Australian Dollar recovers losses as US Dollar slips, with markets awaiting Fed decision

- The Australian Dollar rebounds after losing more than 0.50% in the previous session.

- The AUD may lose ground due to a risk-off mood as Israel and Iran continue to attack each other.

- The Federal Reserve is widely expected to keep interest rates unchanged on Wednesday.

The Australian Dollar (AUD) edges higher against the US Dollar (USD) on Wednesday after registering more than 0.50% losses in the previous session. However, the AUD/USD pair struggled due to dampened risk appetite amid escalating Middle East tensions. Israel and Iran continue their cycle of retaliation. However, Tehran has reportedly urged several countries, including Oman, Qatar, and Saudi Arabia, to urge US President Donald Trump to declare an immediate ceasefire.

The US Dollar may regain its ground due to increased safe-haven demand amid rising geopolitical tensions in the Middle East. On Tuesday, US President Donald Trump posted on his social media platform, calling for Iran’s “unconditional surrender.” Investors are concerned that the United States will participate in the Israel-Iran conflict.

G7 leaders issued a joint statement on Monday: “We have been consistently clear that Iran can never have a nuclear weapon.” The leaders emphasized that resolving the Iranian crisis could lead to broader de-escalation of hostilities in the region.

Australia’s upcoming labor data, including Employment Change and Unemployment Rate, will be released later this week. The jobs figures will likely offer fresh impetus to the domestic economy and shape expectations for the Reserve Bank of Australia’s (RBA) policy outlook.

Australian Dollar advances as US Dollar edges lower ahead of Fed policy decision

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is edging lower and trading at around 98.70 at the time of writing. The Greenback faces challenges due to the weaker-than-expected US Retail Sales released on Tuesday.

- US Retail Sales fell by 0.9% in May, worse than the expected 0.7% decline and April’s 0.1% decrease (revised from +0.1%).

- The Federal Reserve (Fed) is anticipated to leave the interest rate unchanged at the June meeting scheduled on Wednesday. Traders now see a nearly 80% probability of a Fed rate cut in September, followed by another one in October, per Reuters.

- Last week, President Trump expanded steel tariffs starting June 23 on imported “steel derivative products,” including household appliances, such as dishwashers, washing machines, refrigerators, etc. The tariffs were initially imposed at 25% in March and later doubled to 50% for most countries. This is the second time the scope of affected products has been expanded.

- China Retail Sales rose 6.4% year-over-year in May, surpassing the 5.0% expected and April’s 5.1% increase. Meanwhile, Industrial Production increased 5.8% YoY, but came in below the 5.9% forecast and 6.1% prior.

- Moreover, the National Bureau of Statistics (NBS) in China noted that the domestic economy is expected to have remained generally stable for the first half (H1) of 2025. However, economic growth in China may struggle since the second quarter due to uncertain trade policies.

