Australian Dollar remains subdued following RBA rate decision

- The Australian Dollar holds losses as RBA Governor Bullock discussed the risks of rising inflation have eased.

- The RBA decided to hold the Official Cash Rate steady at 4.35% in its final policy meeting in December.

- The US Dollar continues to gain ground ahead of US Consumer Price Index data due on Wednesday.

The Australian Dollar (AUD) continues to fall as the Reserve Bank of Australia (RBA) decides to maintain the Official Cash Rate (OCR) at 4.35% in its final policy meeting this year. RBA Governor Michele Bullock, speaking at a press conference, explained the decision to maintain the interest rate at a 12-year high of 4.35% for the ninth consecutive meeting in December.

RBA Governor Bullock highlighted that while upside inflation risks have eased, they persist and require ongoing vigilance. The RBA will closely monitor all economic data, including employment figures, to guide future policy decisions.

Chinese President Xi Jinping stated on Tuesday, "China has full confidence in achieving this year's economic target." He emphasized that China will continue to serve as the largest engine of global economic growth and asserted that there would be no winners in tariff wars, trade wars, or tech wars.

China's Trade Balance (CNY) expanded to CNY 692.8 billion in November, up from CNY 679.1 billion in the previous month. Exports grew by 1.5% year-over-year in November, compared to the 11.2% rise in October. Meanwhile, imports increased by 1.2% YoY, recovering from the 3.7% decline recorded earlier.

The US Dollar (USD) extends its winning streak for the third successive day as traders adopt caution ahead of the US Consumer Price Index (CPI) data release on Wednesday. Traders are now pricing in nearly an 85.8% chance of Fed rate reductions by 25 basis points on December 18, according to the CME FedWatch Tool.

Australian Dollar depreciates ahead of the RBA interest rate decision

- The Australian Unemployment Rate remained at 4.1% in October for the third consecutive month. The economy added 9,700 full-time jobs and 6,200 part-time roles, making a net change of 15,900 positions.

- The RBA’s closely watched inflation gauge, the annual Trimmed Mean Consumer Price Index (CPI), slowed to 3.5% from 4.0% in the third quarter but stayed well above the Bank’s 2%- 3% target.

- Australia's economy grew at its slowest annual pace since the pandemic in the third quarter. The OZ nation’s Gross Domestic Product (GDP) rose 0.3% in the September quarter, missing market forecasts of 0.4%. Weaker-than-expected GDP growth made markets almost fully price in a rate cut next April at 96% (from 73% before), according to Refinitive interest rate probabilities data.

- US November NFP data from Friday showed a robust 227,000 gain, well above expectations, and stable Average Hourly Earnings growth at 0.4% MoM.

- The AUD received support from improved sentiment and stimulus expectations from China. China’s leaders announced plans for proactive fiscal and looser monetary policies to accelerate domestic consumption in 2024.

- Weak Chinese CPI data (-0.6% in November, worse than expected) highlights challenges in the recovery but bolsters stimulus speculation.

