Boston Scientific Corporation (BSX) should continue uptrend and remain supported

Boston Scientific Corporation (BSX) develops, manufactures & markets medical devices for use in various interventional medical specialties worldwide. It operates through MedSurg & Cardiovascular segments. It offers devices to diagnose & treat different medical conditions and offer remote patient management systems. It is based in Marlborough, US, comes under Healthcare sector & trades as “BSX” ticker at NYSE.

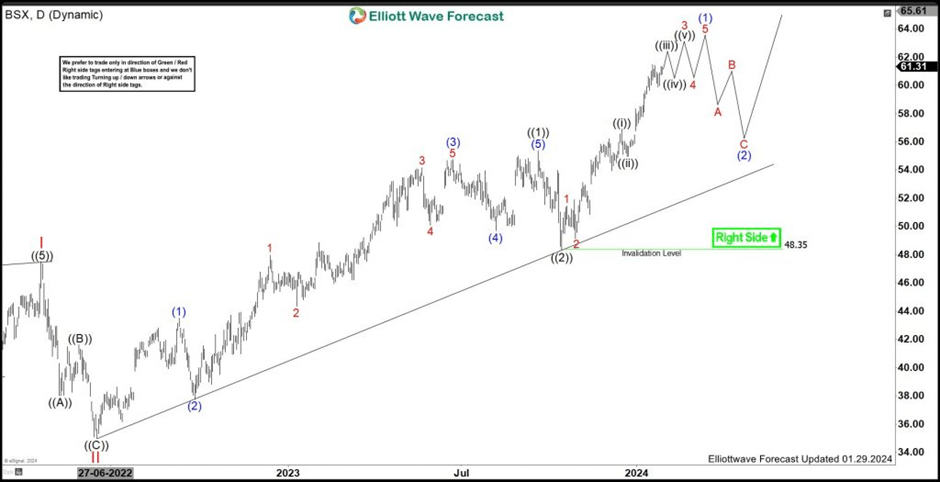

As discussed in previous article, BSX reacted higher since $48.35 low & extend higher within the sequence started from October-2023 low. It erased the momentum divergence in daily suggesting further upside to continue as ((3)) of III in impulse sequence.

BSX – Elliott Wave latest daily view

In weekly sequence, it placed (II) at $24.10 low in March-2020 & II of (III) at $34.98 low in June-2022. Above there, it favors upside in (1) of ((3)) of III & expect to remain supported in 3, 7 or 11 swings pullback. It placed ((1)) of I at $42.37 high, ((2)) at $32.99 low, ((3)) at $46.28 high, ((4)) at 37.96 low & ((5)) as I at $47.49 high. It placed ((1)) of III at $55.38 high & ((2)) at $48.35 low as shallow pullback. Within ((1)) of III, it placed (1) at $43.52 high, (2) at $37.74 low, (3) at $54.74 high, (4) at 49.69 low & finally (5) at $55.38 high as ((1)).

BSX – Elliott Wave latest weekly view

Above ((2)) low, it favors upside in ((iii)) of 3 & expect further higher to finish (1) of ((3)). It placed 1 of (1) at $51.43 high & 2 at $49.15 low as flat correction. Above there, it favored ended ((ii)) at $54.95 low & favors upside in ((iii)) of 3 of (1). It expects few more highs to finish (1) of ((3)) before the next pullback may starts in (2) correction, which unfold in 3, 7 or 11 swings before resume upside in (3) of ((3)).

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com