Canadian Dollar trims gains against Greenback after Fed sees fewer 2024 rate cuts

- Canadian Dollar broadly weaker on Wednesday, trims early gains against Greenback.

- Canada brings little of note to the table, BoC Governor Macklem due later.

- Cooling US CPI inflation bolsters market confidence, but Fed remains cautious.

The Canadian Dollar (CAD) is broadly lower on Wednesday, falling against most of its competitors as CAD interest flounders. However, a cooler-than-expected print in US Consumer Price Index (CPI) inflation bolstered broad-market sentiment, pushing the US Dollar down even faster than the CAD. The US Dollar recovered after the Federal Reserve (Fed) cautioned that interest rates may continue to stick higher for longer, and the Federal Open Market Committee's (FOMC) "dot plot" of interest rate expectations trimmed previous forecasts for rate cuts in 2024.

Canada delivers little of note on the economic calendar for the rest of the week. An appearance by Bank of Canada (BoC) Governor Tiff Macklem due later on Wednesday is likely to be drowned out after the Fed's hawkish shift on rate expectations crimped broad-market risk appetite.

Daily digest market movers: Canadian Dollar weakens, but Greenback dumps after US CPI beat

- US CPI inflation eased to 0.0% MoM from the previous 0.3%, dipping below the forecast for 0.1% in May.

- Core CPI inflation ticked down to 3.4% YoY in May, lower than the forecast 3.5% and easing further back from the previous period’s 3.6%.

- Signs of easing inflation pummeled the Greenback and sparked a resurgence of hope for a September rate cut from the Fed. The CME’s FedWatch Tool shows rate markets are still pricing in around 65% odds of at least a quarter-point trim from the Fed on September 18.

- FOMC Summary of Economic Projections (SEP) sees decreasing odds of rate cuts in 2024.

- Fed's Interest Rate Expectations tick higher, 1-year rate outlook now sees rates near 4.1% one year from now compared to the previous 3.9%.

- BoC Governor Tiff Macklem will participate in a panel discussion labeled “Overcoming Economic Volatility” during one of the most volatile days of the season at the Conference of Montreal beginning at 19:30 GMT.

- Read more: Jerome Powell comments on rate outlook after keeping policy settings unchanged

- Powell speech: Unexpected weakness in labor market could call for a response

Technical analysis: Canadian Dollar falls but Greenback falls faster

The Canadian Dollar (CAD) is broadly weaker on Wednesday, backsliding against most of its major currency peers. The CAD is down seven-tenths of onie percent against the Australian Dollar (AUD) and half of a percent against the New Zealand Dollar (NZD). Despite weak bids for the CAD, the Greenback remains down around a quarter of a percent against the Canadian Dollar.

