Canadian Dollar sinks on fresh tariff threats, date changes again

- The Canadian Dollar lost over 0.7% on Thursday.

- US President Donald Trump pivoted tariffs to March 4.

- “Reciprocal tariffs” still coming in April, Canadian PM vows retaliatory tariffs.

The Canadian Dollar (CAD) shed over two-thirds of a percent against the US Dollar (USD) on Thursday, falling for a fifth consecutive session and accelerating losses after US President Donald Trump renewed his threats to impose a 25% tariff on Canadian goods beginning on March 4. According to President Trump, a package of “reciprocal tariffs” is also set to begin on April 2.

Canadian Prime Minister Justin Trudeau has already responded to Donald Trump’s wavering reversals on tariffs, vowing that Canada is ready to retaliate against any US tariffs that the White House imposes.

Daily digest market movers: Canadian Dollar recedes as tariff threats resurface

- The Canadian Dollar lost 0.72% on Thursday, bolstering USD/CAD to 1.440 for the first time since the beginning of February.

- Loonie markets are recoiling in the face of renewed threats of a 25% tariff on Canadian goods from US President Donald Trump.

- US President Donald Trump reiterates March 4 tariffs, still seeking Ukraine deal

- According to President Trump, Canada isn’t doing enough to stop the flow of fentanyl into the US, although less than 1% of the drugs seized by US officials were at the US-Canada border.

- US data is also souring, reinforcing fears of a steepening economic slowdown and accelerating inflation pressures across the board.

