Australian Dollar gathers strength on hawkish RBA, weaker US Retail Sales data

- Australian Dollar (AUD) trades on a stronger note on Wednesday amid the weaker US Dollar.

- The hawkish messages from the RBA and weaker-than-expected US Retail Sales data support the pair.

- US markets are closed for Juneteenth; US S&P Global PMI reports will be in the spotlight on Friday.

The Australian Dollar (AUD) gains momentum on Wednesday, backed by the hawkish hold by the Reserve Bank of Australia (RBA) at its June meeting. The markets have pushed back RBA rate cut expectations and see the start of the easing cycle in 2025, which continues to boost the Aussie. Furthermore, weaker-than-expected Retail Sales prompted the case for US Federal Reserve (Fed) rate cuts later this year, which undermine the Greenback across the board.

The US markets will be closed on Wednesday due to Juneteenth National Independence Day. Investors will focus on the US S&P Global Manufacturing and Services PMI reports at the end of the week. Any signs of expanding US business activity could lift the US Dollar (USD) and cap the upside for the pair.

Daily Digest Market Movers: Australian Dollar extends upside due to RBA’s hawkish hold and weaker US data

- The Reserve Bank of Australia (RBA) held the Official Cash Rate (OCR) steady at 4.35% for the fifth meeting in a row at its June meeting. It marks the longest on-hold period since May 2022, when the rate hike cycle began.

- The RBA board noted in a statement that "the economic outlook remains uncertain and recent data have demonstrated that the process of returning inflation to target is unlikely to be smooth.”

- It would be some time yet before inflation is sustainably in the target range and the recent data had reinforced the need to remain vigilant to upside risks to inflation, according to a statement.

- The US Retail Sales increased 0.1% MoM in May following the 0.2% decline in April, missing the estimation for an increase of 0.2%, the Commerce Department reported Tuesday.

- Boston Fed President Susan Collins stated on Tuesday that there are possibilities of one or two interest rate cuts from the Fed later this year, but the central bank must be patient amid volatile readings on inflation, per Reuters.

- Richmond Fed President Thomas Barkin said on Tuesday that he needs to parse several more months of economic data before considering cutting the interest rate.