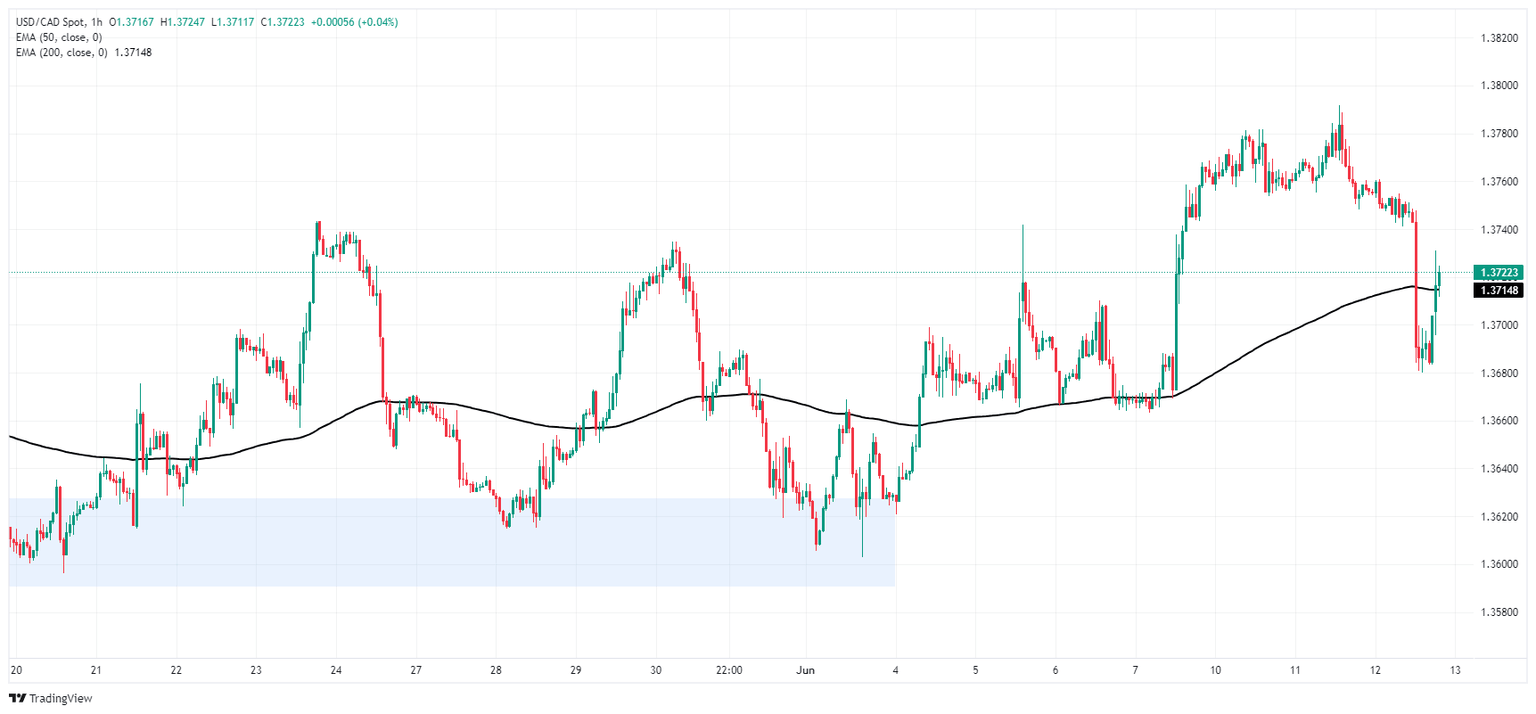

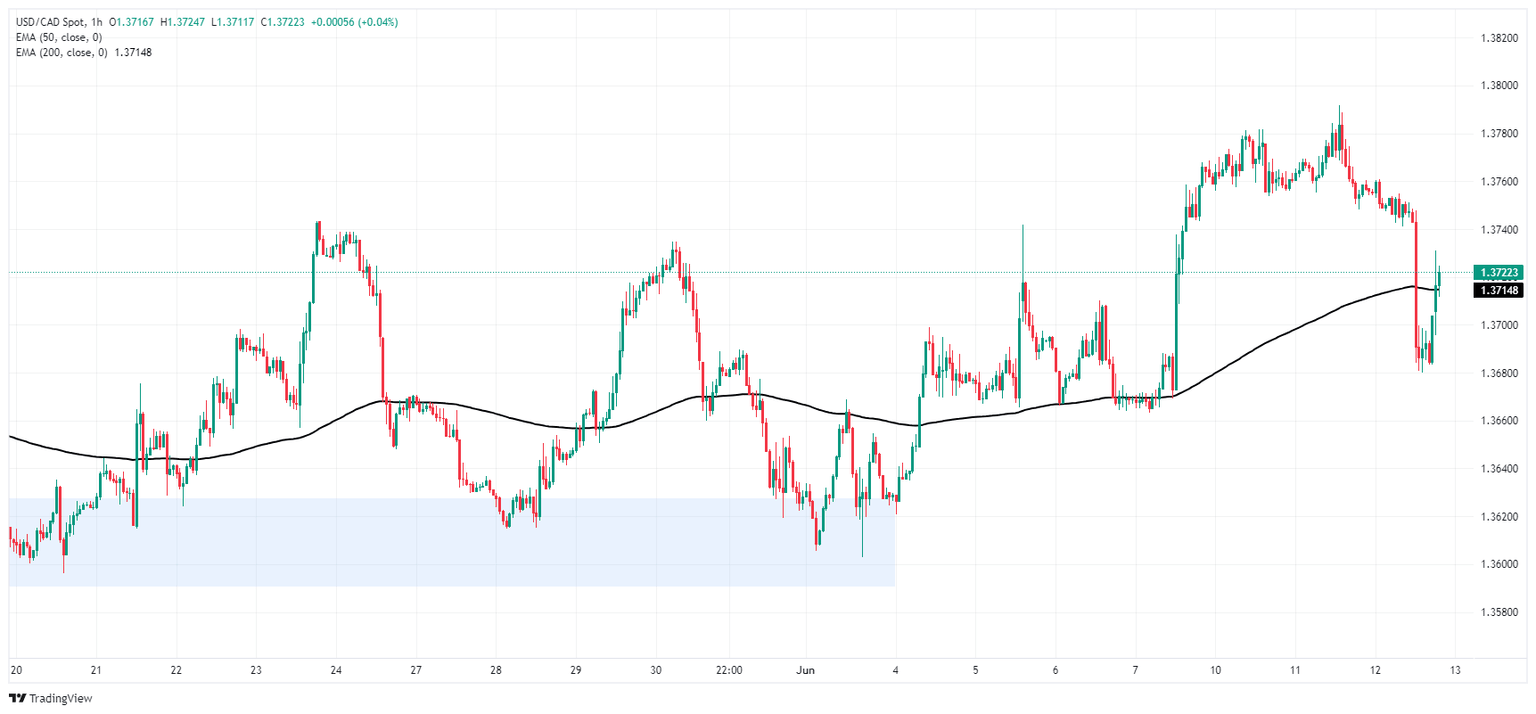

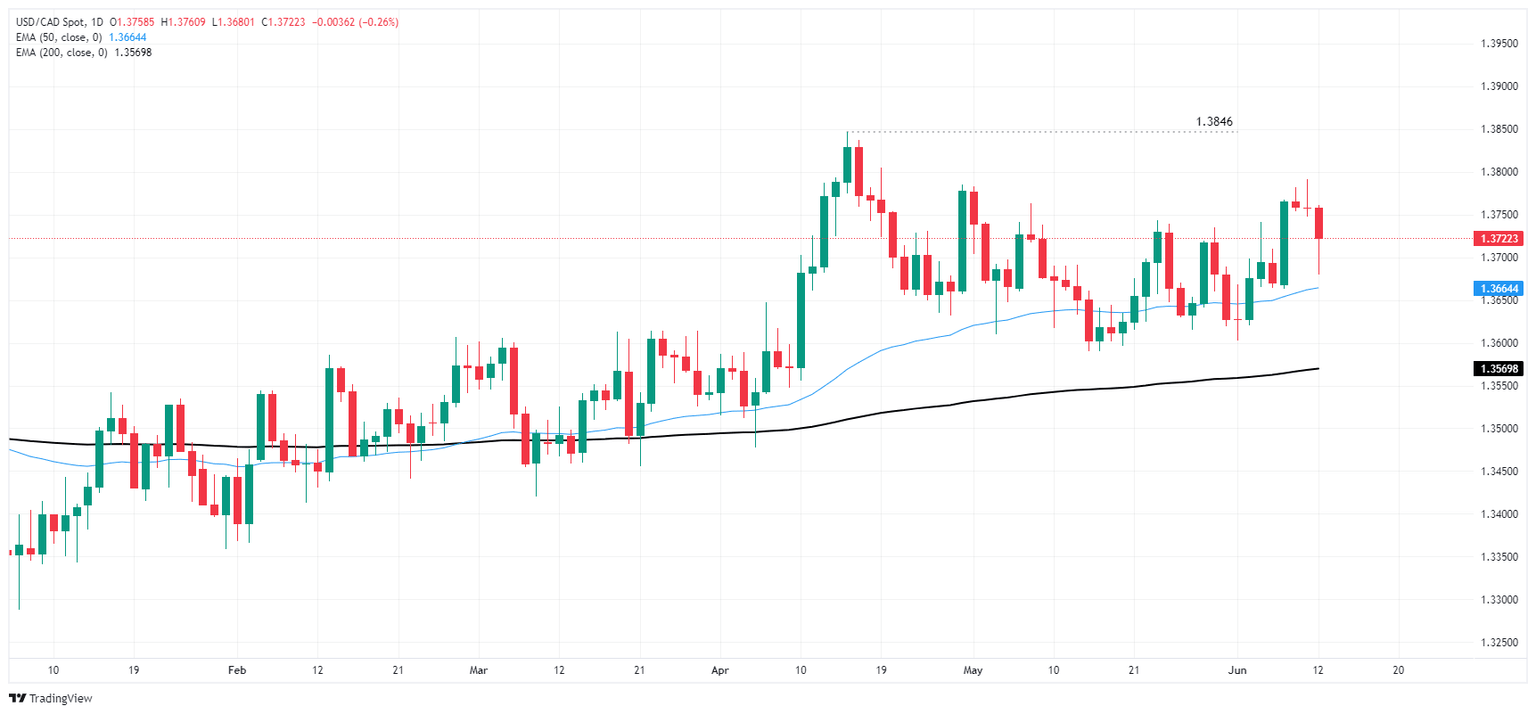

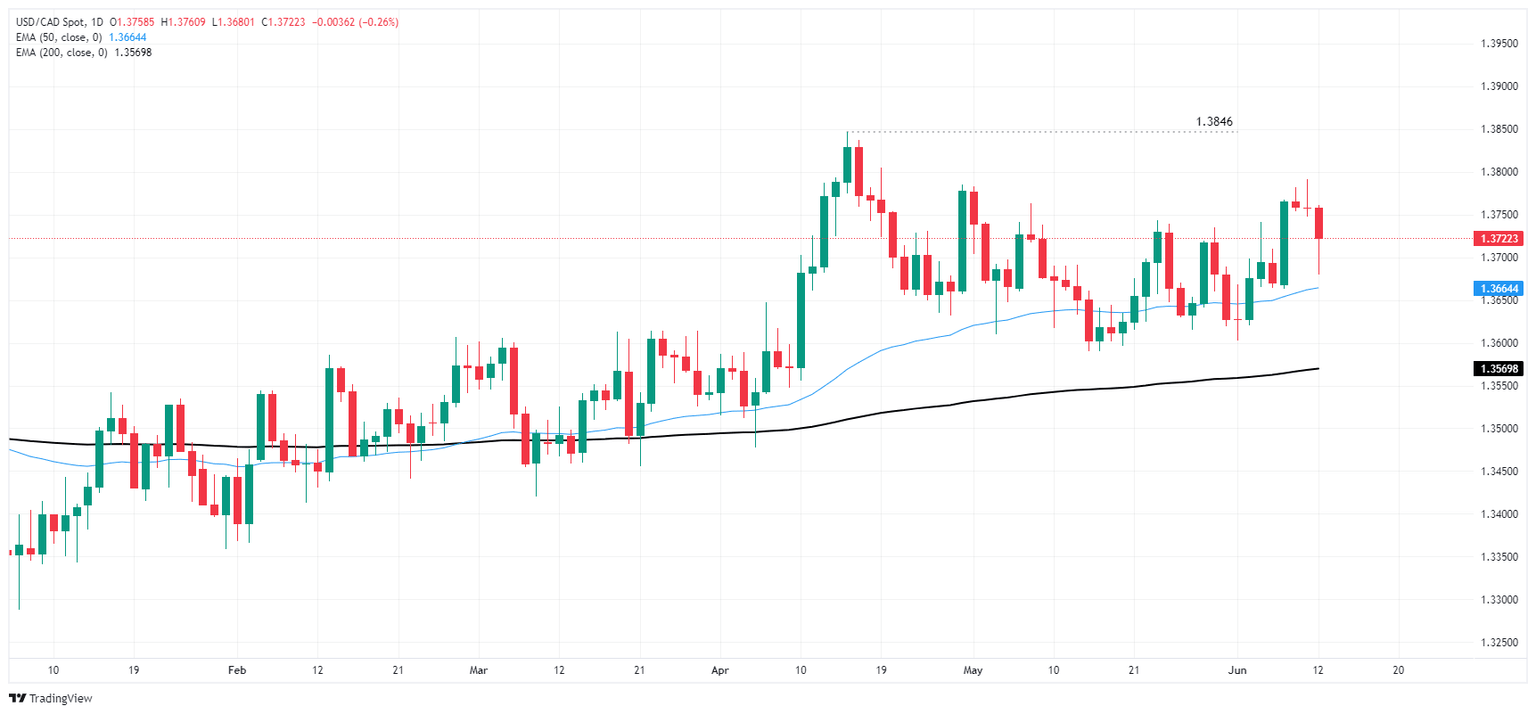

USD/CAD backslid half of a percent on Wednesday, falling back below 1.3750 as the pair routinely fails to drive further north of the 50-day Exponential Moving Average (EMA) at 1.3663. A drop below key technical levels will see the pair extend declines into a near-term demand zone below 1.3630, where a price floor at the 1.3600 handle is waiting.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.