Australian Dollar holds gains as US Dollar remains subdued ahead of UoM Consumer Sentiment

- The Australian Dollar rises as the US Dollar struggles following dovish remarks from Fed officials.

- San Francisco Fed President Mary Daly said that expecting two rate cuts this year is a "reasonable" outlook.

- US Retail Sales rose by 0.6% MoM, while Retail Sales climbed 3.9% YoY in June.

The Australian Dollar (AUD) advances on Friday, recovering its more than 0.5% losses from the previous session. The AUD/USD pair appreciates as the US Dollar (USD) faces challenges due to dovish remarks from the Federal Reserve (Fed) officials.

San Francisco Fed President Mary Daly said that expecting two rate cuts this year is a "reasonable" outlook, while warning against waiting too long. Daly added that rates will eventually settle at 3% or higher, which is higher than the pre-pandemic neutral rate.

Fed Governor Christopher Waller said late Thursday that he believes that the US central bank should reduce its interest rate target at the July meeting, citing mounting economic risks. Waller added that delaying cuts runs the risk of needing more aggressive action later.

However, FOMC Governor Adriana Kugler said that the US central bank should not lower interest rates "for some time" since the effects of Trump administration tariffs are starting to show up in consumer prices. Kugler added that restrictive monetary policy is essential to keep inflationary psychology in line.

China's Commerce Minister Wang Wentao said on Friday that the economic and trade relations with the United States have gone through storms, but remain important to each other. Wentao also stated that Mutual benefit is the essence of US-China commercial ties. Geneva agreement, London framework effectively stabilised commercial ties, cooled down tensions, he added.

Australian Dollar appreciates as US Dollar edges lower ahead of UoM Consumer Sentiment

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is edging lower and trading at around 98.50 at the time of writing. Traders will likely observe the University of Michigan Consumer Sentiment, Building Permits, and Housing Starts later on Friday.

- US Retail Sales rose by 0.6% month-over-month in June versus -0.9% prior. This figure came in above the market consensus of 0.1%. Meanwhile, the annual Retail Sales climbed 3.9%, compared to a rise of 3.3% in May.

- US Producer Price Index (PPI) was unexpectedly unchanged in June, against the market consensus of a 0.2% rise. Meanwhile, the core PPI rose by 2.6% YoY versus 3.0% prior, softer than the 2.7% expected.

- The latest Fed Beige Book shows that while overall business activity remains healthy and inflation pressures are relatively subdued, underlying cost pressures are building, and business operators remain cautious.

- US President Donald Trump said on Wednesday that he plans to send letters to over 150 countries, notifying them of a 10% tariff rate they will face. He emphasized that these are "not big countries" with limited trade ties to the US, unlike China or Japan. He also hinted the rate could rise to 15–20%, though he did not confirm any specifics.

- President Trump said in an interview with the Real America's Voice network on Wednesday that he would love for Fed Chair Jerome Powell to resign, but that it would disrupt the markets if the president were to remove him. He also mentioned the possibility of striking a deal with Europe. Regarding tariffs on Canada, he said it’s too soon to comment. A tariff deal with India, however, is very close.

- China’s economy expanded at an annual rate of 5.2% in the second quarter, compared to a 5.4% growth in the first quarter and the expected 5.1% growth. Meanwhile, the Chinese Gross Domestic Product (GDP) rate rose 1.1% in Q2, against the market consensus of a 0.9% increase. Moreover, Retail Sales increased by 4.8% YoY in June, against the 5.6% expected and 6.4% prior, while Industrial Production came in at 6.8%, against the 5.6% expected.

- The Australian Bureau of Statistics reported on Thursday that seasonally adjusted Employment Change was 2K in June, recovering from a previous decline of 2.5K in May, though falling way short of the expected 20K new jobs. Meanwhile, the Unemployment Rate rose to 4.3% from 4.1% prior. The figure came in above the market consensus of 4.1%.

- Australia’s Westpac Consumer Confidence on Tuesday, which climbed 0.6% month-over-month in July, following a 0.5% gain in June. This marked a third consecutive monthly increase, signaling a modest yet encouraging improvement in consumer outlook.

