BNGO Stock Price: BioNano Genomics Inc. retreats, starts week in the red

- NASDAQ:BNGO dips, despite another analyst upgrade.

- Micro-cap healthcare stocks provide mix results for Nasdaq.

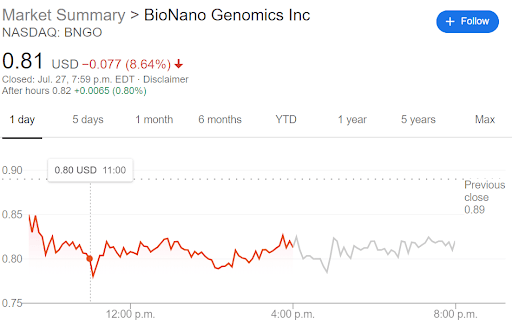

NASDAQ:BNGO fell on Monday, despite more news that should keep investors bullish on the healthcare company. The stock price dropped 8.64% to finish the trading session at $0.8131 per share, nearly wiping out the 14% rise from Friday of last week. BioNano briefly touched a low of $0.78 before finishing out strong, climbing back above $0.80 to end the day. Surprisingly, there was a higher than average volume trading throughout the day, which is another relatively positive sign for investors who have remained loyal to the company.

BNGO Stock Forecast: Dips, despite optimism, further analyst upgrade

The micro-cap healthcare sector produced another mixed day of results, even as the Nasdaq rebounded from the mini correction to end last week. BioNano Genomics Inc. rivals Pacific Biosciences of California (NASDAQ: PACB) rose on Monday, despite a Zacks Consensus Estimate report that Wall Street is expecting a 43.8% year over year decline in revenues. Other industry companies like Progenity Inc. (NASDAQ:PROG), Predictive Oncology Inc. (NASDAQ:POAI) and Precipio (NASDAQ:PRPO) all remained relatively flat.

Earlier on Monday, a report from Oppenheimer stated that 5-Star healthcare analyst Kevin DeGeeter doubled down on his stock price upgrade, giving BioNano an 'Outperform' rating and a new price target of $1.50 per share. While this is lower from his price target earlier in the year of $1.83, investors should still feel optimistic that there is quite a bit of sentiment on Wall Street that Bionano Genomics Inc. has a bright future on coronavirus vaccine development. Along with their usual work in human genetics, BioNano has been in the news recently for its work in discovering commonalities in the genetic variants of young male patients who had severe cases of COVID-19.

Author

Stocks Reporter

FXStreet