Breaking: Aussie June employment beats expectations, AUD whippy in H&S formation

Reuters reported that Australia's unemployment rate jumped to a level last seen in the late 1990s, even though jobs grew by far more than expected as more people went looking for work, official data for June on Thursday showed.

The unemployment rate shot up to 7.4% in June, from 7.1% in May and marking the highest since November 1998, according to figures from the Australian Bureau of Statistics (ABS). The participation rate increased by 1.3 percentage points to 64%.

The jump in the jobless rate came even as employment surged by 210,800 in June following hefty falls in April and May. Economists polled by Reuters had expected an increase of about 112,000 jobs.

Australia’s June labour force survey is out as follows:

Aussie jobs outcome

- Australia June employment +210.8k s/adj (Reuters poll: +112.5k).

- Australia June unemployment rate +7.4 pct, s/adj (Reuters poll: +7.4).

- Australia June full-time employment -38.1k s/adj.

- Australia June participation rate +64.0 pct, s/adj (Reuters poll: +63.6 pct).

- ABS says hours worked rose 4.0% in June but remained 6.8% lower than March.

- ABS says around 70 per cent of newly unemployed people in June were not in the labour force in May.

- ABS says underemployment rate decreased by 1.4 percentage points, to 11.7%.

-

AUD/USD outlook

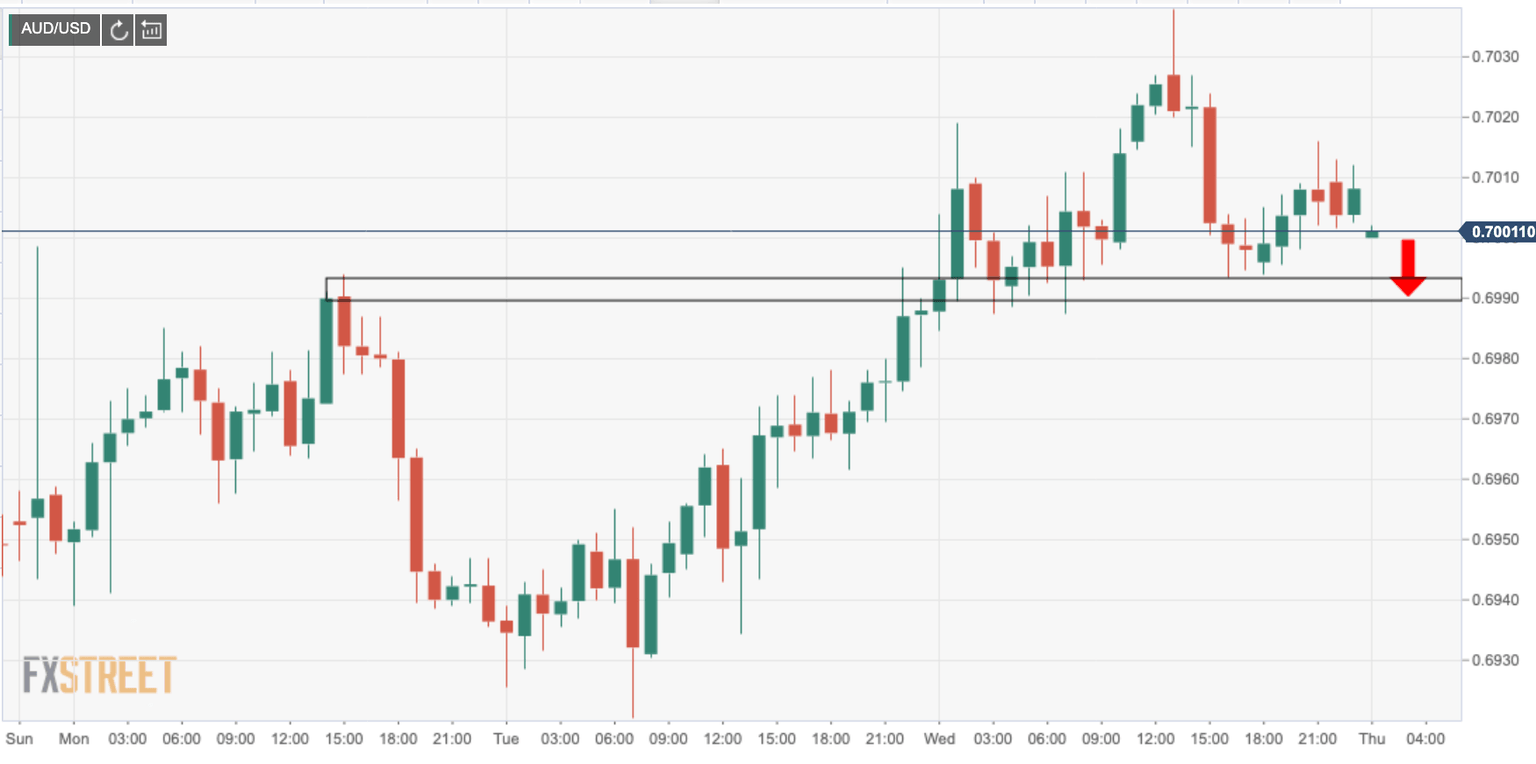

AUD/USD was in the process of forming a head and shoulders before the data on the hourly time frame:

However, the support structure to the left was reinforcing the prospects of a failed reversal pattern.

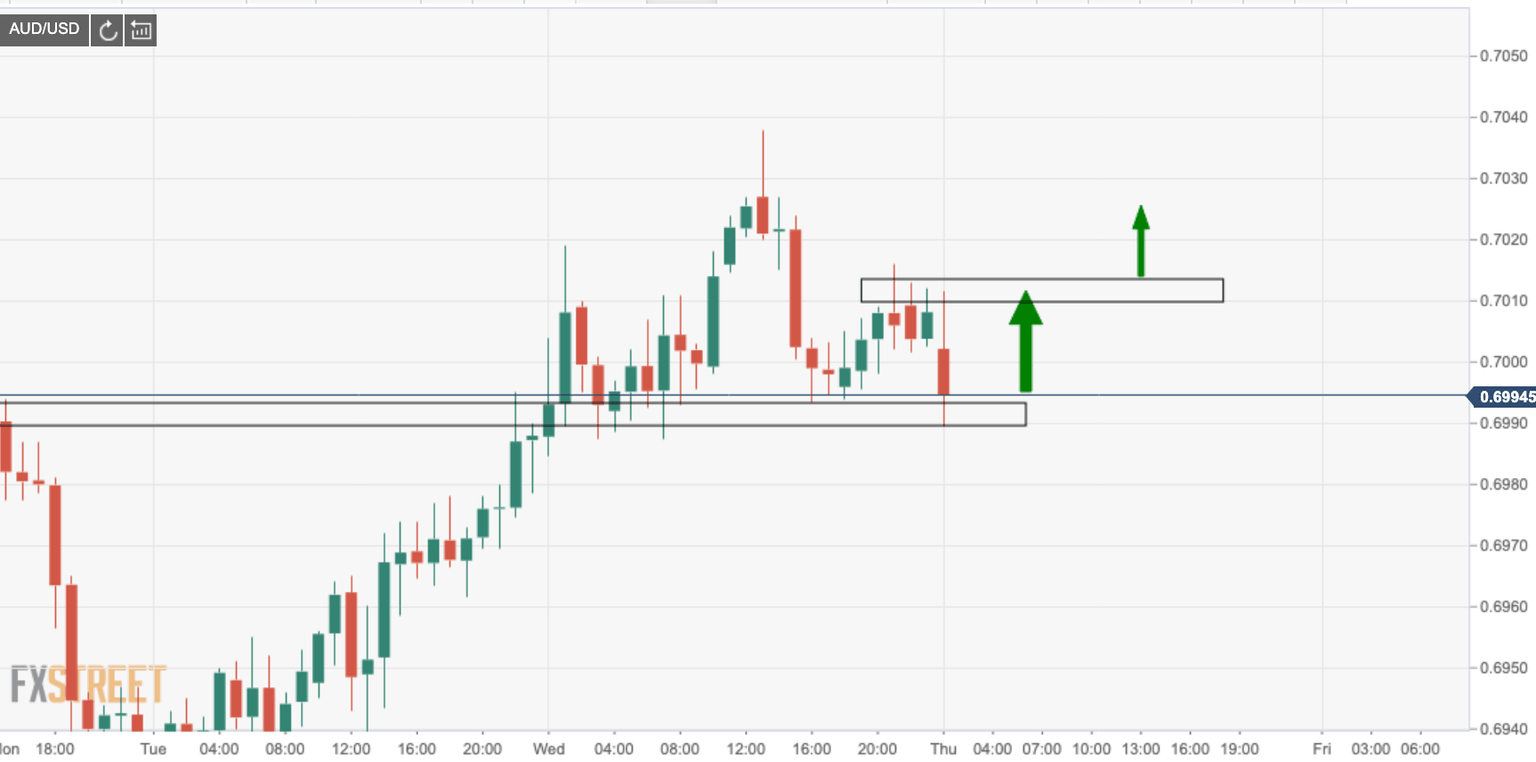

Looking left on the 4HR, that support is reinforced by multiple tops:

