Australia’s CPI inflation eases to 0.7% QoQ in Q2 vs. 0.8% expected

Australia’s Consumer Price Index (CPI) rose 0.7% QoQ in the second quarter (Q2) of 2025, compared with the 0.9% increase seen in the first quarter, according to the latest data published by the Australian Bureau of Statistics (ABS) on Wednesday. The market consensus was for a growth of 0.8% in the reported period.

Annually, Australia’s CPI inflation eased to 2.1% in Q2 versus 2.4% prior and below the market consensus of 2.2%.

The RBA Trimmed Mean CPI for Q2 rose 0.6% and 2.7% on a quarterly and annual basis, respectively. Markets estimated an increase of 0.7% QoQ and 2.7% YoY in the quarter to June.

The monthly Consumer Price Index rose by 1.9% YoY in June, compared to the previous reading of 2.1% increase.

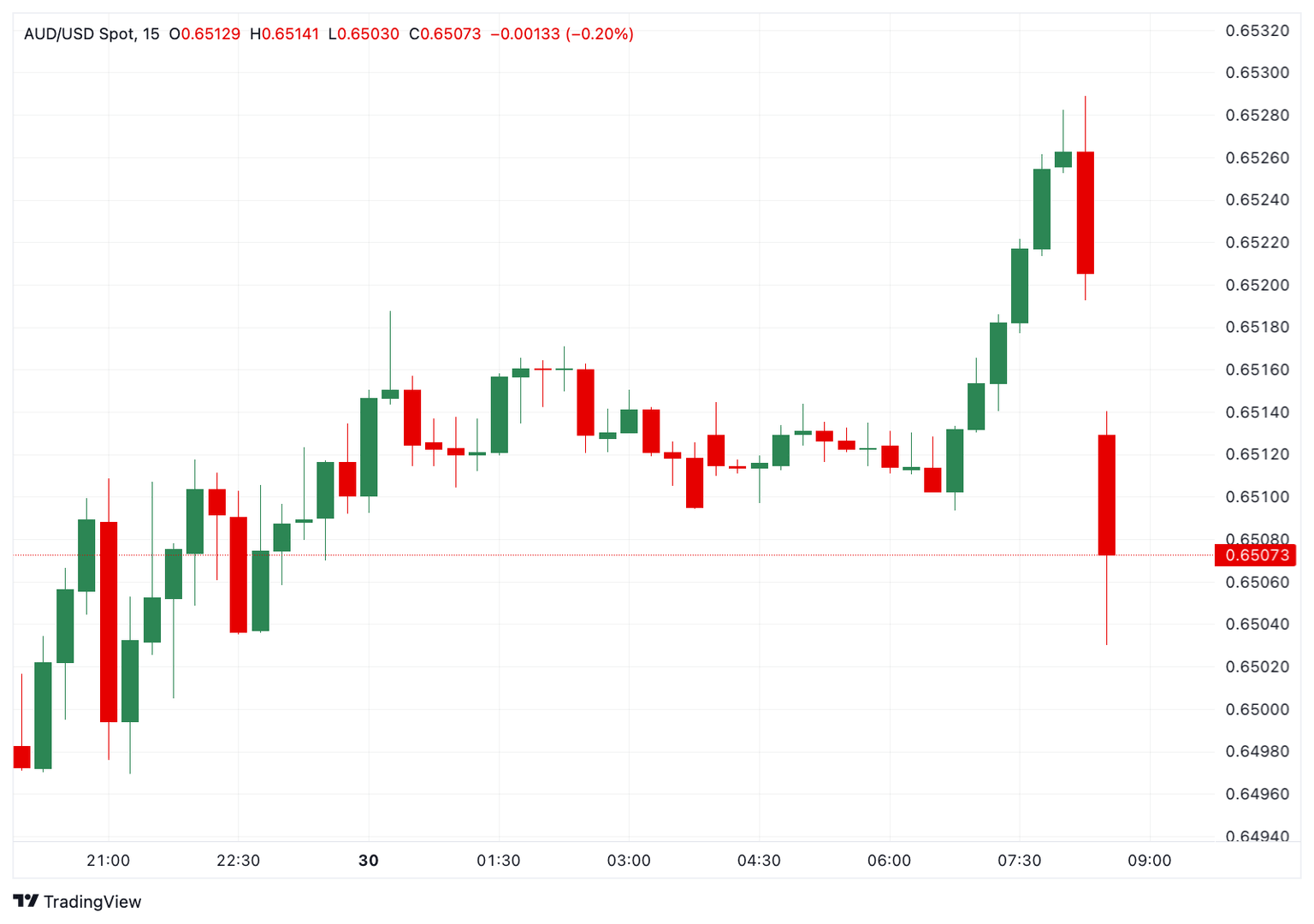

AUD/USD reaction to Australia's Consumer Price Index data

The Australian Dollar (AUD) attracts some sellers following the inflation data from Australia. The AUD/USD pair is losing 0.04% on the day to trade at 0.6507, at the press time.

AUD/USD 15-min chart

Australian Dollar PRICE This week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 1.66% | 0.53% | 0.25% | 0.40% | 0.86% | 0.79% | 0.89% | |

| EUR | -1.66% | -1.14% | -1.37% | -1.25% | -0.79% | -0.86% | -0.77% | |

| GBP | -0.53% | 1.14% | -0.42% | -0.11% | 0.33% | 0.28% | 0.38% | |

| JPY | -0.25% | 1.37% | 0.42% | 0.15% | 0.56% | 0.52% | 0.81% | |

| CAD | -0.40% | 1.25% | 0.11% | -0.15% | 0.43% | 0.39% | 0.49% | |

| AUD | -0.86% | 0.79% | -0.33% | -0.56% | -0.43% | -0.07% | 0.05% | |

| NZD | -0.79% | 0.86% | -0.28% | -0.52% | -0.39% | 0.07% | 0.10% | |

| CHF | -0.89% | 0.77% | -0.38% | -0.81% | -0.49% | -0.05% | -0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

This section below was published at 21:30 GMT as a preview of the Australian inflation data.

