Australian Dollar loses daily gains as US Dollar appreciates on easing US-China tensions

- The Australian Dollar depreciates ahead of the second meeting between US-China advisors on Tuesday.

- Australia’s Westpac Consumer Confidence increased 0.5% MoM in June, down from May’s 2.2% rise.

- US Consumer Price Index is expected to climb by 2.5% YoY in May, above April’s 2.3% rise.

The Australian Dollar (AUD) edges lower against the US Dollar (USD) on Tuesday after paring daily losses. However, the AUD/USD pair receives support from hopes for a cooldown in the United States’ (US) latest broad tariff tensions with China. Any economic update from China could impact AUD as China and Australia are close trade partners.

US-China advisers are expected to meet again on a second day on Tuesday at 10.00 a.m. in London. Trade talks will continue as the world’s two largest economies look to ease tensions over shipments of technology and rare earth elements, per Bloomberg.

Australia’s Westpac Consumer Confidence rose 0.5% month-over-month in June, sharply falling from the 2.2% gain in May. The ongoing uncertainty over global trade weighed on sentiment. However, it was the fourth monthly increase this year, driven by the Reserve Bank of Australia’s (RBA) May rate cut and signs of easing inflation.

Australian Dollar loses ground as US Dollar rises amid easing tariff tensions

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is trading higher at around 99.10 at the time of writing. US Consumer Price Index (CPI) inflation is slated for Wednesday, with expectations of a rise of 2.5% YoY in May.

- The US Bureau of Labor Statistics (BLS) reported that US Nonfarm Payrolls (NFP) rose by 139,000 in May compared to the 147,000 increase (revised from 177,000) in April. This reading came in above the market consensus of 130,000. Moreover, the Unemployment Rate held steady at 4.2%, and the Average Hourly Earnings remained unchanged at 3.9%, both readings came in stronger than the market expectation.

- US President Donald Trump called upon, in a post published on Truth Social on Wednesday, Federal Reserve (Fed) Chairman Jerome Powell to lower the policy rate. "ADP NUMBER OUT!!! “Too Late” Powell must now LOWER THE RATE. He is unbelievable!!! Europe has lowered NINE TIMES," Trump said.

- On Wednesday, Minneapolis Fed President Neel Kashkari noted that the labor market is showing some signs of slowing down. However, persistent uncertainty prevails over the economy, and the Fed must stay in wait-and-see mode to assess how the economy responds to the uncertainty.

- House Republicans passed Trump’s “Big Beautiful Bill,” a multitrillion-dollar tax and spending package, which could increase the US fiscal deficit, along with the risk of bond yields staying higher for longer. This scenario raises concerns over the US economy and prompts traders to sell American assets under the “Sell America” trend. Policy experts anticipate Senate changes as GOP lawmakers aim to finalize the “big bill” by July 4.

- The National Bureau of Statistics of China reported that the Consumer Price Index (CPI) dropped at an annual pace of 0.1% in May, following April’s 0.1% decline. However, the market consensus was for a 0.2% decrease in the reported period. Meanwhile, China’s CPI inflation declined by 0.2% MoM, against April’s 0.1% increase. China’s Producer Price Index (PPI) continues to weaken with an annual decline of 3.3% in May, following a 2.7% decline in April.

- China's Trade Balance (CNY) arrived at CNY743.56 billion in May, expanding from the previous surplus of CNY689.99 billion. Meanwhile, Exports rose 6.3% YoY against 9.3% in April. The country’s imports fell 2.1% YoY in the same period, from a 0.8% rise recorded previously.

- Australia’s Trade Balance posted a 5,413M surplus month-over-month in April, below the 6,100M expected and 6,892M (revised from 6,900M) in the previous reading. Exports declined by 2.4% MoM in April, against a 7.2% rise prior (revised from 7.6%). Meanwhile, Imports rose by 1.1%, compared to a decline of 2.4% (revised from -2.2%) seen in March. China’s Caixin Services PMI rose to 51.1 in May as expected, from 50.7 in April.

