Berkshire Hathaway Inc. (BRK:B) Elliott Wave technical analysis [Video]

![Berkshire Hathaway Inc. (BRK:B) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/i/bullish-chart_XtraLarge.png)

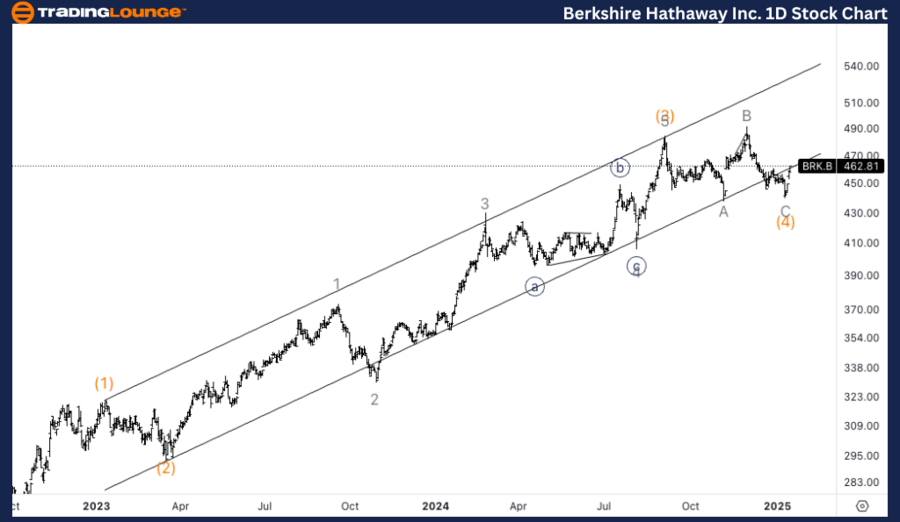

BRK.B Elliott Wave Analysis Trading Lounge.

Berkshire Hathaway Inc., (BRK:B) daily chart.

BRK:B Elliott Wave technical analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 1 of (5).

Direction: Upside in wave 1.

Details: We are looking at a bottom in wave (4) in place as we hit the base of the parallel trend channel and we seem to have reacted from it in quite the impulsive manner for the past week.

BRK.B Elliott Wave technical analysis – Daily chart

We are observing a potential bottom in wave (4) as the price touched the base of the parallel trend channel and reacted sharply in an impulsive manner over the past week. This suggests the start of wave 1 of the final leg (wave 5), indicating a continuation of the uptrend.

BRK:B Elliott Wave technical analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 1 of (5).

Direction: Upside in wave 1.

Details: Looking for a complex correction here as when we zoom in it seems like we had three waves of threes(double three). Looking for upside into wave 1 of (5). The strong reaction off equality of Y vs. W adds additional confirmation.

BRK.B Elliott Wave technical analysis – One-hour chart

On the 1H chart, we're seeing signs of a complex correction, with the wave structure appearing as a double three (three waves of threes). The strong upward reaction from the equality level of Y vs. W further supports the bullish scenario. We expect wave 1 of (5) to unfold next, continuing the upward momentum.

This analysis of Visa Inc., (V) focuses on both the daily and 1-hour charts, using the Elliott Wave Theory to assess current market trends and forecast future price movements.

Berkshire Hathaway Inc. (BRK:B) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.