Australian Dollar maintains position as US Dollar depreciates, FOMC Minutes awaited

- The Australian Dollar appreciates despite fresh tariff threats from US President Donald Trump.

- Australia's Wage Price Index increased by 0.7% QoQ in Q4 2024, missing the expected 0.8% rise.

- The US Dollar loses ground as Treasury yields depreciate despite hawkish Fedspeak.

The Australian Dollar (AUD) recovers its daily losses against the US Dollar (USD) on Wednesday. However, the AUD/USD pair faced challenges amid rising risk aversion following new tariff threats from US President Donald Trump. Investors brace for the Federal Open Market Committee (FOMC) Meeting Minutes, which will be released later in the North American session.

Australia's Wage Price Index increased by 0.7% quarter-over-quarter in Q4 2024, falling short of the expected 0.8% rise and down from the previous quarter's 0.9% gain. Annually, the index grew by 3.2%, slowing from a revised 3.6% in the prior quarter and aligning with forecasts. This marks the slowest wage growth since Q3 2022.

The AUD faced additional downward pressure after the Reserve Bank of Australia (RBA) cut its Official Cash Rate (OCR) by 25 basis points (bps) to 4.10% on Tuesday—the first rate cut in four years.

Following the policy decision, RBA Governor Michele Bullock acknowledged that high interest rates have had an impact but cautioned that it is too soon to declare victory over inflation. Bullock also highlighted the strength of the job market and clarified that further rate cuts are not guaranteed, despite market expectations.

Australian Dollar could weaken due to risk-off mood following Trump tariff threats

- The US Dollar Index (DXY), which measures the USD against six major currencies, has edged lower to around 107.00. Meanwhile, US Treasury yields stand at 4.29% for the 2-year note and 4.55% for the 10-year note at the time of writing.

- The USD could regain strength as risk sentiment shifts following fresh tariff threats from US President Donald Trump. According to Bloomberg, Trump stated on Tuesday that he plans to impose a 25% tariff on foreign cars, with higher duties also expected on semiconductor chips and pharmaceuticals. He indicated that an official announcement could come as soon as April 2.

- San Francisco Fed President Mary Daly said on Tuesday that prospects of further rate cuts in 2025 remain uncertain despite an overall positive lean to US economic factors. Philadelphia Fed President Patrick Harker emphasized support for maintaining a steady interest rate policy, noting that inflation has remained elevated and persistent in recent months.

- Federal Reserve Governor Michelle Bowman stated on Monday that rising asset prices may have slowed the Fed’s recent progress on inflation. While Bowman expects inflation to decline, she cautioned that upside risks remain and emphasized the need for more certainty before considering rate cuts.

- The US Census Bureau reported on Friday that Retail Sales fell by 0.9% in January, following a revised 0.7% increase in December (previously reported as 0.4%). This decline was sharper than the market’s expectation of a 0.1% drop.

- Fed Chair Jerome Powell said in his semi-annual report to Congress that the board officials “do not need to be in a hurry" to cut interest rates due to strength in the job market and solid economic growth. He added that US President Donald Trump's tariff policies could put more upward pressure on prices, making it harder for the central bank to lower rates.

- On Monday, Chinese President Xi Jinping led a meeting with Alibaba co-founder Jack Ma and other prominent entrepreneurs, signaling Beijing’s renewed support for the private sector, which is now seen as crucial to economic recovery, according to Bloomberg. Xi emphasized the need to eliminate barriers that hinder equal access to production resources and fair market competition.

