Australian Dollar steadies as US Dollar remains subdued ahead of Fed decision

- The Australian Dollar maintains its position as China plans to increase fiscal support aimed at boosting domestic consumption.

- Australia’s Consumer Price Index rose by 0.7% QoQ in Q2, compared to the expected rise of 0.8%.

- The US Fed is expected to keep its benchmark interest rate unchanged on Wednesday.

The Australian Dollar (AUD) holds ground against the US Dollar (USD) on Wednesday, halting its four-day losing streak. The AUD/USD pair maintains its position following the release of consumer inflation data from Australia.

Australia’s Consumer Price Index (CPI) rose 0.7% quarter-over-quarter in the second quarter, against the 0.9% increase in Q1 and the expected growth of 0.8%. Annually, CPI inflation eased to 2.1% in Q2, compared to 2.4% prior and below the market consensus of 2.2%.

The monthly Consumer Price Index rose by 1.9% YoY in June, compared to the previous reading of 2.1% increase. The RBA Trimmed Mean CPI for Q2 rose 0.6% and 2.7% on a quarterly and annual basis, respectively. Markets estimated an increase of 0.7% QoQ and 2.7% YoY in the quarter to June.

US Treasury Secretary Scott Bessent said that the US and China will continue talks over maintaining a tariff truce before the deadline in two weeks, and Trump will make the final decision on any extension. Bessent tamped down any expectation of Trump rejecting the extension. It is important to note that any changes in the Chinese economy could impact the AUD as China and Australia are close trade partners.

China’s Finance Minister Lan Fo’an said on Tuesday that the country will ramp up fiscal support to bolster domestic consumption and mitigate mounting economic headwinds. He emphasized that uncertainty around China’s development environment is growing and Beijing will adopt more proactive fiscal policies to help stabilise growth.

Australian Dollar moves little as US Dollar weakens ahead of Fed decision

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is halting its four-day winning streak and trading around 98.80 at the time of writing. Investors will closely monitor the US Federal Reserve (Fed) interest rate decision later on Wednesday, with no change in rates expected.

- Analysts expect the US Fed will leave its benchmark interest rate unchanged at 4.25% to 4.50% in July. Traders are now pricing in nearly a 97% odds of no change to interest rates at the July meeting, according to the CME FedWatch tool.

- The United States and European Union reached a framework trade agreement on Sunday that sets 15% tariffs on most European goods, taking effect on August 1. This deal has ended a months-long stand-off, per Bloomberg.

- Fed Governor Adriana Kugler said earlier that the US central bank should not lower interest rates "for some time" since the effects of the Trump administration's tariffs are starting to show up in consumer prices. Kugler added that restrictive monetary policy is essential to keep inflationary psychology in line.

- San Francisco Fed President Mary Daly said that expecting two rate cuts this year is a "reasonable" outlook, while warning against waiting too long. Fed Governor Christopher Waller believes that the US central bank should reduce its interest rate target at the July meeting.

- The latest Reserve Bank of Australia (RBA) Meeting Minutes indicated that the board agreed further rate cuts were warranted over time, with attention centered on the timing and extent of easing. The majority believed it was best to await confirmation of an inflation slowdown before easing. Most members felt cutting rates three times in four meetings would not be "cautious and gradual.”