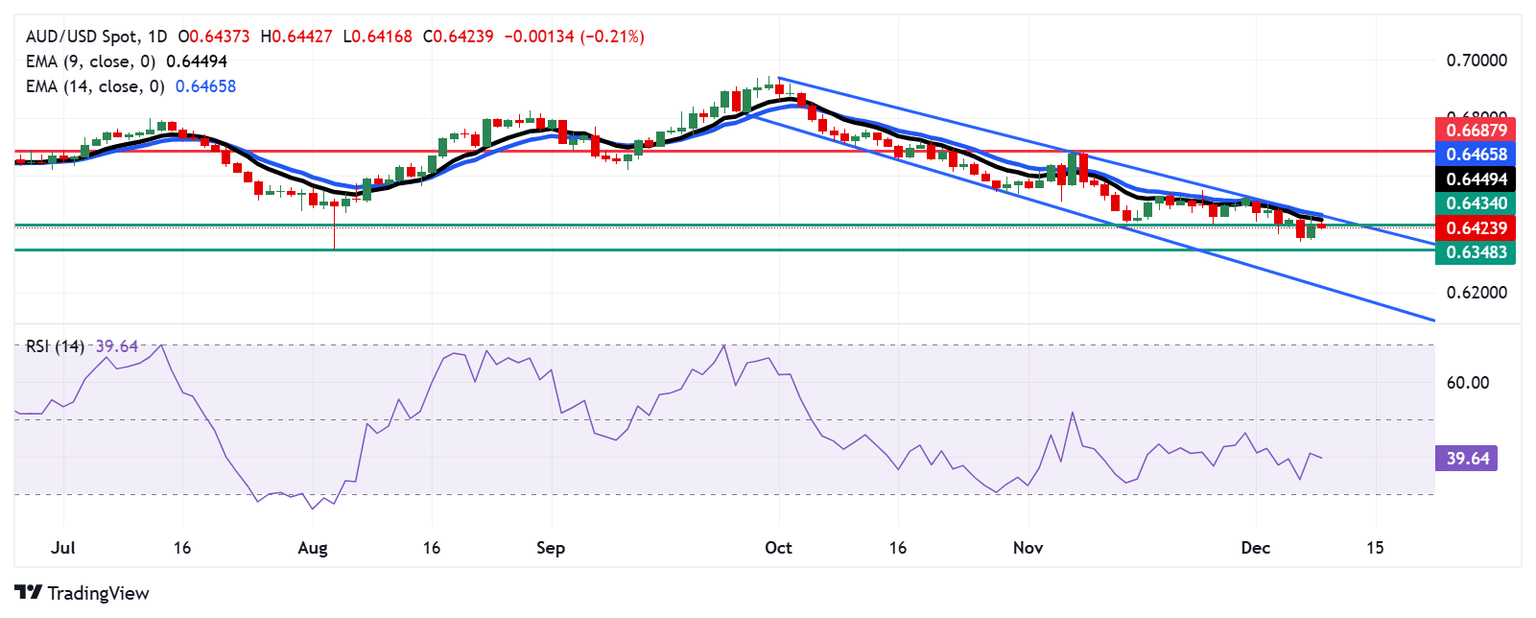

Technical Analysis: Australian Dollar breaks below 0.6450, five-month lows

AUD/USD trades near 0.6420 on Tuesday, with bearish momentum gaining strength according to technical analysis. The pair remains confined within a descending channel, and the 14-day Relative Strength Index (RSI) remains below 50, indicating sustained negative sentiment.

On the downside, the AUD/USD pair has dropped below its five-month low of 0.6434, recorded on November 26. If this level is decisively broken, it could open the path toward the yearly low of 0.6348, last seen on August 5. Further support lies near the descending channel’s lower boundary, around 0.6225.

Immediate resistance for the AUD/USD pair is located at the nine-day Exponential Moving Average (EMA) at 0.6449, followed by the 14-day EMA at 0.6465, which aligns closely with the upper boundary of the descending channel. A decisive breakout above these levels could pave the way for a potential rally toward the five-week high of 0.6687.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.12% | -0.07% | -0.09% | 0.01% | 0.58% | 0.48% | -0.17% | |

| EUR | 0.12% | 0.05% | 0.02% | 0.12% | 0.70% | 0.62% | -0.05% | |

| GBP | 0.07% | -0.05% | -0.06% | 0.08% | 0.65% | 0.56% | -0.10% | |

| JPY | 0.09% | -0.02% | 0.06% | 0.12% | 0.69% | 0.59% | -0.06% | |

| CAD | -0.01% | -0.12% | -0.08% | -0.12% | 0.57% | 0.49% | -0.17% | |

| AUD | -0.58% | -0.70% | -0.65% | -0.69% | -0.57% | -0.09% | -0.74% | |

| NZD | -0.48% | -0.62% | -0.56% | -0.59% | -0.49% | 0.09% | -0.65% | |

| CHF | 0.17% | 0.05% | 0.10% | 0.06% | 0.17% | 0.74% | 0.65% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.