Beware, red flags in the market – Is the bull run about to hit a roadblock? [Video]

![Beware, red flags in the market – Is the bull run about to hit a roadblock? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Food/beers_XtraLarge.jpg)

Watch the video extracted from the live session on 31 Jul 2023 below to find out the following:

-

How to detect the red flags for a potential topping formation.

-

The first red flag showed up on 27 Jul 2023 and how to seek confirmation

-

The healthy characteristics in the uptrend since Jun 2023

-

The critical level S&P 500 needs to hold before the start of the meaningful pullback

-

And a lot more

One red flag was spotted in S&P 500 and confirmation is needed to violate the short-term rally before starting a meaningful pullback as discussed in the video.

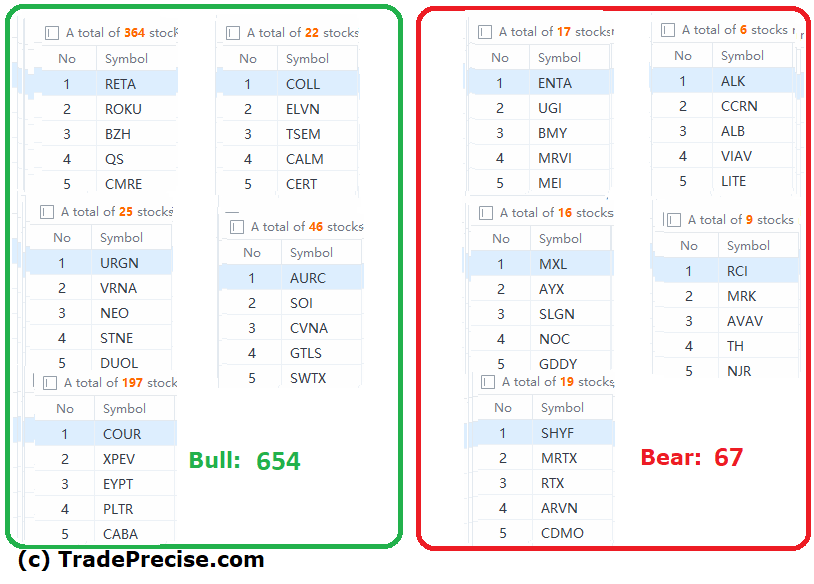

The bullish vs. bearish setup is 654 to 67 from the screenshot of my stock screener below pointing to a positive market environment.

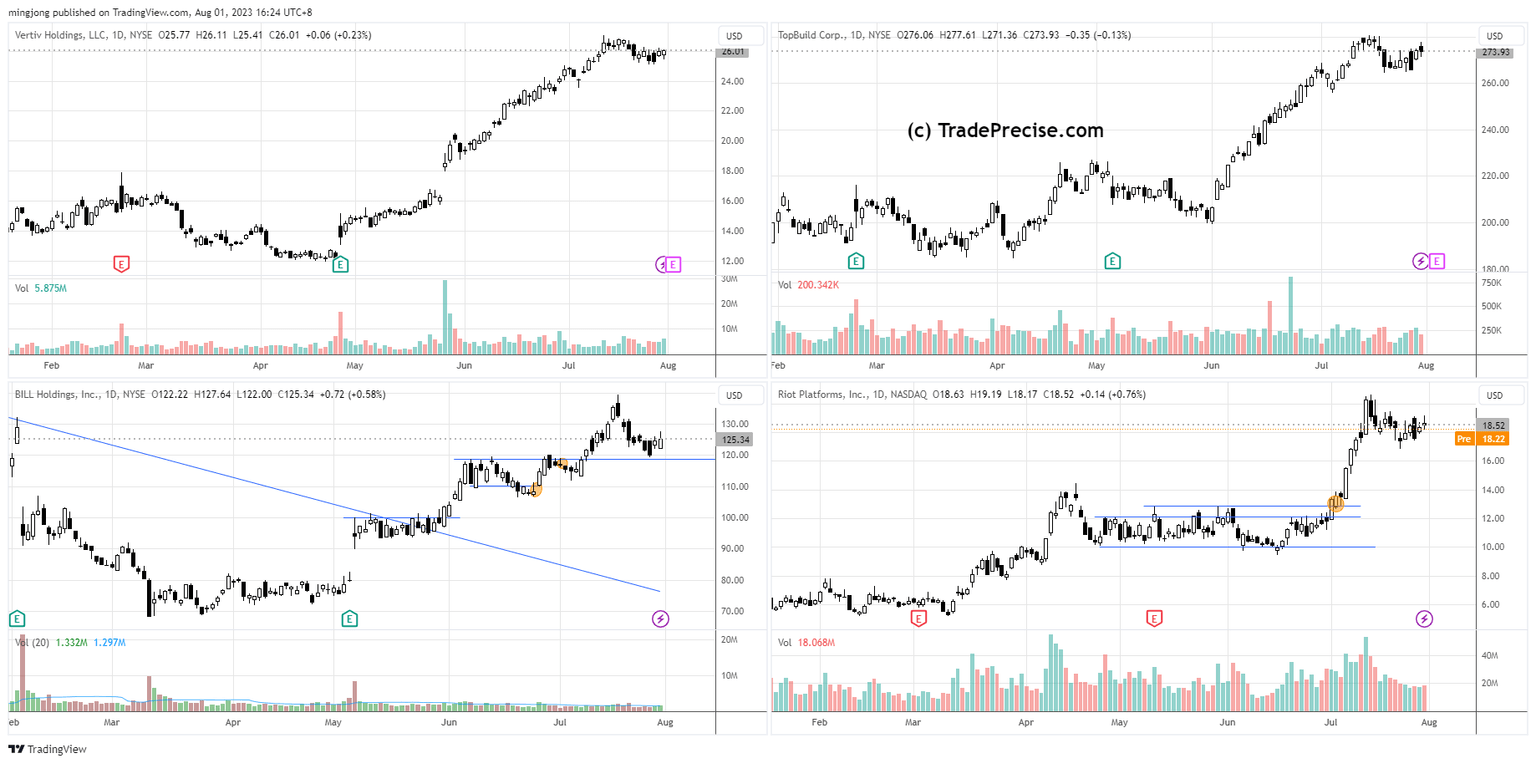

8 “low hanging fruits” (VRT, BLD, etc…) trade entries setup + 28 others (BILL, RIOT, etc…) plus 15 “wait and hold” candidates are discussed in the video (50:10) accessed by subscribing members below.

The recipe to maximize the profit

Here is a recent win from a WLGC member’s trading portfolio.

The stocks above are from the live weekly session and there are at least another dozen of stocks in the portfolio (not shown).

Here are the keys to maximizing the profit:

-

Great entry with a decent reward-to-risk ratio

-

Manage the positions from swing trading to position trading until topping formation shows up.

-

Trim the under-performers and add positions to the winners.

Note: switching from swing to position trading is essential during a sustainable rally in order to maximize the profit.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.