Australian Dollar hovers above 0.6500 near seven-month highs

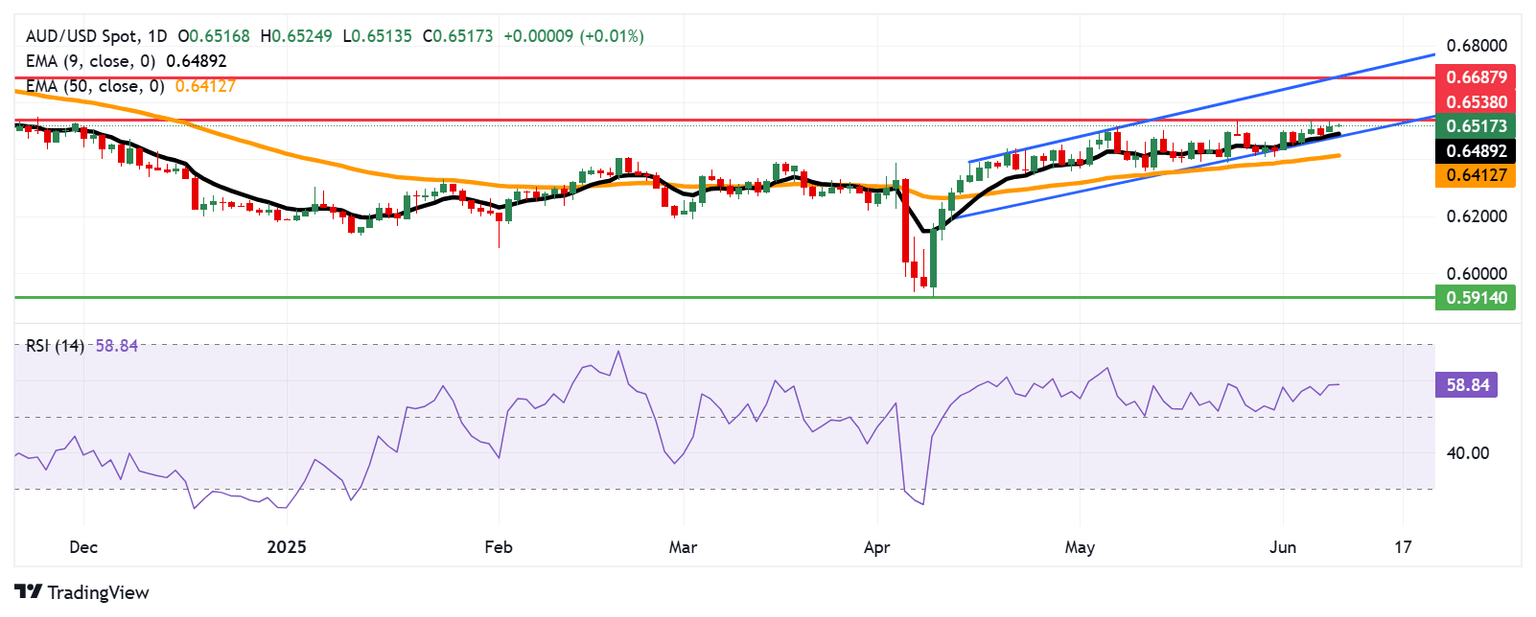

The AUD/USD is trading around 0.6520 on Tuesday. The daily chart’s technical analysis suggests a persistent bullish bias as the pair remains within the ascending channel pattern. Moreover, the pair remains above the nine-day Exponential Moving Average (EMA), which indicates the short-term price momentum is stronger. The 14-day Relative Strength Index (RSI) is also remaining above the 50 mark, suggesting a bullish bias.

The AUD/USD pair targets an immediate barrier at a seven-month high of 0.6538, marked on June 5. Further advances could prompt the pair to explore the region around the eight-month high at 0.6687, aligned with the upper boundary of the ascending channel around 0.6690.

On the downside, the primary support appears at the nine-day EMA of 0.6489, aligned with the ascending channel’s lower boundary around 0.6480. A break below this crucial support zone could weaken the bullish bias and lead the AUD/USD pair to test the 50-day EMA at 0.6412.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.14% | 0.06% | -0.03% | 0.07% | 0.12% | 0.05% | -0.01% | |

| EUR | -0.14% | -0.06% | -0.16% | -0.03% | 0.01% | -0.07% | -0.12% | |

| GBP | -0.06% | 0.06% | -0.18% | 0.02% | 0.07% | -0.01% | -0.06% | |

| JPY | 0.03% | 0.16% | 0.18% | 0.12% | 0.11% | -0.01% | -0.07% | |

| CAD | -0.07% | 0.03% | -0.02% | -0.12% | 0.04% | -0.04% | -0.08% | |

| AUD | -0.12% | -0.01% | -0.07% | -0.11% | -0.04% | -0.07% | -0.13% | |

| NZD | -0.05% | 0.07% | 0.01% | 0.00% | 0.04% | 0.07% | -0.04% | |

| CHF | 0.00% | 0.12% | 0.06% | 0.07% | 0.08% | 0.13% | 0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.