Canadian Dollar holds steady as markets await key movers

- The Canadian Dollar remains entrenched near 1.38 against the Greenback.

- Investors are expecting a trade showdown between President Trump and Prime Minister Carney.

- Fed rate call expected to keep rates steady, but policymaker language will be key this week.

The Canadian Dollar (CAD) is holding steady against the US Dollar (USD) to kick off the new trading week, with USD/CAD holding steady near the 1.3800 handle. Trade tensions continue to simmer away on the back burner between the US and Canada, and an incoming discussion between US President Donald Trump and newly-minted Canadian Prime Minister Mark Carney is expected to deliver some sparks.

The latest batch of key Canadian employment figures are due at the end of the week, but the key headline generators for Loonie traders will be this week’s Federal Reserve (Fed) rate call. A fresh round of trade-focused talks is expected to kick off following a key meeting between PM Carney and President Trump.

The Trump administration continues to ramp up combative rhetoric about ‘folding’ Canada into the United States in a direct attack on Canadian sovereignty. Meanwhile, PM Carney is expected to put President Trump into the hot seat about deteriorating trade conditions between Canada and the US.

Daily digest market movers: Canadian Dollar holds steady as investors weigh incoming risk factors

- The Fed’s latest rate call, slated for Wednesday this week, will be a key piece in the investor puzzle despite markets broadly expecting another hold on rates. Fed policymaker rhetoric will take center stage as investors look for signs that the Fed will begin pivoting toward another rate-cutting cycle.

- Canadian employment figures are slated for Friday, but that looms a long way off.

- Trade talks are expected to ramp up in coming weeks after PM Carney’s widely anticipated meeting with the Trump administration, expected on Tuesday.

- A delegation of key northern states is also expected to meet with Canadian PM Carney separately, which is poised to raise tensions with the Trump administration.

- President Trump insists he’s “not sure” what Carney wants to meet him about, despite Carney openly stating that the old Canada-US relationship based on integration “is over”. According to PM Carney, “Our focus will be on both immediate trade pressures and the broader future economic and security relationship between our two sovereign nations.”

Canadian Dollar price forecast

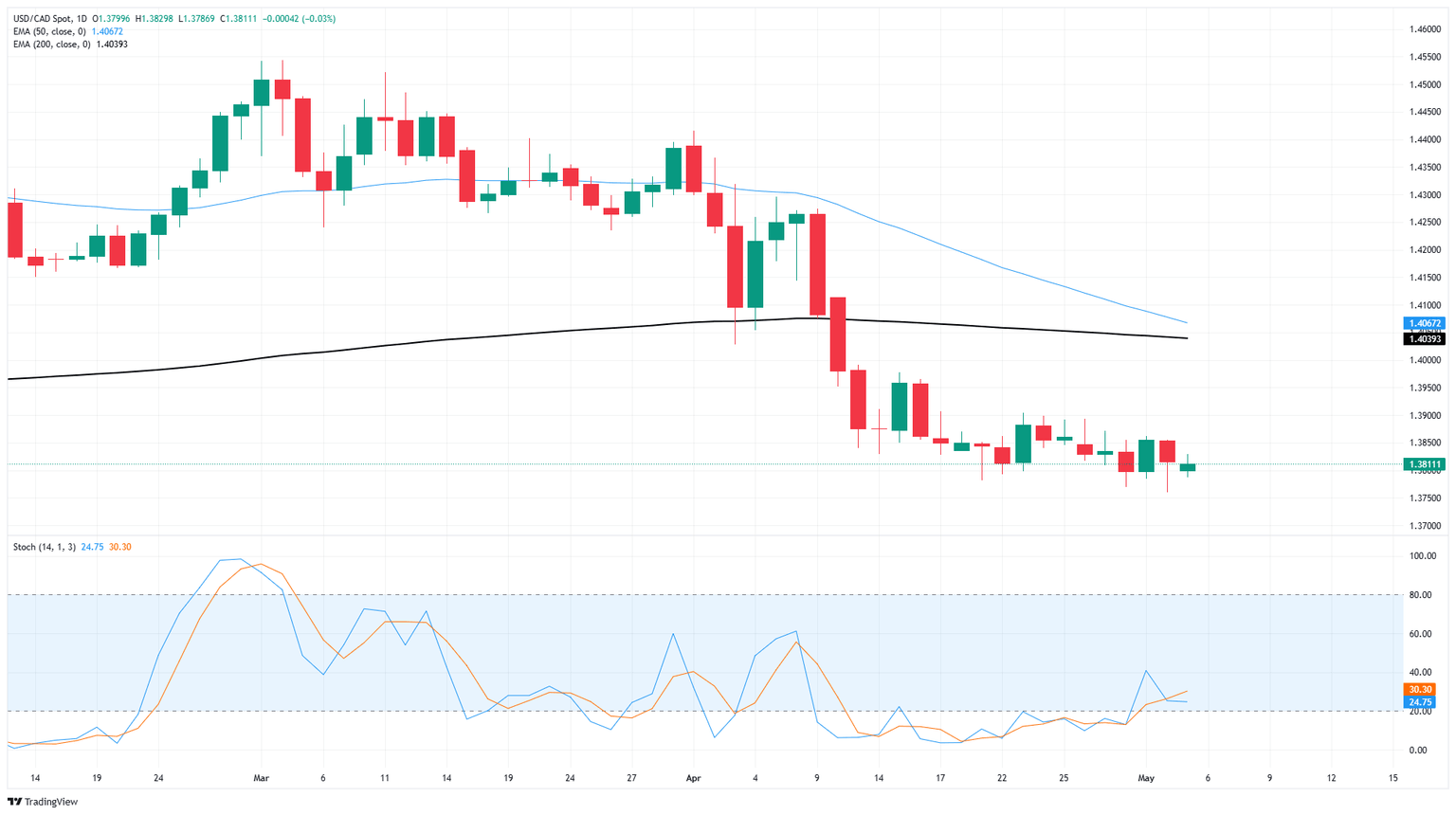

Despite a broad-market theme of shorting the Greenback, the Canadian Dollar appears to have found a fresh plateau, with USD/CAD churning out a new congestion pattern near the 1.3800 handle. USD/CAD has backslid from March’s peaks near the 1.4500 region, falling back below the 200-day Exponential Moving Average (EMA) near 1.4040.

A firm technical floor remains priced in at 1.3800, however a fresh bout of Loonie strength could easily force the pair into a fresh bearish pattern.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.