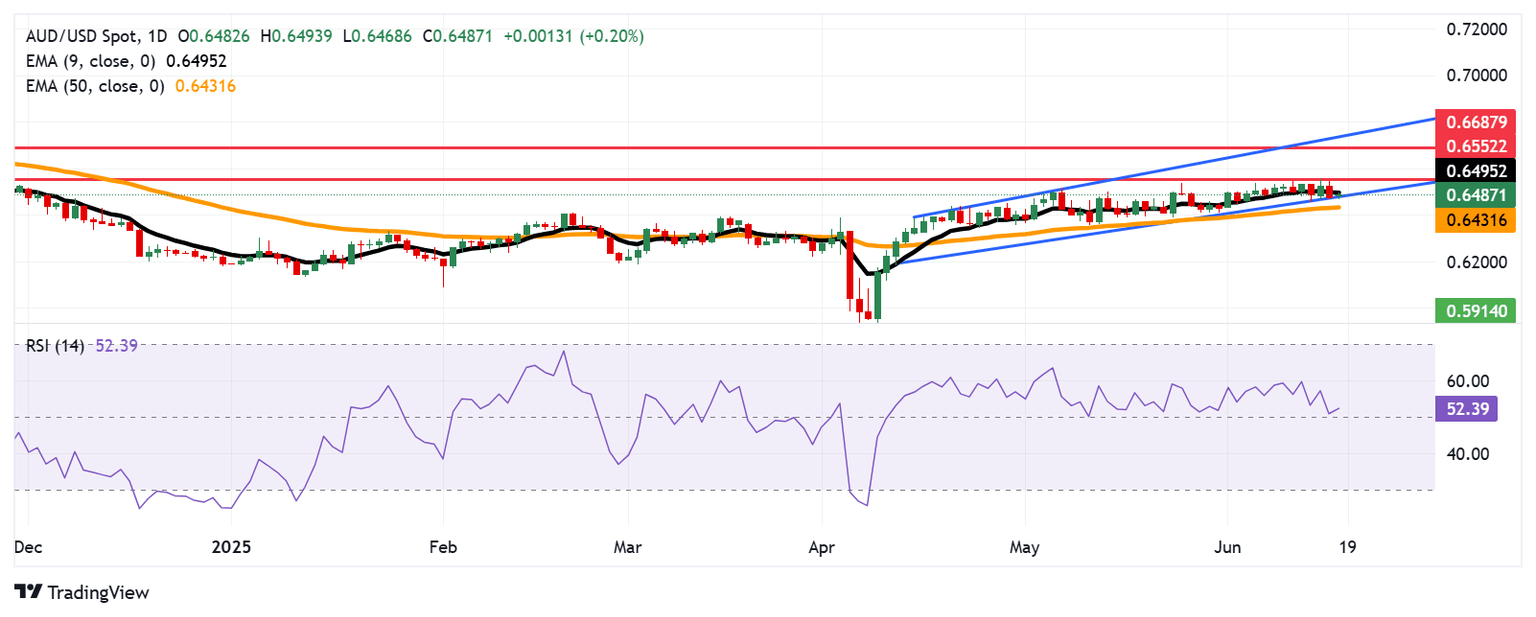

Australian Dollar rebounds from ascending channel’s lower boundary

AUD/USD is trading around 0.6480 on Wednesday, with a prevailing bullish bias as the daily chart’s technical analysis indicates that the pair remains within the ascending channel. Moreover, the 14-day Relative Strength Index (RSI) is positioned slightly above the 50 mark, suggesting a prevailing bullish outlook. However, the pair has moved below the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is weakening.

The nine-day EMA at 0.6495 is acting as the immediate barrier, followed by the seven-month high of 0.6552, which was recorded on June 16. A break above this level could support the pair to target the eight-month high at 0.6687, followed by the upper boundary of the ascending channel around 0.6740.

On the downside, the AUD/USD pair may target the ascending channel’s lower boundary around 0.6480. A break below the channel would weaken the bullish bias and prompt the pair to test the 50-day EMA at 0.6431.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.20% | -0.14% | -0.19% | -0.05% | -0.32% | -0.25% | -0.04% | |

| EUR | 0.20% | 0.07% | -0.02% | 0.06% | -0.21% | 0.03% | 0.17% | |

| GBP | 0.14% | -0.07% | -0.08% | -0.01% | -0.28% | -0.17% | 0.12% | |

| JPY | 0.19% | 0.02% | 0.08% | 0.17% | -0.10% | 0.18% | 0.40% | |

| CAD | 0.05% | -0.06% | 0.00% | -0.17% | -0.26% | -0.17% | 0.12% | |

| AUD | 0.32% | 0.21% | 0.28% | 0.10% | 0.26% | 0.24% | 0.40% | |

| NZD | 0.25% | -0.03% | 0.17% | -0.18% | 0.17% | -0.24% | 0.16% | |

| CHF | 0.04% | -0.17% | -0.12% | -0.40% | -0.12% | -0.40% | -0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Jun 18, 2025 18:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.