AUD/USD steady around 0.6640 ahead of Aussie’s inflation data

- AUD/USD remains at 0.6649, unchanged as Asian session begins.

- Minneapolis Fed President Kashkari's comments on rate hikes bolster USD strength.

- Upcoming Australian CPI data may influence AUD, with potential rise aiding in recovery.

The Australian Dollar registered minuscule losses against the US Dollar on Tuesday amid higher US Treasury yields. A softer-than-expected US 5-year Treasury note auction boosted the Greenback, which posed gains versus most other currencies. As the Asian session begins, the AUD/USD trades at 0.6649, virtually unchanged.

AUD/USD trades flat as higher US yields and hawkish Fed remarks support US Dollar

Fed speakers grabbed the headlines on Tuesday, led by Minneapolis Fed President Neel Kashkari. He said, “I don’t think anybody has totally taken rate increases off the table,” while in a Q&A session, he answered he wasn’t confident about the evolution of the disinflationary process and foresees just two rate cuts.

Data-wise, the Conference Board revealed that Consumer Confidence persists after hitting 102.0 from 97.5, the highest print after posting three months of decreases. The lift was primarily driven by improved expectations meaning consumer spending may remain robust in the second half of 2024.

Aside from this, US Treasury bond yields jumped on a softer US 5-year T-note auction, with the 10-year note coupon rising seven basis points to 4.548%, a tailwind for the US Dollar.

On the Aussie’s front, the schedule would feature the Westpac Leading and the monthly Consumer Price Index (CPI) for April. Analysts estimate prices to fall from around 3.5% YoY to 3.4%, which would maintain the status quo. Otherwise, a rise exceeding expectations could benefit the AUD/USD and push prices toward the March 8 high of 0.6667.

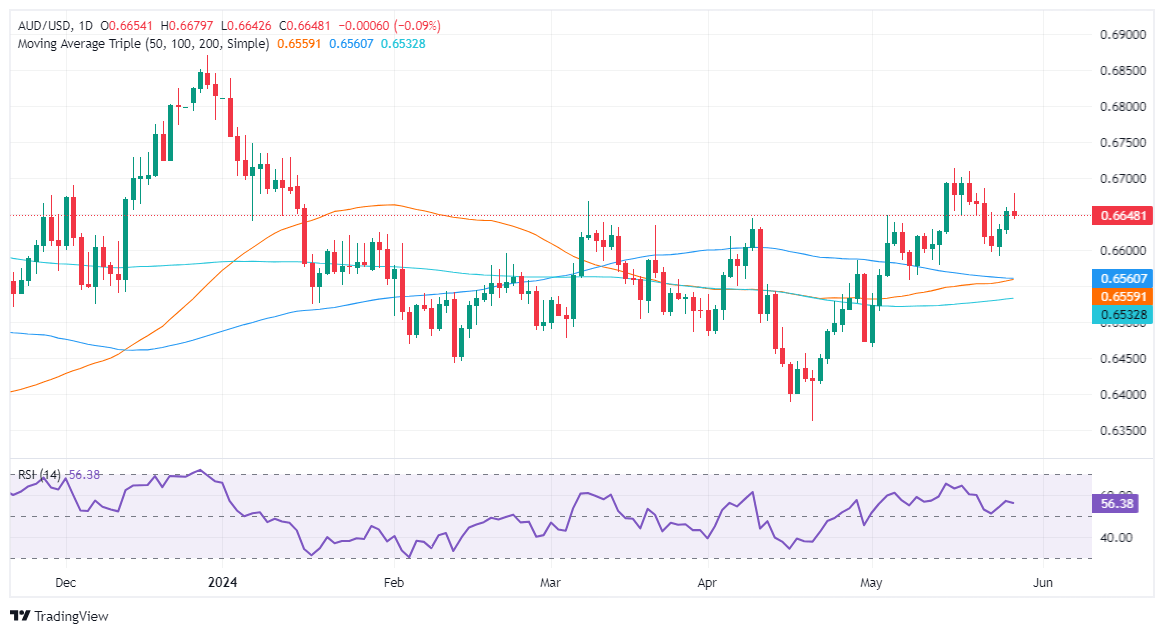

AUD/USD Price Analysis: Technical outlook

The Aussie Dollar remains upward biased despite retreating from weekly highs of 0.6673, amid forming a ‘gravestone doji,’ which hints further downside is seen. Momentum shows that buyers are in charge, as depicted by the Relatives Strength Index (RSI) standing at bullish territory. Still, in the short term, the AUD/USD could be headed for a correction to the latest cycle low of 0.6592 before targeting the year-to-date (YTD) high of 0.6839.

Australian Dollar PRICE This week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.08% | -0.17% | 0.11% | -0.15% | -0.29% | -0.40% | -0.24% | |

| EUR | 0.08% | -0.11% | 0.22% | -0.07% | -0.28% | -0.41% | -0.13% | |

| GBP | 0.17% | 0.11% | 0.28% | 0.02% | -0.16% | -0.23% | -0.04% | |

| JPY | -0.11% | -0.22% | -0.28% | -0.31% | -0.43% | -0.44% | -0.39% | |

| CAD | 0.15% | 0.07% | -0.02% | 0.31% | -0.16% | -0.24% | -0.14% | |

| AUD | 0.29% | 0.28% | 0.16% | 0.43% | 0.16% | -0.05% | 0.11% | |

| NZD | 0.40% | 0.41% | 0.23% | 0.44% | 0.24% | 0.05% | 0.15% | |

| CHF | 0.24% | 0.13% | 0.04% | 0.39% | 0.14% | -0.11% | -0.15% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.