Bulls on break? Navigating the aftermath of up momentum burnout [Video]

![Bulls on break? Navigating the aftermath of up momentum burnout [Video]](https://editorial.fxstreet.com/images/Macroeconomics/CentralBanks/InterestRate/display-stock-market-charts-gm535538449-57390594_XtraLarge.jpg)

Watch the video extracted from the WLGC session before the market open on 5 Dec 2023 below to find out the following:

- How to analyze the shortening of the up wave and its context.

- How to interpret the recent increase in the supply level

- The 2 immediate support levels (#2 is more meaningful for a major reaction)

- How the market is testing the current resistance zone.

- And a lot more...

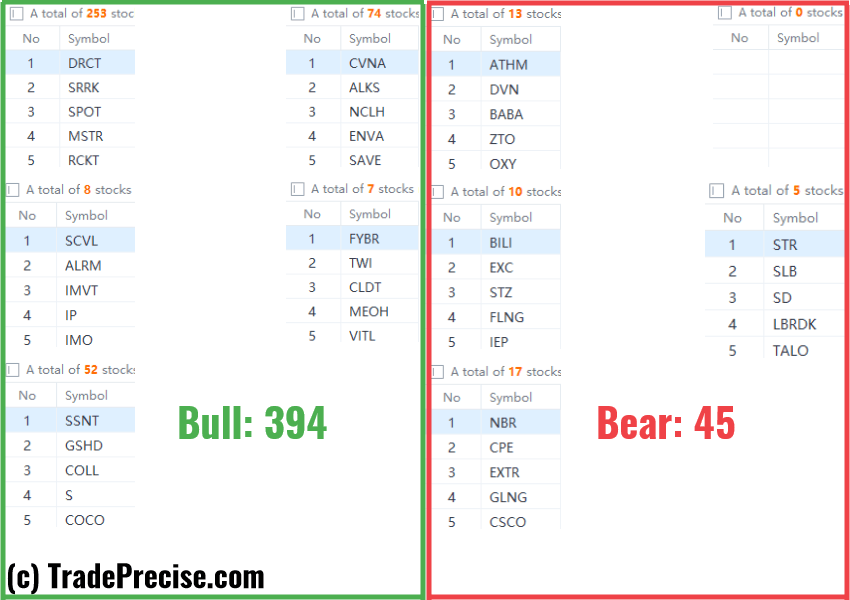

The bullish vs. bearish setup is 394 to 45 from the screenshot of my stock screener below pointing to a healthy and positive market environment.

Both the long-term market breadth (200 MA & 150 MA) are above 50%, which are very healthy for a sustainable rally.

The short-term market breadth (20 MA) is at the overbought level, which is a sign of strength. Watch out for a pullback/consolidation as some stocks are extended.

This could be a potential market rotation into the small-cap stocks as discussed during the live session last week, as shown in the tweet below.

"That's why it's worthwhile to monitor some of the small cap stock as well, because a lot of the large cap are just way extended.

— Ming Jong Tey (@MingJong) December 2, 2023

We could see another rotation into the small cap." $RTY #Russell2000 $IWM pic.twitter.com/KYILe93fIp

