BBBY Stock Forecast: Bed Bath & Beyond extends losses and closes out a volatile week of trading

- NASDAQ:BBBY fell by 0.92% during Friday’s trading session.

- The future remains muddled for Bed Bath and Beyond as its turnaround plan disappoints.

- AMC and APE reverse course while GameStop extends its slide to close the week.

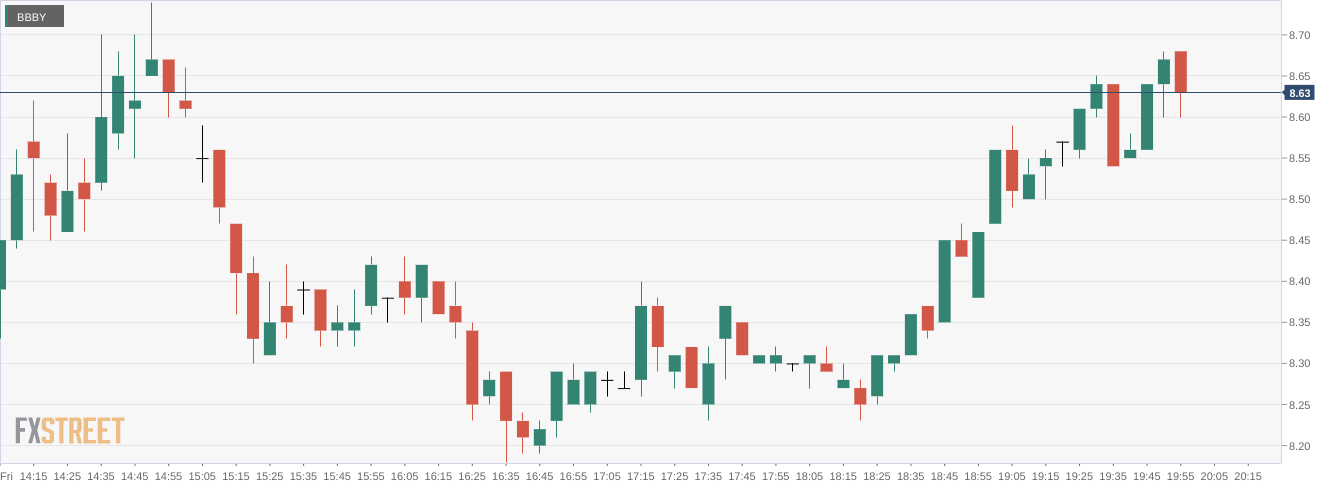

NASDAQ:BBBY fell for the fourth straight day on Friday, closing out a tumultuous week of trading for the recently squeezed meme stock. Shares of BBBY slumped by a further 0.92% and closed the trading week at a price of $8.63. It brought the total losses for the week to more than 25%. Stocks closed Friday on a down note as the major averages all fell below water after a positive start to the day. This marks the third consecutive week of losses for Wall Street. Overall, the Dow Jones lost 337 basis points, the S&P 500 fell by 1.07%, and the NASDAQ dropped for the sixth straight day and posted a 1.31% loss for the session.

Stay up to speed with hot stocks' news!

Since Bed Bath and Beyond revealed its turnaround strategy on Wednesday, the stock has fallen off of a cliff. Investors have clearly seen the light with the business, as store closures and staff layoffs will likely not be enough to save the company over the long-term. Given the recent undisclosed stock sale by the company and the way that Ryan Cohen sold his stake in BBBY, it seems unlikely now that a further short squeeze will be able to save BBBY like it did for AMC (NYSE:AMC).

BBBY stock price

AMC did manage to snap its recent losing streak on Friday as did its preferred share counterpart APE (NYSE:APE). The two stocks rose by 3.50% and 8.28% respectively on no news from the company. One interesting note: an analyst at MKM Partners has reiterated the Sell rating for AMC and lowered the price target to just $0.50. GameStop (NYSE:GME) was in the green for most of the day but closed the session lower by 0.98% and marked the fourth consecutive losing day for the stock.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet