Australian Dollar declines as US Dollar gains ground ahead of Retail Sales data

- The Australian Dollar falls as weaker employment data reinforced the case for RBA rate cuts.

- Australia’s Employment Change came at 2K in June, against the expected 20K, while Unemployment Rate climbed to 4.3%.

- Trump announced plans to notify over 150 countries in a single letter about a forthcoming 10% tariff.

The Australian Dollar (AUD) declines against the US Dollar (USD) on Thursday, retracing its recent gains from the previous session. The AUD/USD pair further depreciates following the release of disappointing employment data from Australia, reinforcing the case for the Reserve Bank of Australia (RBA) easing.

The Australian Bureau of Statistics reported on Thursday that seasonally adjusted Employment Change was 2K in June, recovering from a previous decline of 2.5K in May, though falling way short of the expected 20K new jobs. Meanwhile, the Unemployment Rate rose to 4.3% from 4.1% prior. The figure came in above the market consensus of 4.1%.

The AUD/USD pair appreciated as market sentiment improved after US President Donald Trump's comments in an interview with the Real America's Voice network on Wednesday. Trump said he would love for Fed Chair Jerome Powell to resign, but that it would disrupt the markets if the president were to remove him. He also mentioned the possibility of striking a deal with Europe. Regarding tariffs on Canada, he said it’s too soon to comment. A tariff deal with India, however, is very close.

Australian Dollar loses ground as US Dollar holds ground ahead of Retail Sales data

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is edging higher and trading at around 98.50 at the time of writing. Traders will keep an eye on the US Retail Sales for June, followed by weekly Initial Jobless Claims and Philly Fed Manufacturing Index due later on Thursday.

- The US Producer Price Index (PPI) was unexpectedly unchanged in June, against the market consensus of a 0.2% rise. Meanwhile, the core PPI rose by 2.6% YoY versus 3.0% prior, softer than the 2.7% expected.

- The latest Fed Beige Book shows that while overall business activity remains healthy and inflation pressures are relatively subdued, underlying cost pressures are building, and business operators remain cautious.

- On Wednesday, Trump said he plans to send a single letter to over 150 countries, notifying them of a 10% tariff rate they will face. He emphasized that these are "not big countries" with limited trade ties to the US, unlike China or Japan. He also hinted the rate could rise to 15–20%, though he did not confirm any specifics.

- The US Consumer Price Index (CPI) rose 2.7% year-over-year in June, matching market expectations. Core CPI came in at 2.9%, just below the 3.0% forecast but still notably above the Federal Reserve’s 2% target. The hotter-than-expected June inflation figures reignited concerns about prolonged high Fed interest rates.

- Dallas Fed President Lorie Logan said on Tuesday that the Fed will probably need to leave interest rates where they are for a while longer to ensure inflation stays low in the face of upward pressure from the Trump administration's tariffs. Moreover, New York Fed President John Williams said late Wednesday that monetary policy is in the right place to allow the Fed to monitor the economy before taking its next decision.

- Trump has threatened to impose “very severe” tariffs on Russia if no peace deal is reached within 50 days. Trump also warned of secondary tariffs on countries importing Russian Oil. Moreover, Trump, alongside NATO Secretary-General Mark Rutte, confirmed that European allies will purchase billions of dollars’ worth of American-made weapons, such as Patriot missile systems. These weapons will be transferred to Ukraine in the coming weeks to tackle intensified Russian attacks.

- The US government immediately imposed a 17% duty on Monday on most imports of fresh tomatoes from Mexico after negotiations ended without an agreement to avert the tariff. Trump announced, on Saturday, a 30% tariff on imports from the European Union (EU) and Mexico starting August 1. He also proposed a blanket tariff rate of 15%-20% on other trading partners, an increase from the current 10% baseline rate. In response, the European Union announced on Sunday that it will extend its pause on retaliatory measures against US tariffs until early August, in hopes of reaching a negotiated agreement.

- Chinese economy expanded at an annual rate of 5.2% in the second quarter, compared to a 5.4% growth in the first quarter and the expected 5.1% growth. Meanwhile, the Chinese Gross Domestic Product (GDP) rate rose 1.1% in Q2, against the market consensus of a 0.9% increase. Moreover, Retail Sales increased by 4.8% YoY in June, against the 5.6% expected and 6.4% prior, while Industrial Production came in at 6.8%, against the 5.6% expected.

- Australia’s Westpac Consumer Confidence on Tuesday, which climbed 0.6% month-over-month in July, following a 0.5% gain in June. This marked a third consecutive monthly increase, signaling a modest yet encouraging improvement in consumer outlook.

- The AUD could face challenges as markets expect an 80% chance of a Reserve Bank of Australia (RBA) rate cut in August. Markets also expect a 75-basis-point rate cut by early 2026. However, RBA Governor Michele Bullock stated that inflation risks persist, citing the elevated unit labor costs and weak productivity as factors that could drive inflation above current projections.