- The Australian monthly Consumer Price Index is foreseen stable at 2.1%.

- Quarterly CPI inflation is expected to have modestly decreased in Q2.

- The Reserve Bank of Australia kept the OCR at 3.85% at its May meeting.

- The Australian Dollar is set to post lower lows vs its American rival.

Australia will release inflation updates on Wednesday, two weeks ahead of the Reserve Bank of Australia (RBA) monetary policy meeting, scheduled for August 11-12. The Australian Bureau of Statistics (ABS) will publish two different inflation gauges: the quarterly Consumer Price Index (CPI) for the second quarter of 2025 and the June Monthly CPI, which measures annual price pressures over the past 12 months. The quarterly report includes the RBA Trimmed Mean CPI, policymakers’ favorite inflation gauge.

The RBA’s Official Cash Rate (OCR) stands at 3.85% after policymakers delivered two 25-basis-point (bps) rate cuts throughout the first half of the year.

Ahead of the announcement, the Australian Dollar (AUD) trades at around the 0.6500 mark against its American rival.

What to expect from Australia’s inflation rate numbers?

The ABS is expected to report that the monthly CPI rose by 2.1% in the year to June, matching the May reading. The quarterly CPI is foreseen to increase by 0.8% quarter-on-quarter (QoQ) and by 2.2% year-on-year (YoY) in the second quarter of 2025. Additionally, the central bank’s preferred gauge, the RBA Trimmed Mean CPI, is expected to rise by 2.7% YoY in the same quarter, easing from the 2.9% advance posted in Q1.

Finally, the RBA Trimmed Mean CPI is forecast to increase by 0.7% QoQ, matching its previous quarterly reading. As it happened in Q1, the figures will fall within the RBA’s goal to keep inflation between 2 and 3%, which means the central bank could deliver additional interest rate cuts in the foreseeable future.

The RBA’s statement on monetary policy released after the July meeting shows officials remained concerned about the global trade conflict launched by the United States (US). While they consider the worst of it will likely be avoided, it is still a source of uncertainty.

Additionally, most officials “believed that lowering the cash rate a third time within the space of four meetings would be unlikely to be consistent with the strategy of easing monetary policy in a cautious and gradual manner to achieve the Board’s inflation and full employment objectives. While the flow of recent data had been broadly in line with earlier forecasts, they judged that some data had been slightly stronger than expected.”

However, “A minority of members judged that there was a case to lower the cash rate target at this meeting. These members placed more weight on downside risks to the economic outlook – stemming from a likely slowing in growth abroad and from the subdued pace of GDP growth in Australia.”

Such concerns are real, considering the ABS reported that the Australian economy expanded by 0.2% in the three months to March 2025, down from the 0.6% posted in the final quarter of 2024 and missing the expected 0.4%. On a positive note, annualised growth held at 1.3%, although missing estimates of a 1.5% gain.

At the same time, labor costs are a source of concern. According to the latest information available, wage inflation rose by 3.4% in the year to March, and by 0.9% in the first quarter of the year.

Tepid growth combined with upside risks to inflation amid labor costs growing at a faster rate than the RBA’s inflation target leaves policymakers between a rock and a hard place. While further interest rate cuts before year-end remain on the table, the most likely scenario will be another on-hold decision in August.

Meanwhile, concerns about the impact of US President Donald Trump's trade war continue to ease. The US announced deals with Japan and the European Union in the last few days, while progressing in talks with China. As a result, the US Dollar (USD) surged across the FX board, leading to the AUD/USD pair falling to 0.6500, its lowest in two weeks.

How could the Consumer Price Index report affect AUD/USD?

The anticipated inflation readings would have no actual impact on the upcoming RBA decision, while easing price pressures should support officials’ wait-and-see stance. However, higher-than-anticipated inflationary pressures could prompt policymakers to make an earlier interest rate cut.

As previously said, the AUD/USD pair struggles at around 0.6500 ahead of the announcement, under pressure amid broad USD strength coming from trade-deal announcements.

Valeria Bednarik, FXStreet Chief Analyst, says: “The AUD/USD pair keeps posting lower lows and lower highs on a daily basis, in line with a continued decline. Speculation that the RBA may go for additional interest rate cuts should weigh on the Aussie, and push the pair towards the 0.6450 region, where it bottomed in July. Additional downward strength could result in AUD/USD falling towards the 0.6390 price zone.”

Bednarik adds: “The AUD/USD pair could surge should inflation results in line or lower than anticipated, yet with persistent USD demand, the uptick could be short-lived. The daily 20 Simple Moving Average (SMA) provides dynamic resistance at around 0.6545, while further gains expose the July peak at 0.6625.”

Economic Indicator

Monthly Consumer Price Index (YoY)

The Monthly Consumer Price Index (CPI), released by the Australian Bureau of Statistics on a monthly basis, measures the changes in the price of a fixed basket of goods and services acquired by household consumers. The indicator was developed to provide inflation data at a higher frequency than the quarterly CPI. The YoY reading compares prices in the reference month to the same month a year earlier. A high reading is seen as bullish for the Australian Dollar (AUD), while a low reading is seen as bearish.

Read more.Next release: Wed Jul 30, 2025 01:30

Frequency: Monthly

Consensus: 2.1%

Previous: 2.1%

Source: Australian Bureau of Statistics

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

FXStreet Team

FXStreet