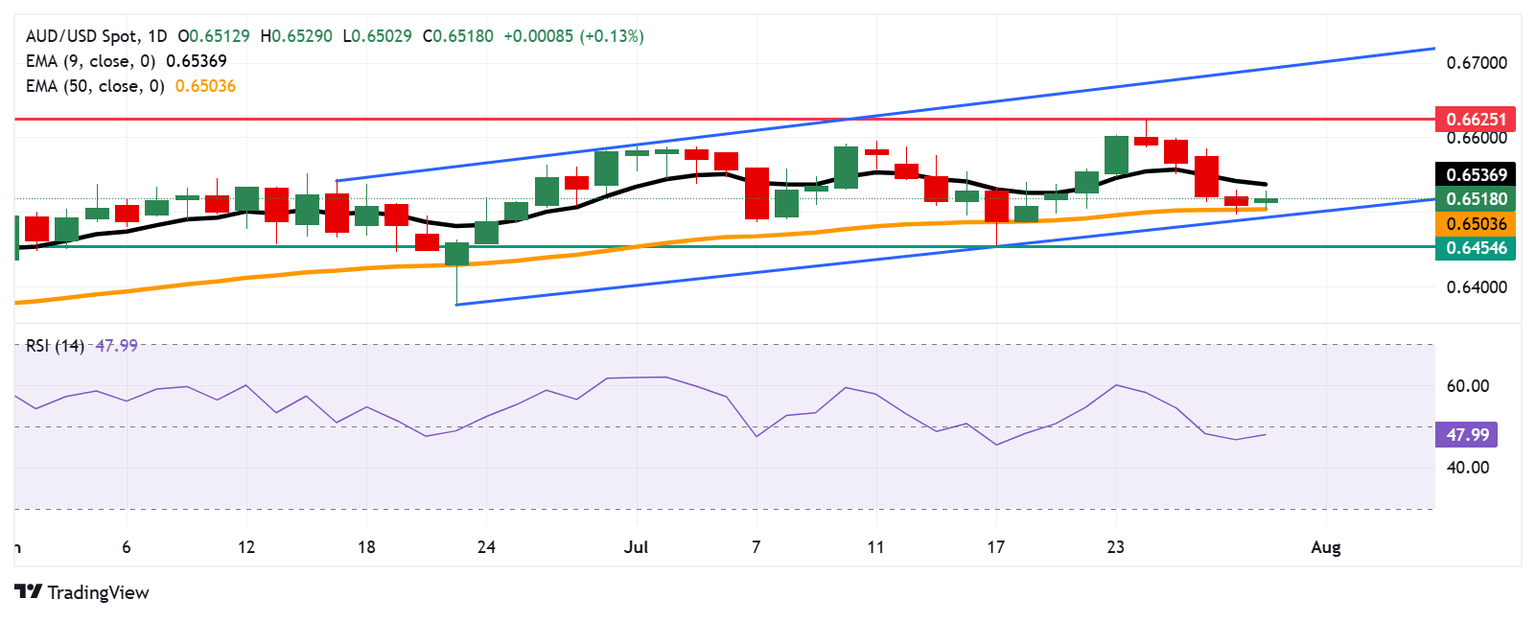

Australian Dollar finds support at 50-day EMA near 0.6500

AUD/USD is trading around 0.6520 on Wednesday. The daily chart’s technical analysis indicates a bullish bias is active as the pair remains within the ascending channel pattern. However, the 14-day Relative Strength Index (RSI) is positioned below the 50 mark, indicating a bullish outlook. Additionally, the pair remains below the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is weaker.

On the upside, the AUD/USD pair may target the initial barrier at the nine-day EMA of 0.6536. A break above this level could strengthen the short-term price momentum and support the pair to test the eight-month high at 0.6625, followed by the ascending channel’s upper boundary around 0.6700.

The AUD/USD pair could find the primary support at the 50-day EMA of 0.6503, followed by the ascending channel’s lower boundary around 0.6490. A break below this crucial support zone would weaken the medium-term price momentum and prompt the pair to approach the monthly low at 0.6454.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.08% | -0.08% | -0.30% | -0.00% | -0.01% | -0.17% | -0.15% | |

| EUR | 0.08% | 0.03% | -0.32% | 0.05% | 0.03% | -0.09% | -0.02% | |

| GBP | 0.08% | -0.03% | -0.34% | 0.08% | 0.03% | -0.09% | -0.04% | |

| JPY | 0.30% | 0.32% | 0.34% | 0.40% | 0.39% | 0.23% | 0.25% | |

| CAD | 0.00% | -0.05% | -0.08% | -0.40% | -0.00% | -0.17% | -0.11% | |

| AUD | 0.00% | -0.03% | -0.03% | -0.39% | 0.00% | -0.12% | -0.05% | |

| NZD | 0.17% | 0.09% | 0.09% | -0.23% | 0.17% | 0.12% | 0.05% | |

| CHF | 0.15% | 0.02% | 0.04% | -0.25% | 0.11% | 0.05% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Jul 30, 2025 18:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.