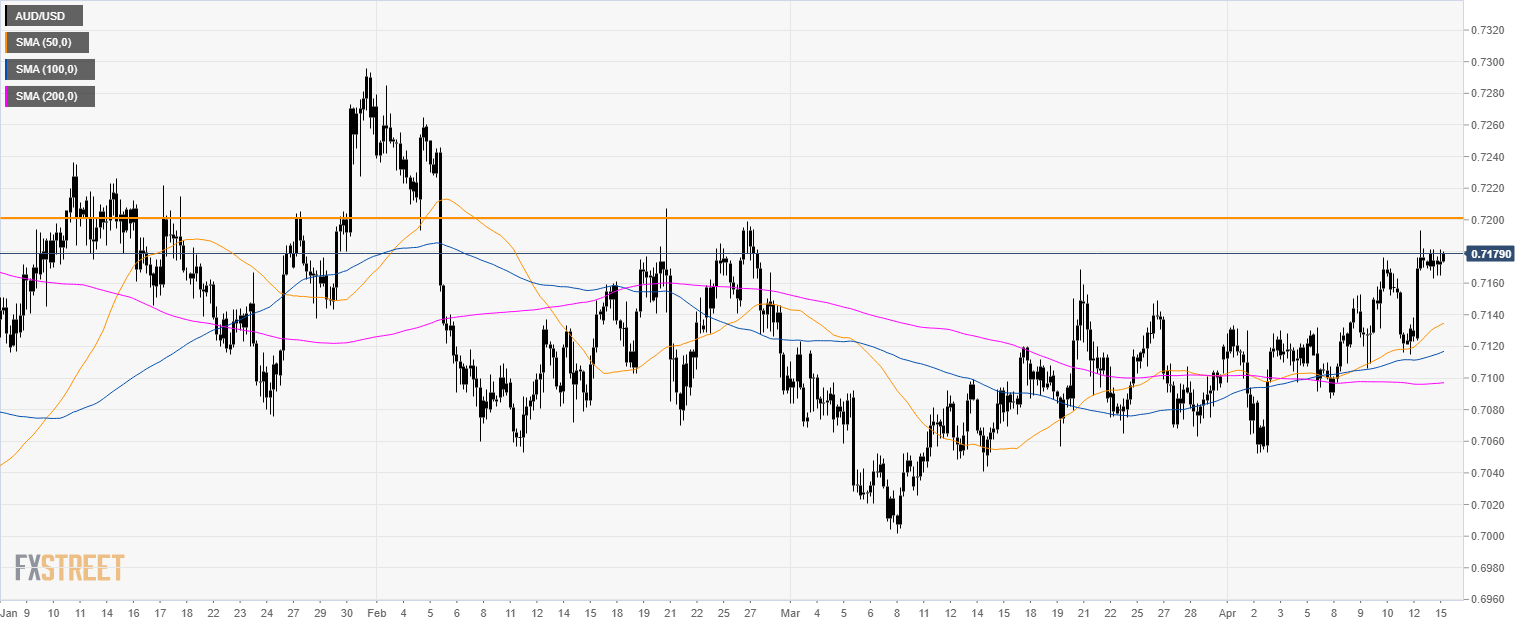

AUD/USD Technical Analysis: Aussie parked below 0.7200 key resistance

AUD/USD daily chart

- AUD/USD is trading in a bear trend below its 200-day simple moving averages (SMA).

- The market is testing the 200 SMA near the 0.7200 figure.

- AUD/USD is trading above its main SMAs suggesting a bullish bias in the medium-term.

AUD/USD 30-minute chart

- AUD/USD found resistance below 0.7200 key resistance.

- The next objective for bears is to drive the market down to 0.7160, 0.7135 and 0.7110 level.

- To the upside, key resistance can be seen at 0.7200 and 0.7220 level.

Additional key levels

Author

Flavio Tosti

Independent Analyst