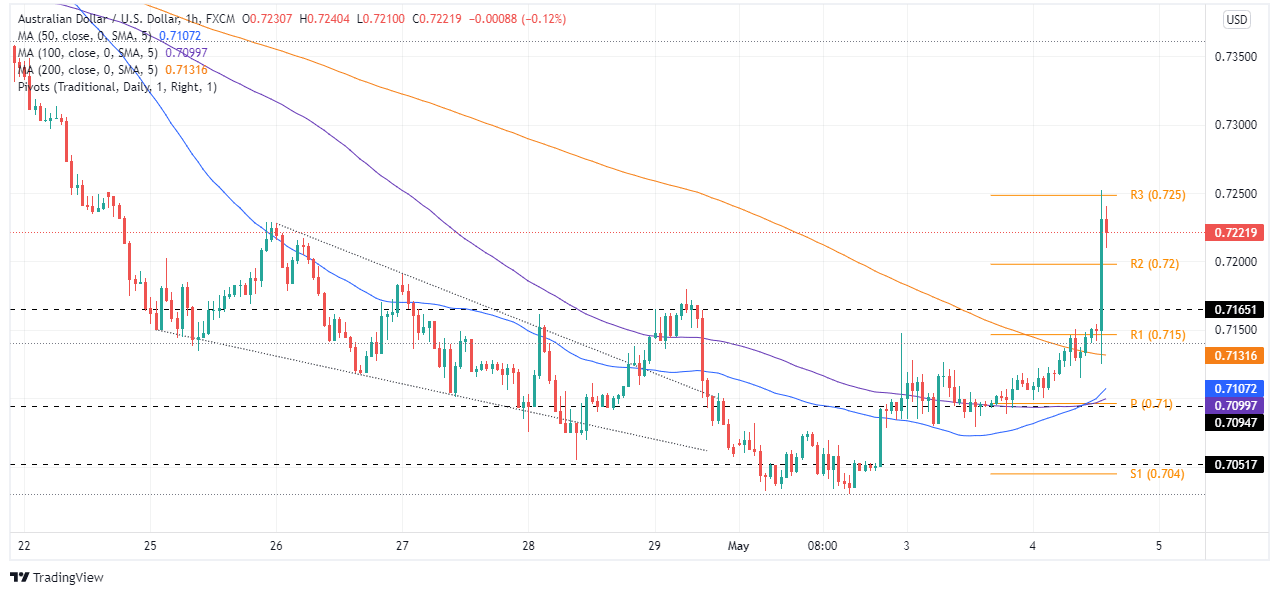

AUD/USD surges above 0.7200 post-Fed hike, as Chair Powell rules out 75-bps increases

- The AUD/USD record gains of more than 130 pips and eyes the 100-DMA at 0.7260.

- The Fed raised 50bps to the Federal Funds Rates (FFR) and would begin its QT on June 1.

- Fed’s Chair Powell emphasized that 75-bps increases are not something the Fed is considering.

The AUD/USD is rallying sharply and jumped from 0.7090s to 0.7230s after the Federal Reserve decided to raise rates by 50 bps and announced the start of the Quantitative Tightening (QT) on June 1, as the US central bank aims to trim its $8.9 trillion balance sheet. At around 0.7220s, the AUD/USD reflects investors’ sentiment as Fed Chair Jerome Powell speaks.

So far, the Fed’s policy decision seems to be perceived as hawkish, as Fed money markets futures are pricing in a 77% chance of a 50-bp hike at the June meeting and a 23% chance of a 75-bp increase.

At his press conference, Fed Chair Powell said that 75-bp increases are not something the Fed is considering, and they are not actively considering it. He added that “if we see what we expect to see,” 50-bp increases would be“on the table” at the following couple of FOMC meetings.

Remarks of the Fed’s decision

The Federal Open Market Committee (FOMC) revealed in its monetary policy statement that inflation is “expected to return to its 2% objective” and expressed that high prices reflect supply and demand imbalances related to the Covid-19 pandemic. The central bank reiterated that it would remain “attentive to inflation risks.”

Also, the US central bank acknowledged the negative print in Q1’s GDP and said that “household spending and business fixed investment remained strong.”

Concerning the balance sheet reduct, the Fed will begin the Quantitative Tightening (QT) program on June 1 at a slower pace than estimated. The central bank would reduce its balance sheet by $47.5 billion for the first three months. The initial cap of US Treasuries would be $30 billion, while $17.5 billion of mortgage-backed securities (MBS). After three months, the QT will hit $60 billion in US Treasuries and $30 billion on MBS.

AUD/USD Market’s reaction

The AUD/USD immediately surged above the R1 daily pivot at 0.7150, rallying sharply towards the R3 pivot point around 0.7250, and is pairing last week’s losses. At the time of writing, the AUD/USD is shy of the daily highs, around 0.7220s.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.