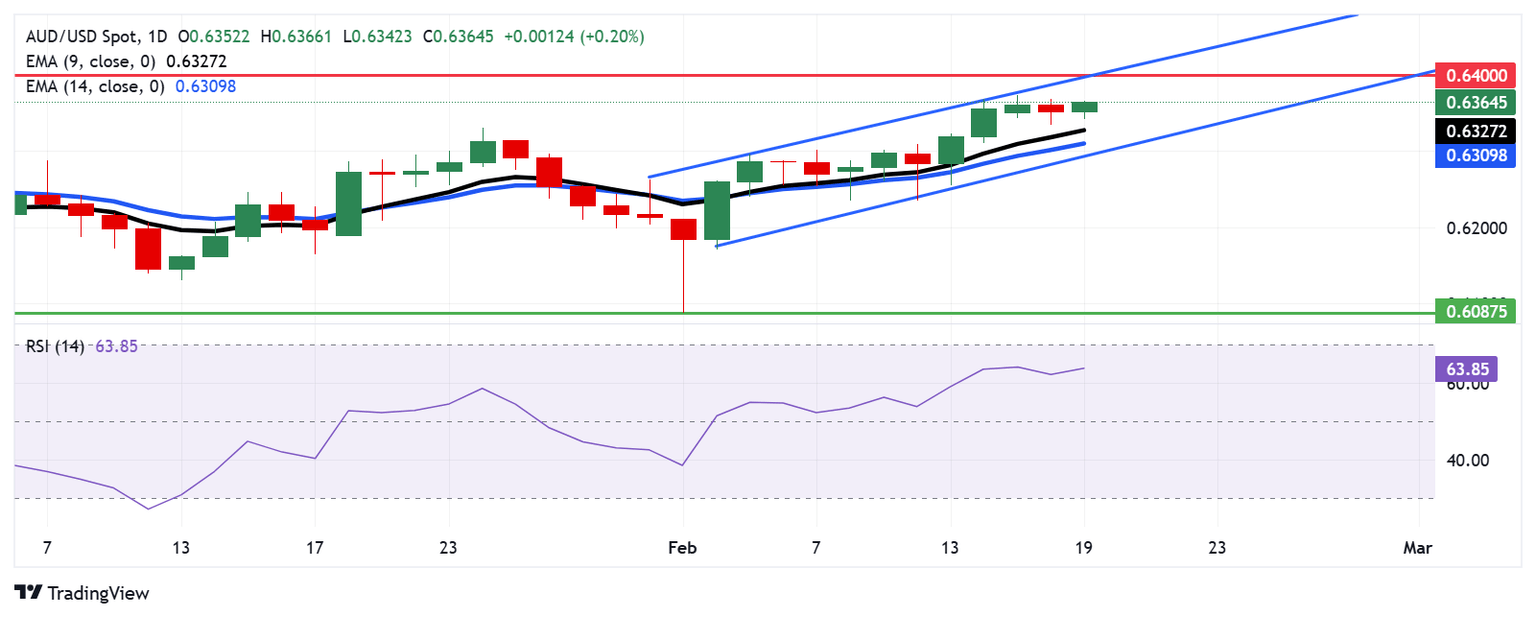

Australian Dollar surpasses 0.6350 amid a bullish market bias

The AUD/USD pair hovers around 0.6360 on Wednesday, trading within an ascending channel pattern that signals a bullish market bias. The 14-day Relative Strength Index (RSI) remains above 50, reinforcing the positive outlook.

On the upside, the AUD/USD pair may test the upper boundary of the ascending channel, which aligns with the key psychological resistance at 0.6400.

Support levels include the nine-day Exponential Moving Average (EMA) at 0.6327, followed by the 14-day EMA at 0.6309. A stronger support zone is near the lower boundary of the ascending channel at 0.6290.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.06% | -0.14% | -0.03% | -0.16% | -0.28% | -0.01% | |

| EUR | 0.02% | -0.04% | -0.08% | -0.02% | -0.14% | -0.26% | 0.00% | |

| GBP | 0.06% | 0.04% | -0.08% | 0.03% | -0.10% | -0.22% | 0.05% | |

| JPY | 0.14% | 0.08% | 0.08% | 0.08% | -0.05% | -0.18% | 0.10% | |

| CAD | 0.03% | 0.02% | -0.03% | -0.08% | -0.13% | -0.25% | 0.01% | |

| AUD | 0.16% | 0.14% | 0.10% | 0.05% | 0.13% | -0.12% | 0.16% | |

| NZD | 0.28% | 0.26% | 0.22% | 0.18% | 0.25% | 0.12% | 0.27% | |

| CHF | 0.00% | -0.01% | -0.05% | -0.10% | -0.01% | -0.16% | -0.27% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Next release: Wed Feb 19, 2025 19:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.