Barrick Gold Stock Price Forecast: Is it a good buy after the boost from the Fed?

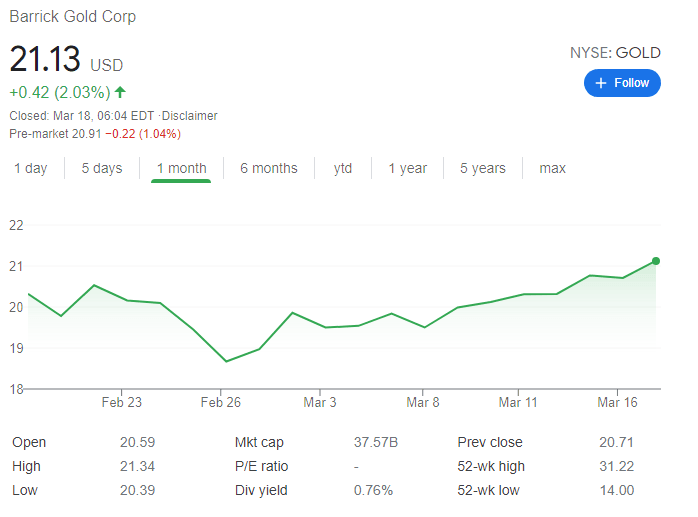

- NYSE: GOLD has risen over 2% on Wednesday, hitting the highest in a month.

- Barrick Gold is benefiting from a dovish outlook by the Federal Reserve, which is positive for the precious metal.

- Weathering higher yields are critical to gold and prices and the miner's stocks.

I'll believe it when I see it – that is a good summary of the Federal Reserve approach on the economy and rising rates – and a great one for gold. The world's most powerful central bank is set to continue printing around $120 billion per month and leave interest rates unchanged for longer.

More funds coming from Washington mean that some could go to the precious metal and thus to Barrick Gold Corp (NYSE: GOLD), the leading miner.

Stay up to speed with hot stocks' news!

However, while XAU/USD jumped on Wednesday, it is falling in response to higher yields on Thursday. Returns on US ten-year yields have leaped to a fresh cycle high of 1.744% and when returns on Uncle Sam's safe debt are elevated, yieldless gold becomes less attractive.

Investors seem concerned that the Fed would let inflation rise too fast and would be forced to hike borrowing costs sooner rather than later. Nevertheless, the case for gold remains bullish.

Similar to stock markets, the precious metal seems more alarmed by the pace of bond sell-off – and resulting jump in yields – rather than the actual move. XAU/USD is trading above levels seen last week when returns on US debt were lower. At some point, things may calm down and allow the precious metal to advance.

Moreover, the Toronto-based miner is not solely dependent on gold but also on copper. And when it comes to industrial metals, demand is only set to rise with further fiscal and monetary stimulus coming from America.

Gold Stock Price

NYSE: GOLD has hit the highest in a month at $21.13. The next technical barrier is $22.50, which was a stubborn cap in late January and early February. Further above, the round $25 level is looming. Support awaits at the round $20 level and is followed by $18.67, the February 26 trough.

Every effort has been made to accurately report the appropriate dollar currency US$ or CAD$. But readers must exercise caution as Sundial is a Canadian company reporting in CAD, listed in the US Nasdaq exchange, but news providers typically convert into $US for earnings comparisons. In some cases, it is not clear in reports from news providers and Sundial which dollar CAD or US is being reported as just the $ symbol is used. For the most part, Sundial does specify CAD$ in press releases unless otherwise stated and this assumption is used in statements above re cash reserves.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.