BABA Stock Price: Alibaba Group inches higher as Jack Ma reemerges in Europe

- NYSE:BABA gained 0.10% during Wednesday’s trading session.

- Jack Ma resurfaces in Europe amidst major news from AliBaba.

- Chinese ADRs record a mixed session as more regulations hit the EV sector.

NYSE:BABA has had a big week so far as shareholders are hoping that the worst of the regulatory crackdowns are behind them. On Wednesday, shares of BABA inched higher and gained 0.10% to close the trading session at $177.18. The stock has been trending higher over the past month as the chart seems to have finally found a bottom after months of decline. AliBaba still lagged the broader markets on Wednesday, as the Dow Jones hit a new all-time high and the S&P 500 pushed its recent win streak to a sixth consecutive trading day.

Stay up to speed with hot stocks' news!

The big news out of AliBaba this week is that the company will be entering the cloud-computing ARM chip race in the near future. This announcement was enough to send shares of BABA surging by nearly 10% earlier this week, and is the best news that AliBaba investors have received in a long time. While this was taking place, AliBaba founder Jack Ma was spotted in Europe on a research trip. The Chinese mogul has not been seen much at all over the past year as his run-in with the Chinese government caused Ma to keep a low profile, even as his company was slaughtered by a sweeping regulatory crackdown.

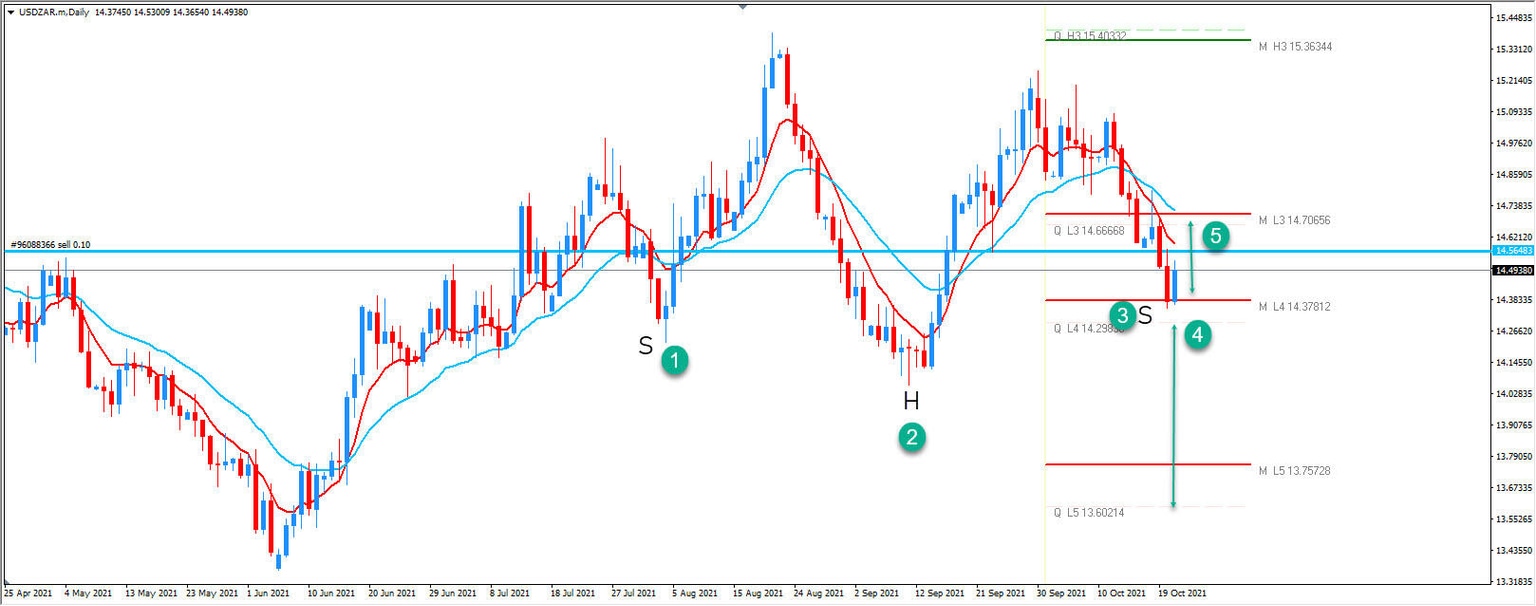

BABA stock analysis

It was a quiet day for Chinese ADRs on Wednesday even with a report about new regulations that could be hitting the EV market. eCommerce companies like JD.Com (NASDAQ:JD) and PinDuoDuo (NASDAQ:PDD) were trading higher alongside AliBaba, while Nio (NYSE:NIO), XPeng (NYSE:XPEV), and Tencent (TCEHY) were all closed the day below water.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet