoC might be considering.

Daily digest market movers: Canadian Dollar ends bull run as BoC rate call looms

- The Canadian Dollar pared recent gains against the Greenback, pushing USD/CAD back to the 1.3900 level.

- Headline Canadian CPI inflation is expected to hold at 2.6% YoY on Tuesday.

- The BoC’s latest rate call is slated for Wednesday.

- The BoC is broadly expected to deliver 50 bps in rate cuts by the end of the year.

- Canadian markets will be cutting the week short for the Easter holiday on Friday.

Canadian Dollar price forecast

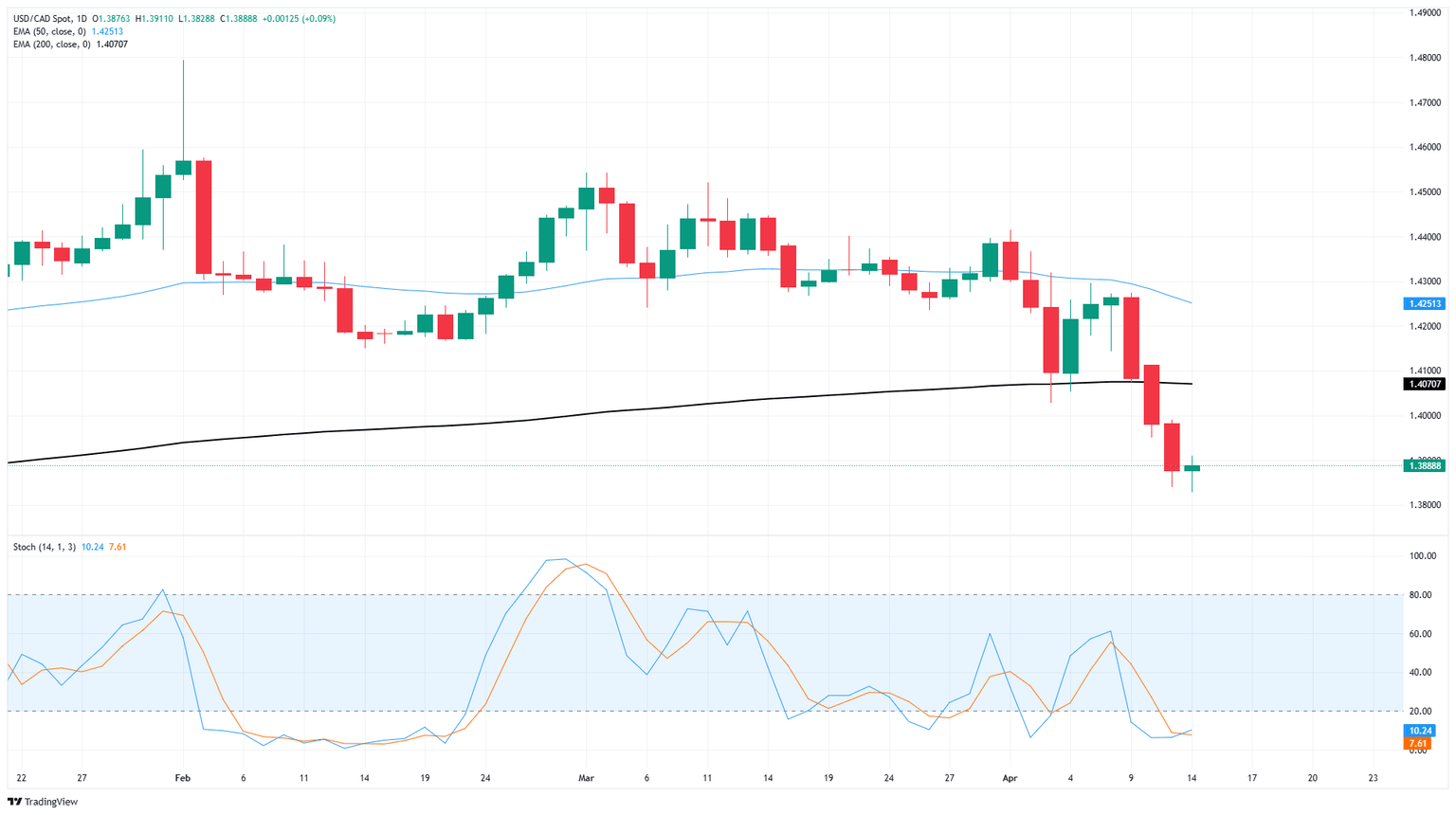

The Canadian Dollar took full advantage of a broad-base weakening in Greenback flows recently, rising 3.1% bottom-to-top against the US Dollar and pushing the USD/CAD pair to six-month lows below 1.3850. Momentum is freezing as markets pivot toward key data releases, leaving USD/CAD to churn on the low side of the 200-day Exponential Moving Average (EMA) near 1.4070.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.