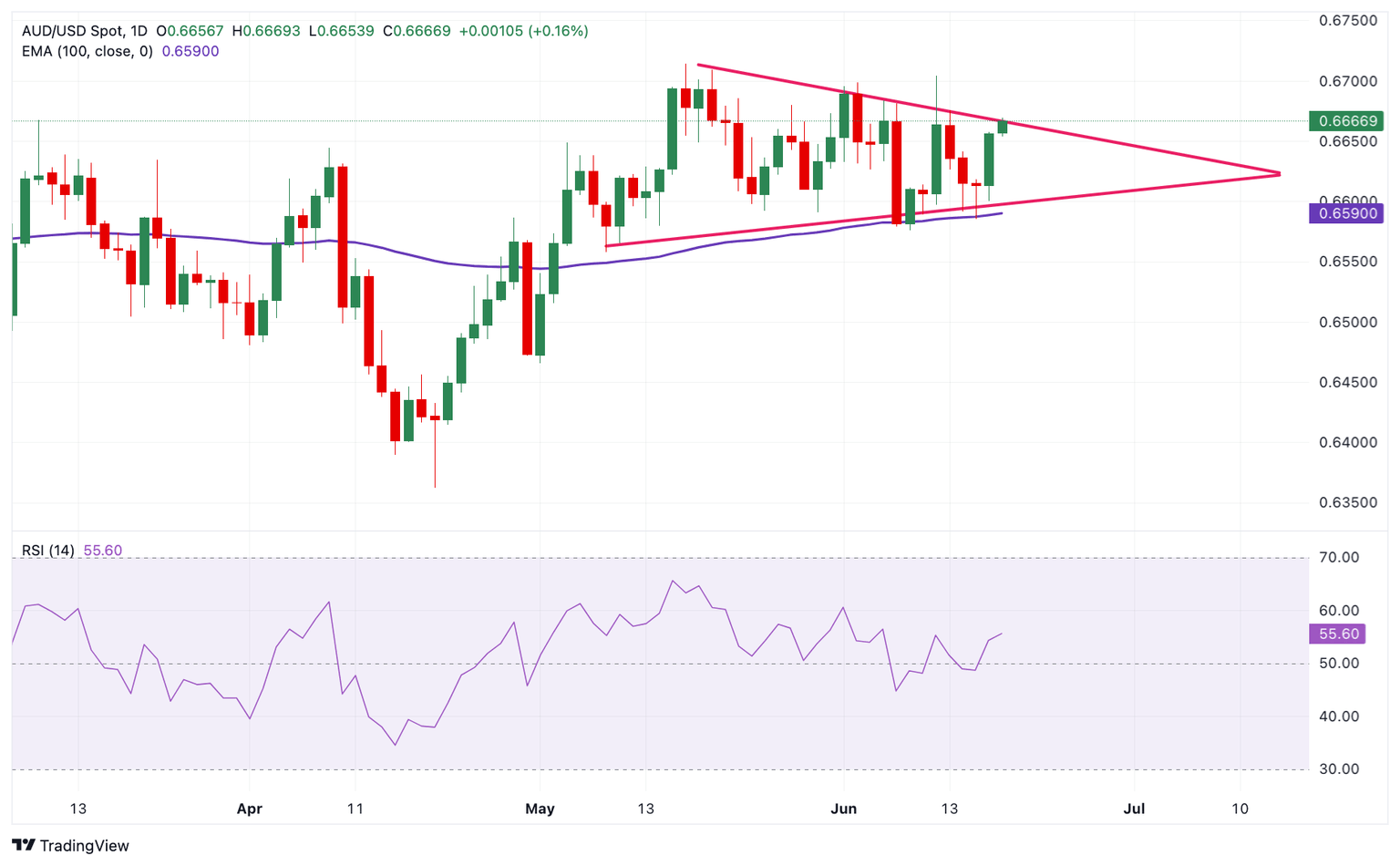

Technical Analysis: AUD/USD maintains a positive stance amid symmetrical triangle pattern

The Australian Dollar trades firmer on the day. The AUD/USD pair has formed a symmetrical triangle pattern since May 8. The bullish lean prevails as the pair stays beyond the key 100-day Exponential Moving Average (EMA) on the daily chart. The upward momentum is supported by the 14-day Relative Strength Index (RSI), which holds in bullish territory around 54.0.

A decisive break above the upper boundary of the symmetrical triangle of 0.6670 will see a rally to 0.6700, the psychological level and a high of May 17. The additional upside filter to watch is 0.6760, a high of January 4.

On the downside, the crucial support level for the pair will emerge near the confluence of the 100-day EMA and the lower limit of triangle patterns at the 0.6590-0.6600 regions. Any follow-through selling will see a drop to 0.6510, a low of March 22, followed by 0.6465, a low of May 1.

Australian Dollar price this week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.34% | -0.38% | -0.13% | -0.93% | 0.09% | 0.00% | -0.73% | |

| EUR | 0.34% | -0.04% | 0.21% | -0.58% | 0.45% | 0.33% | -0.40% | |

| GBP | 0.38% | 0.08% | 0.24% | -0.54% | 0.50% | 0.36% | -0.35% | |

| CAD | 0.13% | -0.21% | -0.26% | -0.78% | 0.25% | 0.12% | -0.59% | |

| AUD | 0.95% | 0.59% | 0.54% | 0.79% | 1.03% | 0.90% | 0.19% | |

| JPY | -0.11% | -0.46% | -0.51% | -0.21% | -1.05% | -0.11% | -0.86% | |

| NZD | 0.00% | -0.34% | -0.37% | -0.13% | -0.93% | 0.09% | -0.70% | |

| CHF | 0.71% | 0.40% | 0.33% | 0.57% | -0.22% | 0.85% | 0.70% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.