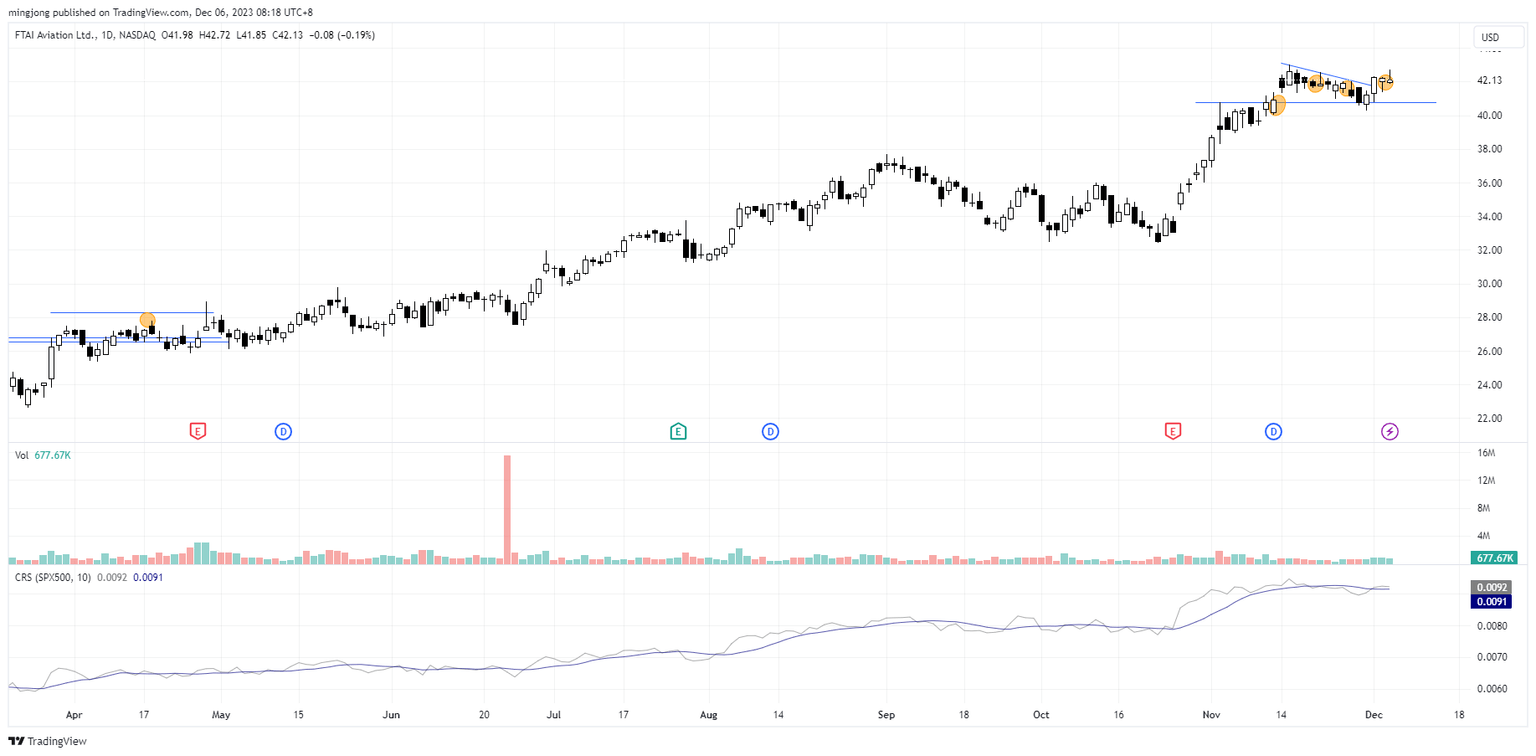

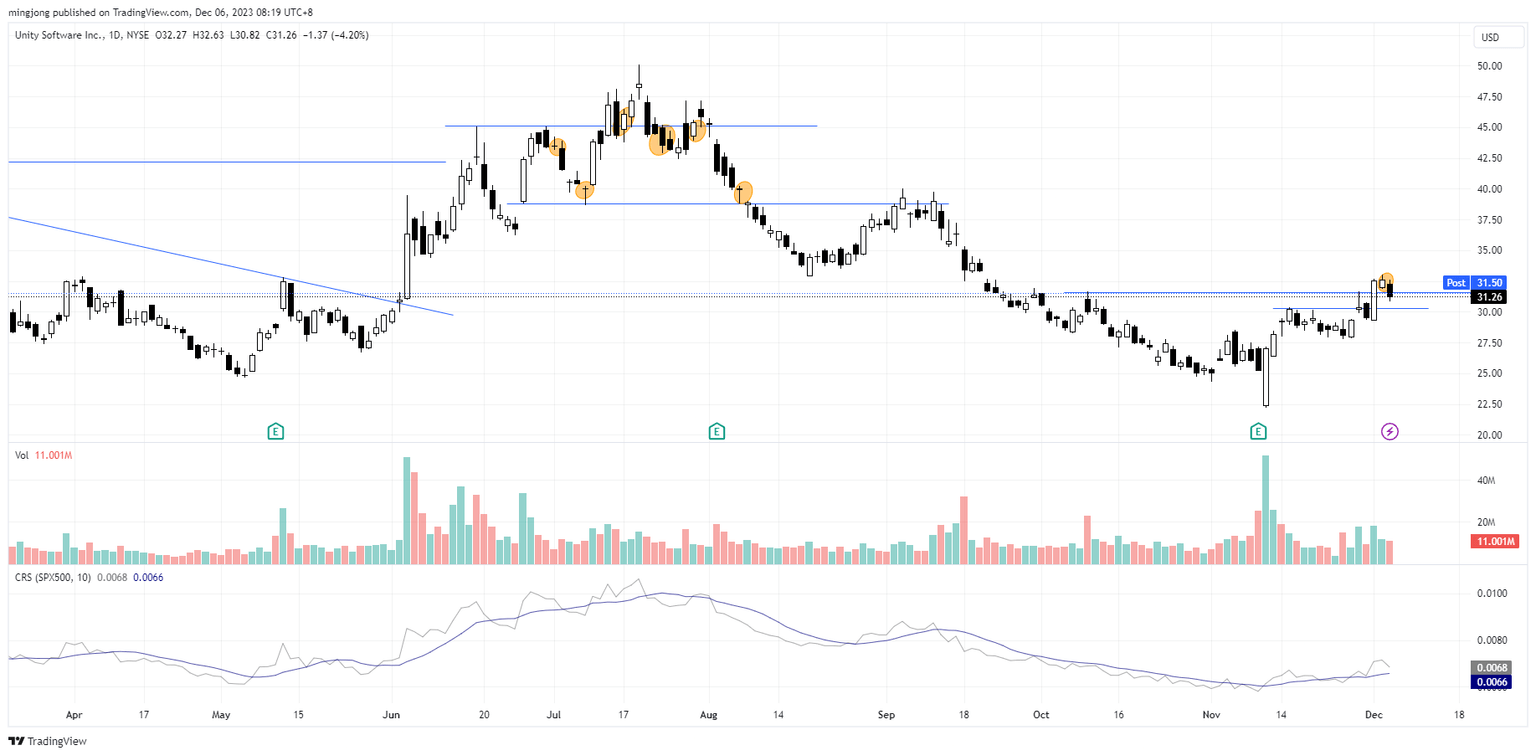

9 “low-hanging fruits” (FTAI, VRT, etc…) trade entries setup + 19 others ( U etc…) plus 15 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

FTAI stock entry buy point

VRT stock entry buy point

U stock entry buy point

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.