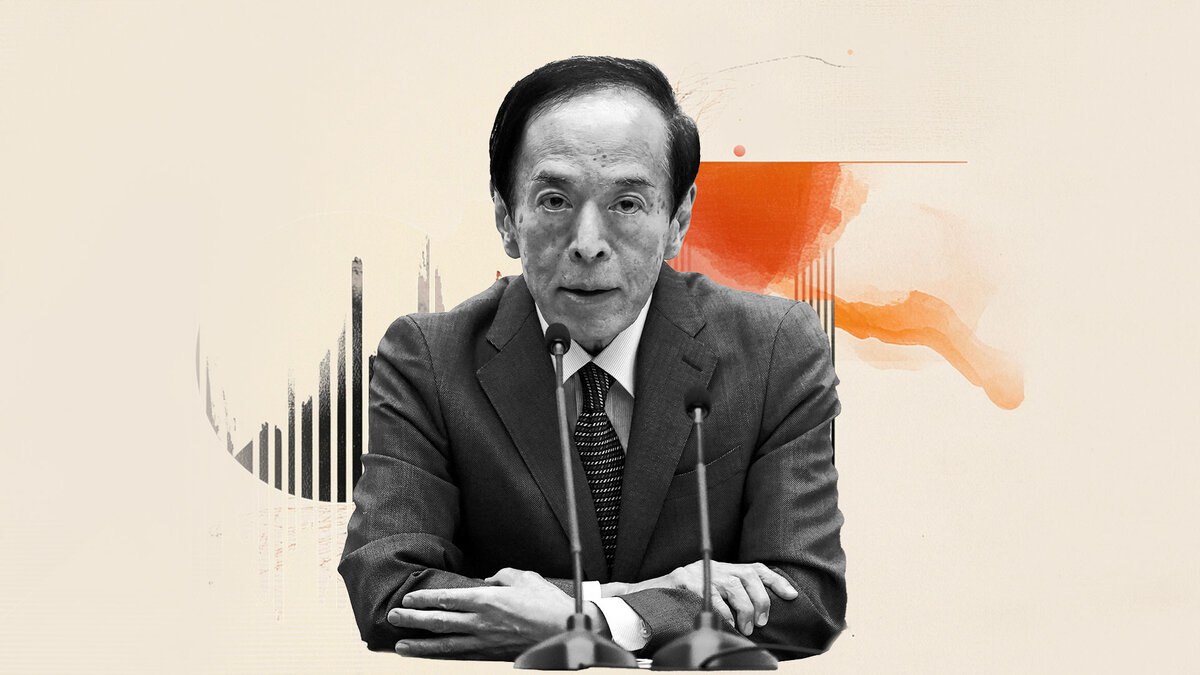

BOJ holds rates, slashes forecasts – Yen falls – BBH

As was widely expected, the Bank of Japan (BOJ) left the policy rate unchanged at 0.50%. The decision was unanimous. The BOJ also reiterated its hawkish guidance that it will continue to raise the policy rate if the outlook for economic activity and prices will be realized. The swaps market is not convinced and implies just one 25bps hike to 0.75% over the next three years, BBH FX analysts report.

USD/JPY eyes 145.00 resistance as downtrend resumes

"JPY fell against all major currencies and 10-year JGBs rallied because the BOJ’s more dovish outlook (table below) further dimmed rate hike expectations. First, the BOJ slashed the projected growth rates for fiscal 2025 and 2026 due to the effects of trade and other policies."

"Second, the BOJ trimmed inflation forecasts (CPI all items less fresh food) for fiscal 2025 and 2026, mainly reflecting the decline in crude oil prices and the downward revision of the GDP growth rates. Third, the BOJ warned that risks to the economic and inflation outlooks are skewed to the downside."

"We expect USD/JPY to resume its year-to-date downtrend as Fed funds futures have adjusted lower and the global growth outlook has worsened. Next USD/JPY technical resistance is offered at 145.00."

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.