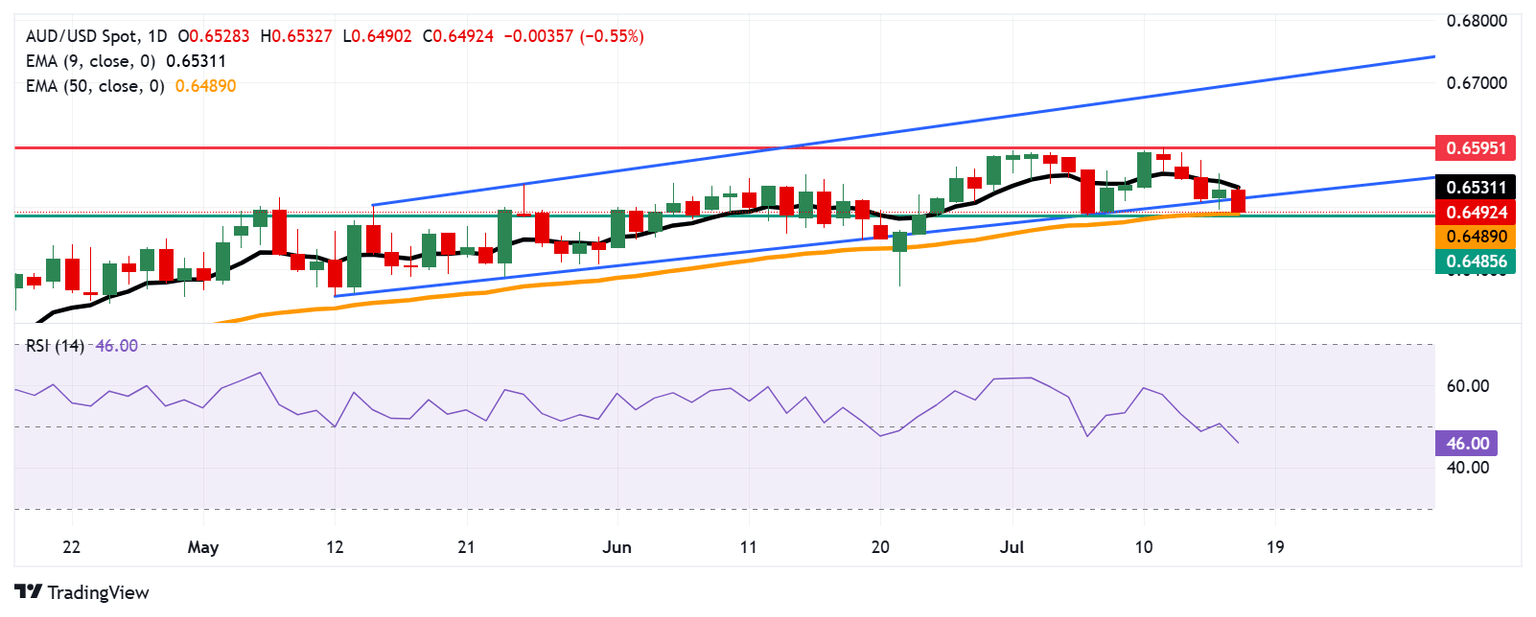

Australian Dollar falls below 0.6500, testing 50-day EMA

The AUD/USD pair is trading around 0.6490 on Thursday. The daily chart’s technical analysis indicated a weakening bullish bias as the pair has broken below the ascending channel pattern. Additionally, the 14-day Relative Strength Index (RSI) is positioned below the 50 mark, suggesting that market bias is weakening. The pair remains below the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is weaker.

On the downside, the AUD/USD pair is testing the 50-day EMA at 0.6489, aligned with the three-week low at 0.6485. A break below this level would weaken the medium-term price momentum and prompt the pair to navigate the region around the psychological level of 0.6400.

The AUD/USD pair may attempt to return to the channel and test the nine-day EMA at 0.6531. A break above this level could strengthen the short-term price momentum and support the pair to approach the eight-month high of 0.6595, which was reached on July 11.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.54% | 0.32% | 0.60% | 0.36% | 0.89% | 0.60% | 0.48% | |

| EUR | -0.54% | -0.22% | 0.03% | -0.15% | 0.38% | 0.08% | -0.01% | |

| GBP | -0.32% | 0.22% | 0.30% | 0.04% | 0.57% | 0.28% | 0.18% | |

| JPY | -0.60% | -0.03% | -0.30% | -0.30% | 0.24% | -0.02% | -0.12% | |

| CAD | -0.36% | 0.15% | -0.04% | 0.30% | 0.62% | 0.23% | 0.14% | |

| AUD | -0.89% | -0.38% | -0.57% | -0.24% | -0.62% | -0.38% | -0.39% | |

| NZD | -0.60% | -0.08% | -0.28% | 0.02% | -0.23% | 0.38% | -0.09% | |

| CHF | -0.48% | 0.01% | -0.18% | 0.12% | -0.14% | 0.39% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Retail Sales (YoY)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Retail Sales measure the change in the total value of goods sold at the retail level during a year. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. A result higher than expected is typically viewed as positive or bullish for the USD, whereas a lower than expected result is considered negative or bearish for the USD.

Read more.Next release: Thu Jul 17, 2025 12:30

Frequency: Monthly

Consensus: -

Previous: 3.3%

Source: US Census Bureau

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.