Bank of America Corp (BAC Stock) Elliott wave view: Forecasting the wave 4 pullback

In this technical blog, we will look at the past performance of 1 hour Elliott Wave Charts of Bank of America ticker symbol: BAC, which we presented to members at the elliottwave-forecast . In which, the rally from 25 March 2021 low ended 5 waves impulse rally in a lesser degree cycle and made a pullback lower. And we knew that the structure is incomplete for 1 more high at least to complete the 5 waves sequence & it should see more strength. Therefore, we advised members not to sell the stock & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

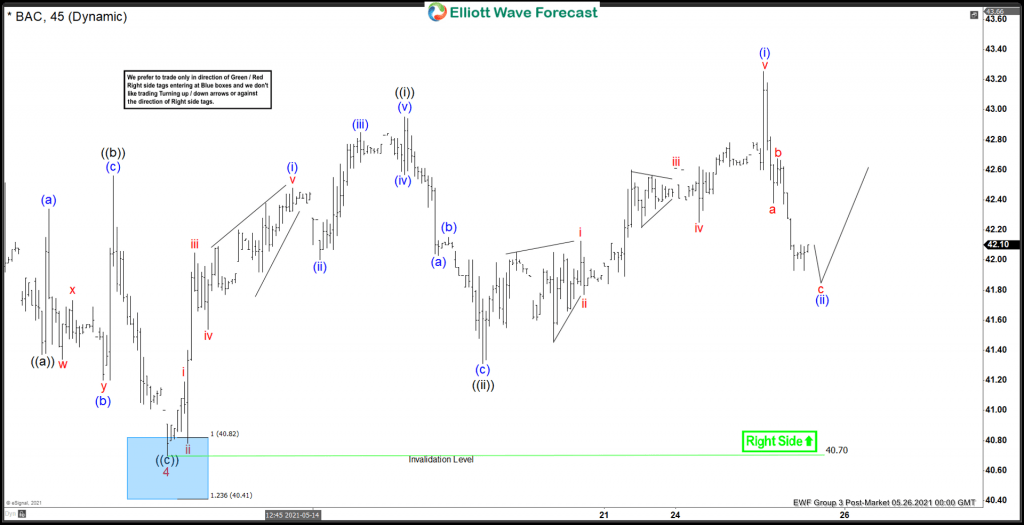

BAC 1 hour Elliott Wave chart

Above is the 1hr Elliott wave chart of BAC from 5/13/2021 Post-Market update. In which the rally to $42.94 high ended the cycle from 3/25/2021 low in 5 waves structure within wave 3. Down from there, the stock made a pullback in wave 4. The internals of that pullback unfolded as Elliott wave zigzag structure where wave ((a)) ended at $41.37 low. Wave ((b)) bounced ended as a lesser degree flat structure at $42.56 high and wave ((c)) was expected to reach the $40.82- $39.75 blue box area. From where next leg higher was expected to take place looking for a new high ideally or for a 3 wave bounce at least.

BAC latest 1 hour Elliott Wave chart

Here’s the latest 1hr chart from 5/26/2021 Post-Market update. The BAC is showing a strong reaction higher taking place from the blue box area after ending the zigzag correction within wave 4 at $40.70 low. Allowed members to create a risk-free position shortly after taking the long positions at the blue box area.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com