Canadian Dollar price forecast

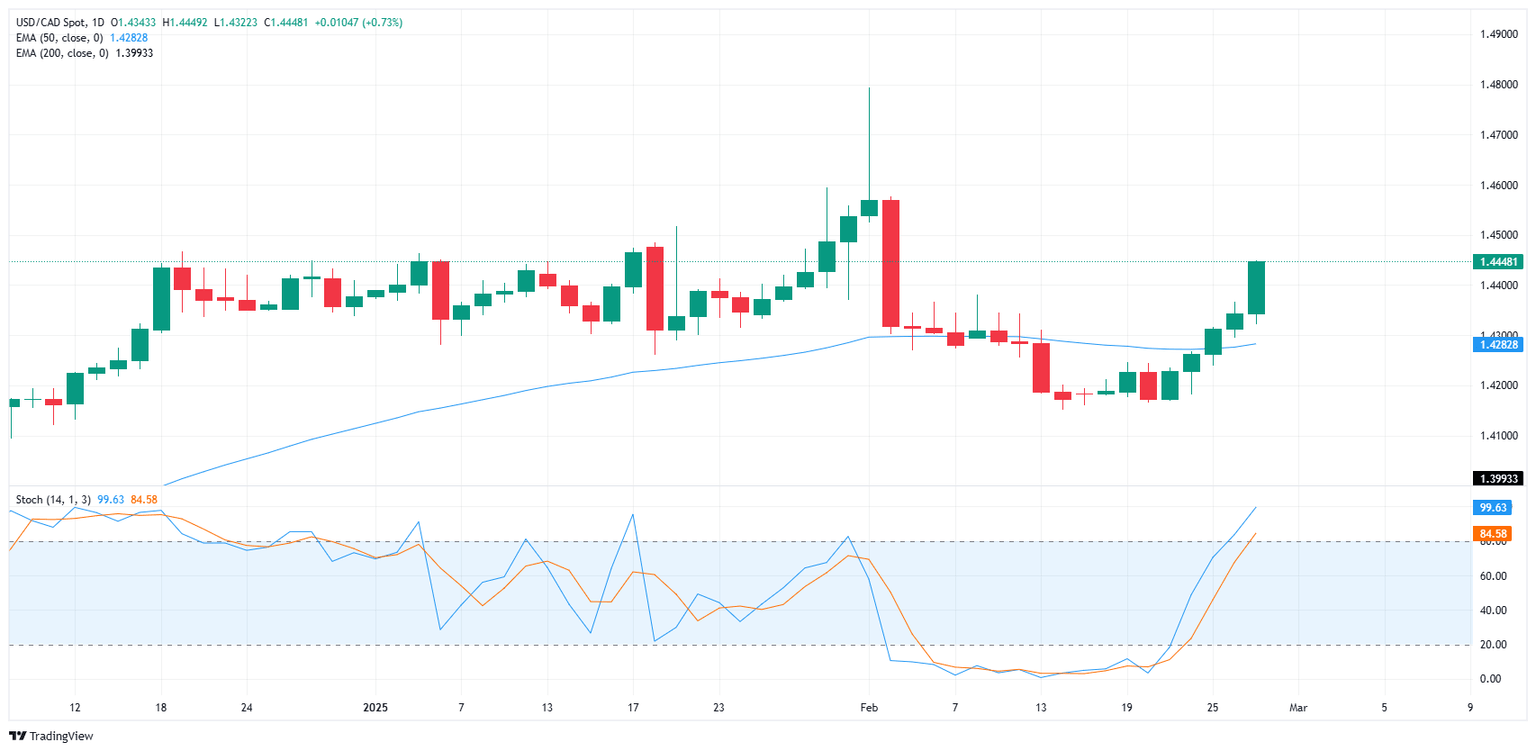

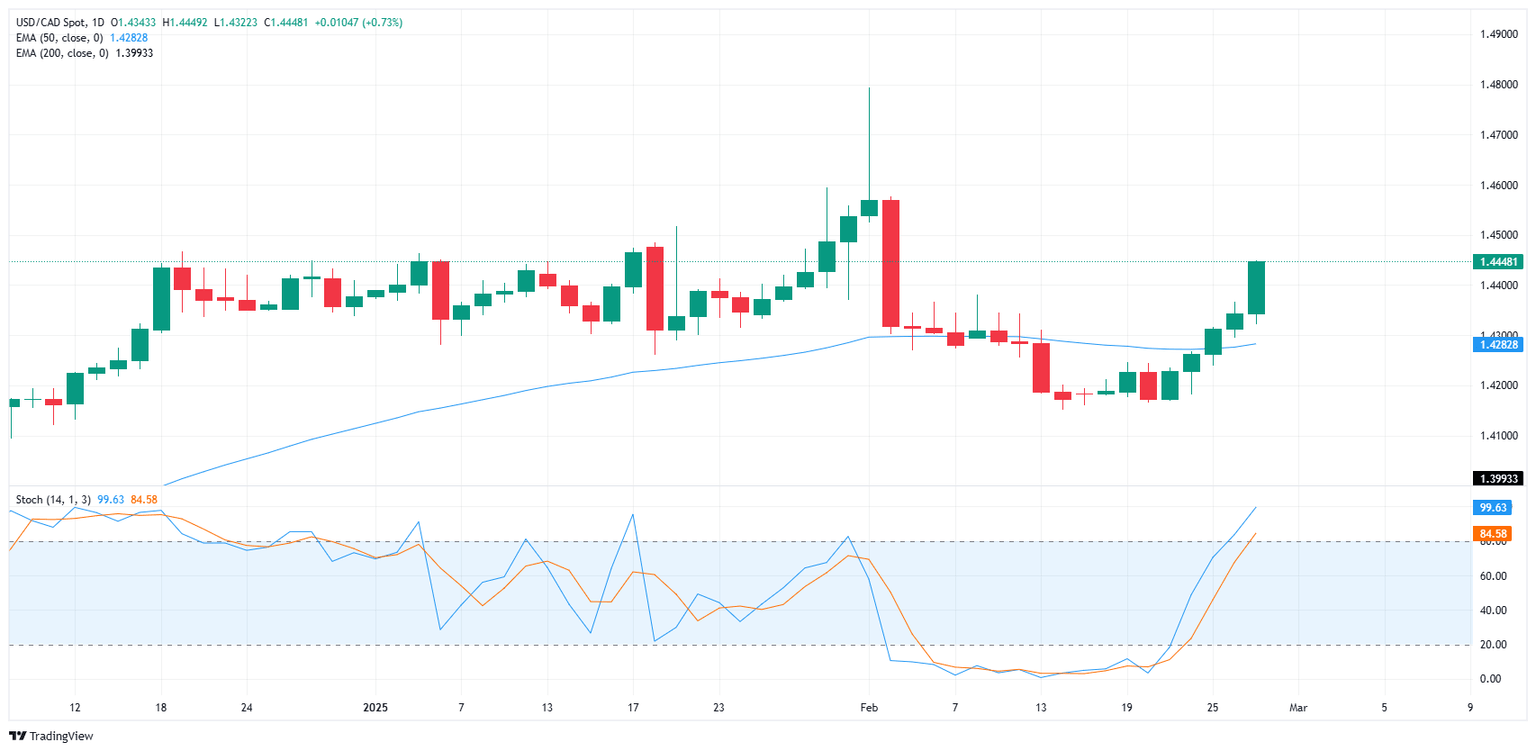

The Canadian Dollar’s fresh weakness puts USD/CAD on pace for fresh gains, bolstering the Dollar-Loonie pairing into new multi-week highs. After a brief slump sparked by a broad-market wind-down in Greenback bidding, USD/CAD is roaring back to life, chalking in five straight daily gains and pushing back into familiar technical contention territory near 1.4500.

USD/CAD daily chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.