Following the outcome, we now are in the situation where the bears have their fills at the said target, and bulls will be eager to pounce on bullish headlines pertaining to COVID-19 vaccine progress for a run to the upside:

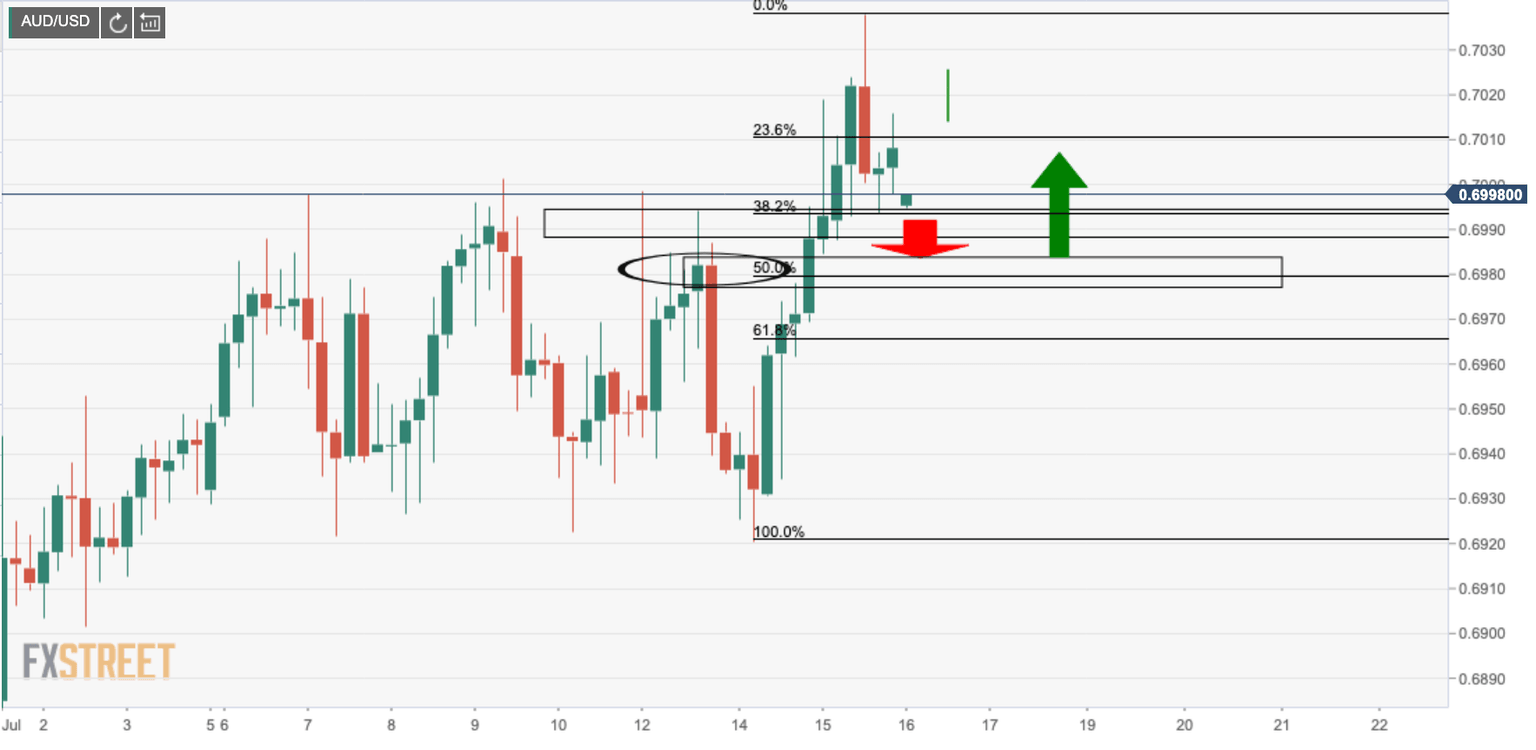

Alternatively, the price could complete a 50% mean reversion to the compelling highs of earlier this week before making its next bullish impulse:

Below, the daily outlook is bullish above support structure ad through resistance:

Description of the Unemployment Rate

The Unemployment Rate release by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

Author

FXStreet Team

FXStreet