Breaking: BOE sends GBP/USD plunging as two voted for a cut amid Brexit, employment concerns

The Bank of England has left interest rates unchanged at 0.75% as expected. Still, two members of the Monetary Policy Committee have voted in favor of a rate cut, defying Governor Mark Carney and six other members. Michael Saunders, who was one of the drivers of hiking rates in the past, has voted for a rate cut.

Both dissenters have stated that more stimulus is needed in the face of global headwinds and data suggesting the labor market has turned to the downside.

The "Old Lady" has warned about growing risks from Brexit and other global headwinds, and suggest that easing may be needed.

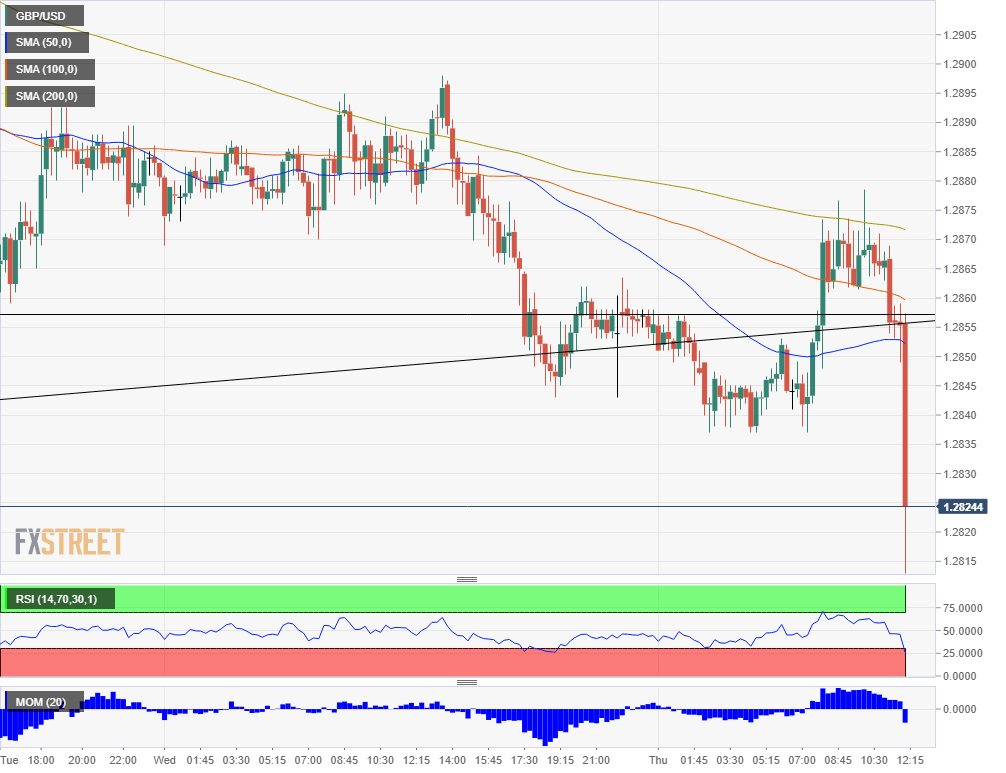

GBP/USD has dropped to a low of 1.2813. Support awaits at 1.2785, while resistance is at 1.2877, the daily high.

Follow all the BOE updates in the live coverage

Bank of England's decisions have been seen as "non-events," but this one is undoubtedly different. Despite the relative on the Brexit front, the BOE is concerned with the damage already done, and Carney provides a substantial departing gift for GBP/USD bears.

The "Old Lady" has joined other central banks in adopting a more dovish stance. That major change has weighed on sterling. Uncertainty remains high around Brexit, trade, and the path of interest rates.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.