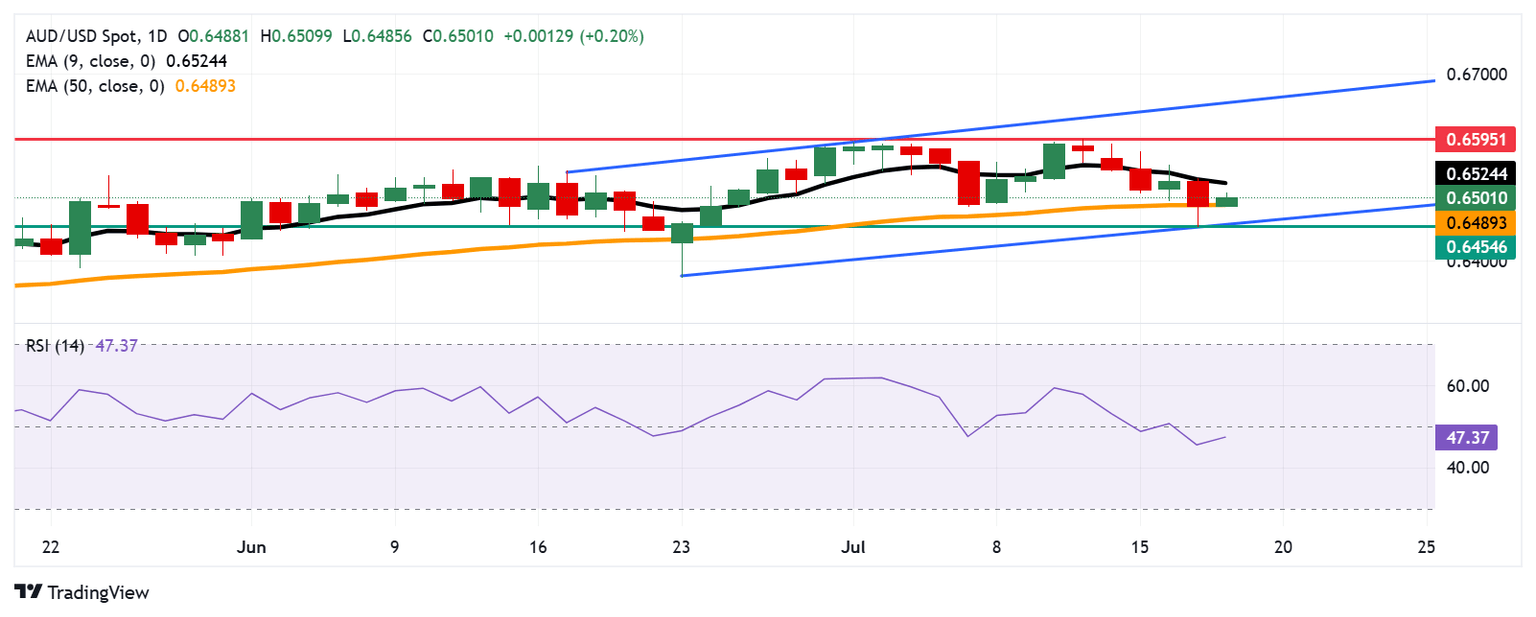

Australian Dollar trades around 0.6500 after rebounding from 50-day EMA

AUD/USD is trading around 0.6510 on Friday. The daily chart’s technical analysis indicated a bullish bias is active as the pair is positioned within the ascending channel pattern. However, the 14-day Relative Strength Index (RSI) is positioned below the 50 mark, suggesting that market bias is weakening. The pair remains below the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is weakening.

On the downside, the 50-day EMA at 0.6490 is acting as an immediate support. A successful breach below this level would weaken the short-term price momentum and put downward pressure on the AUD/USD pair to approach the ascending channel’s lower boundary around 0.6460, aligned with the three-week low at 0.6454, which was recorded on July 17.

The AUD/USD pair may target the nine-day EMA at 0.6524. A break above this level could strengthen the short-term price momentum and support the pair to approach the eight-month high of 0.6595, which was reached on July 11.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.19% | -0.05% | 0.07% | -0.07% | -0.17% | -0.22% | -0.23% | |

| EUR | 0.19% | 0.15% | 0.26% | 0.11% | 0.02% | -0.16% | -0.04% | |

| GBP | 0.05% | -0.15% | 0.10% | -0.02% | -0.12% | -0.25% | -0.18% | |

| JPY | -0.07% | -0.26% | -0.10% | -0.15% | -0.25% | -0.42% | -0.21% | |

| CAD | 0.07% | -0.11% | 0.02% | 0.15% | -0.12% | -0.23% | -0.14% | |

| AUD | 0.17% | -0.02% | 0.12% | 0.25% | 0.12% | -0.13% | -0.05% | |

| NZD | 0.22% | 0.16% | 0.25% | 0.42% | 0.23% | 0.13% | 0.08% | |

| CHF | 0.23% | 0.04% | 0.18% | 0.21% | 0.14% | 0.05% | -0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.