Canadian Dollar finds yet another eight-month peak as Greenback recedes further

- The Canadian Dollar gained another 0.15% on Monday, pushing USD/CAD even lower.

- A quiet Canadian showing on the economic data docket gives Loonie the floor amid Greenback losses.

- Another Fed rate call is in the barrel, with key Canadian inflation data due later this month.

The Canadian Dollar (CAD) found itself getting bolstered even further into the high end to kick off the new trading week, climbing around one-sixth of one percent against the waylaid US Dollar (USD). Broad-market concerns about the still-climbing Middle East conflict acceleration between Israel and Iran are still cooking, as are investor hopes that the scenario will be tempered in the days and weeks to come.

Canada will continue to remain largely absent from the economic calendar until key inflation figures are released at the end of the month. Despite the lack of input from the Canadian side, the Loonie continues to grind its way into fresh multi-month highs against the US Dollar as broader markets hammer the USD.

Daily digest market movers: Investor hopes for Middle East resolution keep the Greenback under pressure

- The Canadian Dollar is extending near-term bullish momentum, sending USD/CAD even further through the 1.3600 handle.

- Israel kicked off a tit-for-tat altercation with Iran last week after targeting Iranian nuclear facilities.

- The two Middle East countries have been lobbing missile barrages at each other for four days.

- Early reporting on Monday suggested Iran was willing to discuss peace solutions, sparking broad-market hopes for a quick resolution.

- Iran was quick to pivot away from the reporting, with a reporter from Qatari-owned Al Jazeera declaring that the early reporting was false.

- The Federal Reserve (Fed) is due to deliver yet another rate hold this week.

- President Trump is expected to continue ramping up antagonistic rhetoric against Fed officials as Trump desperately scrambles for ways to lighten the US’s burgeoning debt load.

Canadian Dollar price forecast

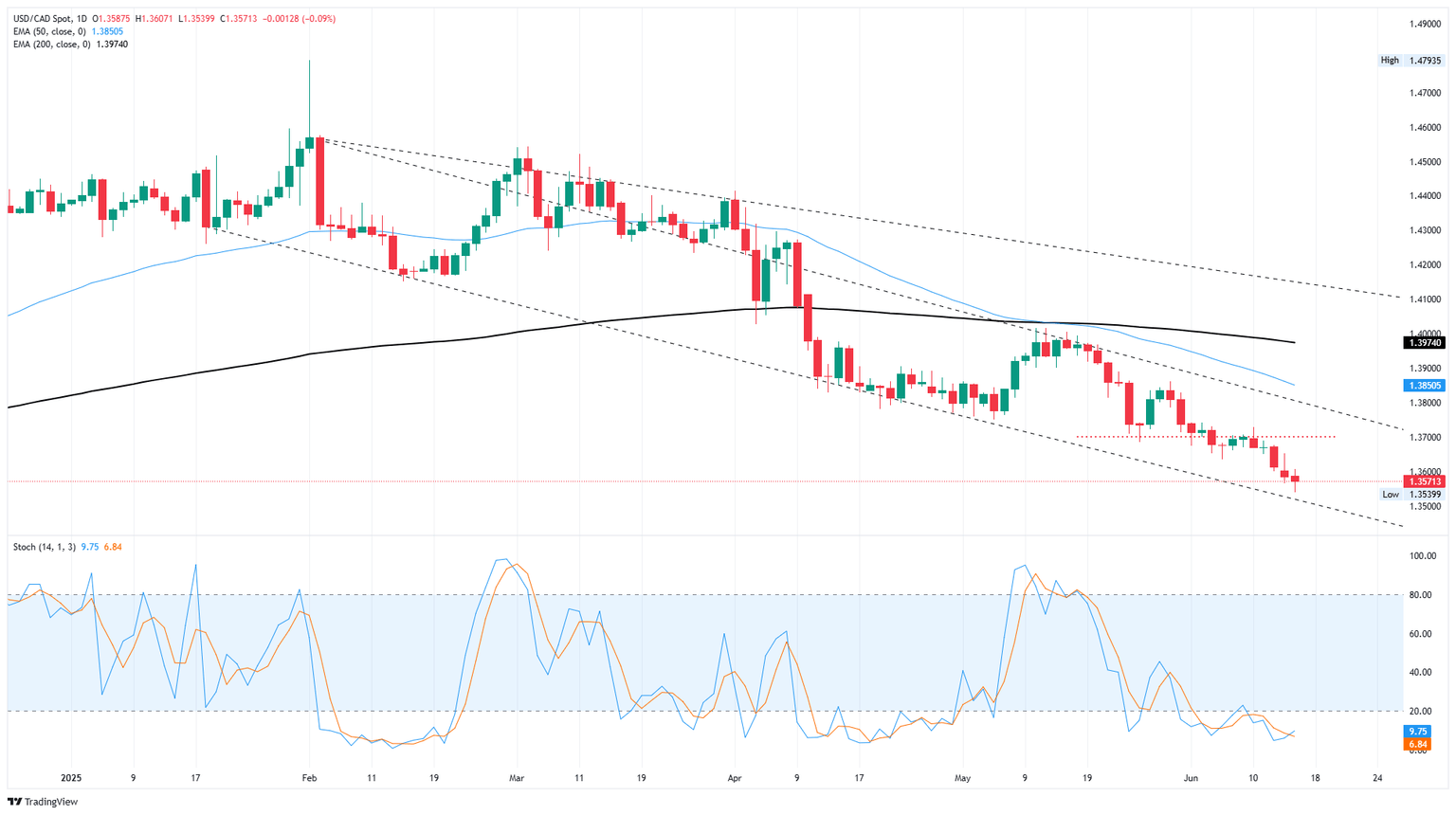

The Canadian Dollar has either closed flat or gained ground against the US Dollar for all but three of the last 12 straight trading sessions. USD/CAD is steadily testing new eight-month highs on a daily basis, and bids are sinking into a descending trendline drawn from multi-decade highs set in February.

Barring any significant changes in global positioning, the Greenback is on pace to continue shedding weight against the Loonie. A technical pullback could be baked into the USD/CAD charts, but a near-term technical ceiling is priced in from the 1.3700 handle.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.